Tullow Oil To Deliver Record FY Earnings, Outlook Positive For Coming Years

Tullow Oil, the independent oil and gas company, expects significant progress in Ghana and Uganda for the FY 2012 and is scheduled to report its full year 2011 results on Wednesday.

The group's significant cash flow from Jubilee production is expected to contribute to record full year financial results for 2011. Its exploration strategy has opened up a new basin in South America and it has a number of high-impact basin-opening wells across its portfolio to drill before year-end.

While there has been further delays in Uganda, it remains ready to proceed towards field development following government approval. With development plans across the group gathering pace and production continuing to grow, the outlook for the full year and for 2012 remains quite positive.

Tullow's financial strategy continues to maintain flexibility to support the group's significant appraisal and development programmes in Ghana and Uganda and effectively allocate capital across the remainder of its business. The outlook for the coming years is positive for Tullow.

Production ramp-up from the Ghana Jubilee field will continue, together with further appraisal and development activities. The Ugandan farm-down is expected to be completed in the near future which will pave the way for the basin-wide appraisal and development with CNOOC and Total.

According to the latest trading update, the group expects 2011 sales revenue to be at $2.3 billion, doubling 2010 revenues. It expects record 2011 financial results with full year capital expenditure of $1.4 billion and forecast capital expenditure for 2012 at $2.0 billion. Net debt at 31 December 2011 was approximately $2.8 billion.

While commenting on the results, Chief Executive Aidan Heavey said: "Record revenues and cash flows from increased production and strong commodity prices combined with industry-leading exploration success underpin another very good year for Tullow in 2011. In 2012 we expect significant progress in Ghana and Uganda as we move forward with Jubilee well remediation and Phase 1A, TEN and the Lake Albert developments. We have an exciting exploration programme to open new basins, both onshore and offshore, and we hope to extend our reach in Africa and elsewhere along the Atlantic Margins with major new partnerships. There is much to look forward to in the year ahead."

The group announced in February that it completed the farm-down of 66.6666 per cent of its Ugandan licences to CNOOC Limited for a total consideration of $2.9 billion. The farm-down follows the recent signing of production sharing agreements and the Kingfisher production licence with the Government of Uganda. Both the parties have been working closely since March 2011 on development options for the Lake Albert Basin and are looking forward to discussing them with the Government of Uganda later this year.

It is currently expected that small-scale oil and gas production for the local power market will commence in 2013 from the Kaiso-Tonya area. Major production from the Lake Albert Basin is expected to commence approximately 36 months after a basin-wide plan of development is approved by the Government of Uganda. Based on this timetable, ramp-up to major production would commence in 2016.

Sanford C. Bernstein raised its oil price forecast for 2012 citing supply concerns around Iran. Tullow Oil is their top pick among exploration and production companies.

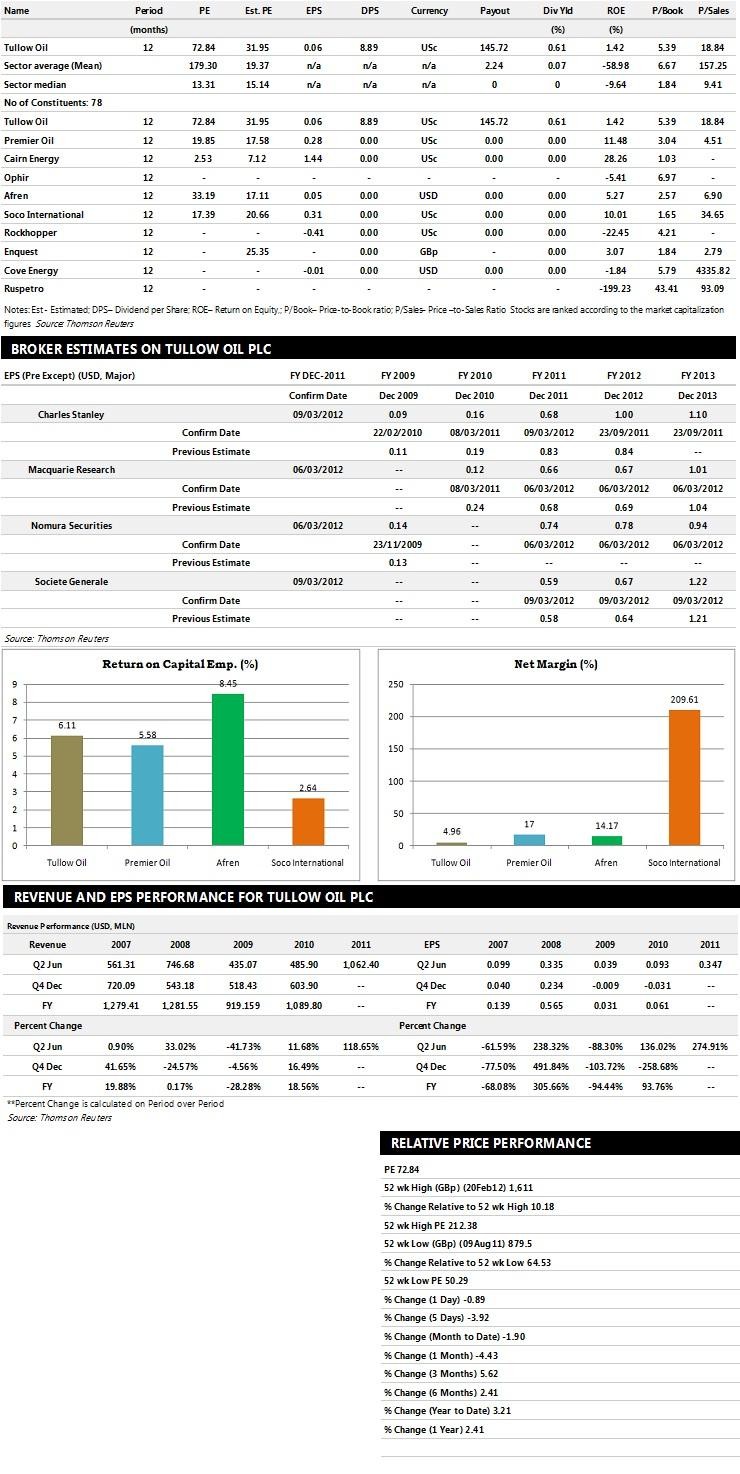

Brokers' Views:

- Societe Generale assigns 'Hold' rating on the stock

- Liberum Capital recommends 'Hold' rating on the stock

- Nomura starts with reduce rating with price target of 1650 pence

- Macquarie Research assigns 'Under Perform' rating on the stock

- Charles Stanley recommends 'Out Perform' rating on the stock

Earnings Outlook:

- Societe Generale estimates the company to report revenues of $2,276 million and $2,540 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of $1,031 million and $1,572 million. Earnings per share are projected at 59 cents for FY 2011 and 67 cents for FY 2012.

- Macquarie Research projects the company to record revenues of $2,255.28 million and $2,402.56 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of $1,016.72 million and $1,148.40 million. Profit per share is estimated at 66 cents and 67 cents for the same periods.

- Nomura Securities expects Tullow Oil to earn revenues of $2,335 million for the FY 2011 and $2,466 million for the FY 2012 respectively with pre-tax profits of $1,157 million and $1,246 million. EPS is projected at 74 cents for FY 2011 and 78 cents for FY 2012.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents ten companies based on market capitalisation.

© Copyright IBTimes 2025. All rights reserved.