Trump Tariff Pause Gets Mixed Reaction From Business Leaders: 'Good to be liberated from Liberation Day'

From Chaos to Calm: But for How Long?

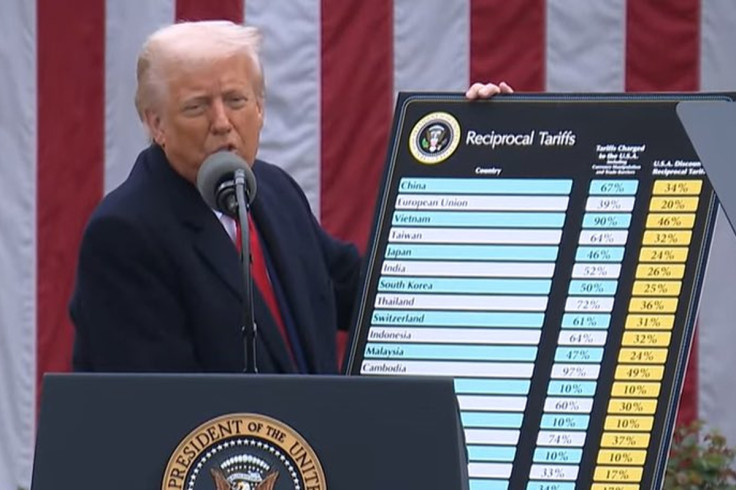

On 9 April 2025, President Donald Trump hit the brakes on his aggressive tariff plan, announcing a 90-day pause on levies against most countries, just a week after unveiling them as his 'Liberation Day' gambit. Markets, which had cratered amid fears of a global trade war, roared back: the Dow surged nearly 3,000 points, and the Nasdaq leapt 12%.

Yet, while Wall Street cheered, business leaders offered a kaleidoscope of reactions, from cautious relief to outright frustration. With a £1.5 trillion ($1.9 trillion) trade deficit in his crosshairs, Trump kept the heat on China, jacking tariffs there to 125%, but for everyone else, the reprieve has sparked hope, doubt, and a dash of sarcasm. Is this a masterstroke or a messy retreat?

Relief With a Side of Scepticism: Markets Bounce, Leaders Ponder

The tariff rollback, announced on 9 April 2025, was a lifeline for jittery investors. After days of chaos, with stocks shedding trillions globally, the pause sent the S&P 500 soaring 9%, its biggest gain since 2008.

Business heavyweights breathed easier, but not without caveats. Chris Fralic, a partner at First Round Capital, captured the mood with a wry quip on X: 'Good to be liberated from Liberation Day' His screenshot of surging stock tickers underscored the relief, though he warned that a 20% drop followed by a 20% rise still leaves you shy of square one.

Bill Ackman, the billionaire hedge funder who'd pushed for a 90-day timeout, hailed it as a win, having warned of 'economic nuclear war' if tariffs stuck. Yet, not all shared his optimism.

China in the Crosshairs: A Trade War Still Simmers

While most nations got a breather, Trump doubled down on China, hiking tariffs to 125% after Beijing slapped 84% retaliatory duties on US goods. 'Based on the lack of respect that China has shown to the World's Markets,' he wrote on Truth Social, 'I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately'.

China's commerce ministry fired back, promising to 'fight to the end,' hinting at more salvos ahead. This escalation could cost US households dearly. Yale Budget Lab pegs short-term losses at £2,960 ($3,800) per family if tariffs persist, with the poorest hit hardest at £1,326 ($1,700).

Companies like Micron are already tacking surcharges onto chips, and retailers warn of price hikes looming by summer 2025. For business leaders, the pause elsewhere is a boon, but China's standoff keeps the global supply chain on edge.

A Rollout Gone Rogue: Clarity Elusive, Confidence Shaky

If Trump's goal was certainty, the execution's been a muddle. The tariff saga, from its 2 April 2025 debut to this abrupt pivot, has drawn flak for sloppiness. Allies like Treasury Secretary Scott Bessent struggled to spin it, insisting to reporters on 9 April 2025 that this was 'Trump's strategy all along'

Yet, the whiplash has rattled CEOs. Jamie Dimon of JPMorgan had dubbed the initial tariffs a 'self-inflicted wound,' and while the pause softens the blow, 10% baseline duties linger, with more threatened post-pause. For now, business leaders oscillate between gratitude and unease, wondering if this is a truce or just a timeout.

© Copyright IBTimes 2025. All rights reserved.