UK house prices: The housing market will 'slow down but not plummet' amid Brexit concerns

House prices will fall in London as demand is throttled by global economic issues, tax rises and Brexit.

House price growth is set to slow sharply across the UK and in London property values will fall as Brexit, tax hikes and global economic turmoil drag the market down, says a report from the Centre for Economics and Business Research (CEBR), a consultancy firm.

CEBR downgraded its forecast for house prices because the UK voted to leave the European Union (EU) in a 23 June referendum, triggering political and economic uncertainty. Exactly when the formal Brexit will happen, and what Britain's future relationship will be with the EU and single market, are unclear. But some economists expect an economic slowdown, perhaps a recession.

"Although Brexit has certainly sent shockwaves CEBR expects the housing market to slow down but not plummet," said Nina Skero, CEBR senior economist and main author of the report.

"Years of underbuilding mean that demand would have to fall very dramatically to meet the low level of supply increases. Keeping in mind that construction companies are very likely to limit their output further in light of Brexit, price pressures will also come from the supply side."

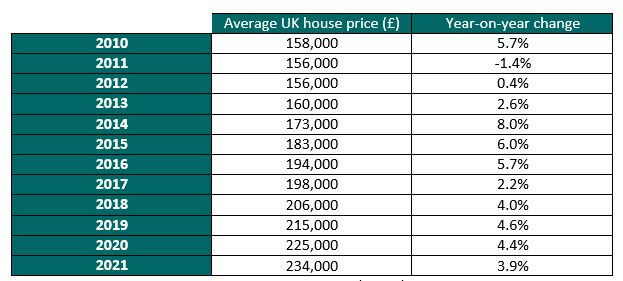

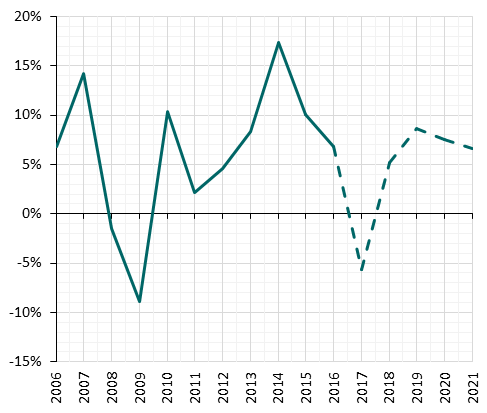

In 2016, UK house price growth will average at 5.7%, said CEBR, before slipping to 2.2% in 2017 and rising again to 4% in 2018.

In London, where price growth has been rapid in recent years amid a protracted supply shortage and intense demand from investors and first-time buyers, CEBR said price growth will be 6.8% in 2016 before falling by 5.6% in 2017. Growth should then return in 2018.

The falling price of commodities such as oil has hurt demand from traditional sources of foreign investment in the top end of the London property market, as the global wealthy from Moscow to Riyadh lick their financial wounds.

Tax rises on expensive and additional properties, as well as those owned by offshore structures, have also weakened demand in London. Brexit may also do damage, though some regard the drop in value of sterling as a buying opportunity for overseas investors.

"The capital's status as a safe haven is under threat, a relatively high share of its residents are non-UK nationals and the sectors facing the greatest uncertainty following Brexit e.g. finance are concentrated in London," Skero said.

© Copyright IBTimes 2025. All rights reserved.