UK housing: Has mortgage regulation done enough to prevent another 2007-style crash?

New mortgage market regulations in the aftermath of the 2007 housing crash are probably enough to prevent a repeat of the UK property bubble at the outbreak of the financial meltdown, according to the estate agency Savills.

Loose lending practices fuelled a house price bubble before the crash with some borrowers able to access mortgages worth as much as 105% of the value of properties they were purchasing. The financial crisis pricked the bubble leading to a collapse of the housing market, which has only recently recovered.

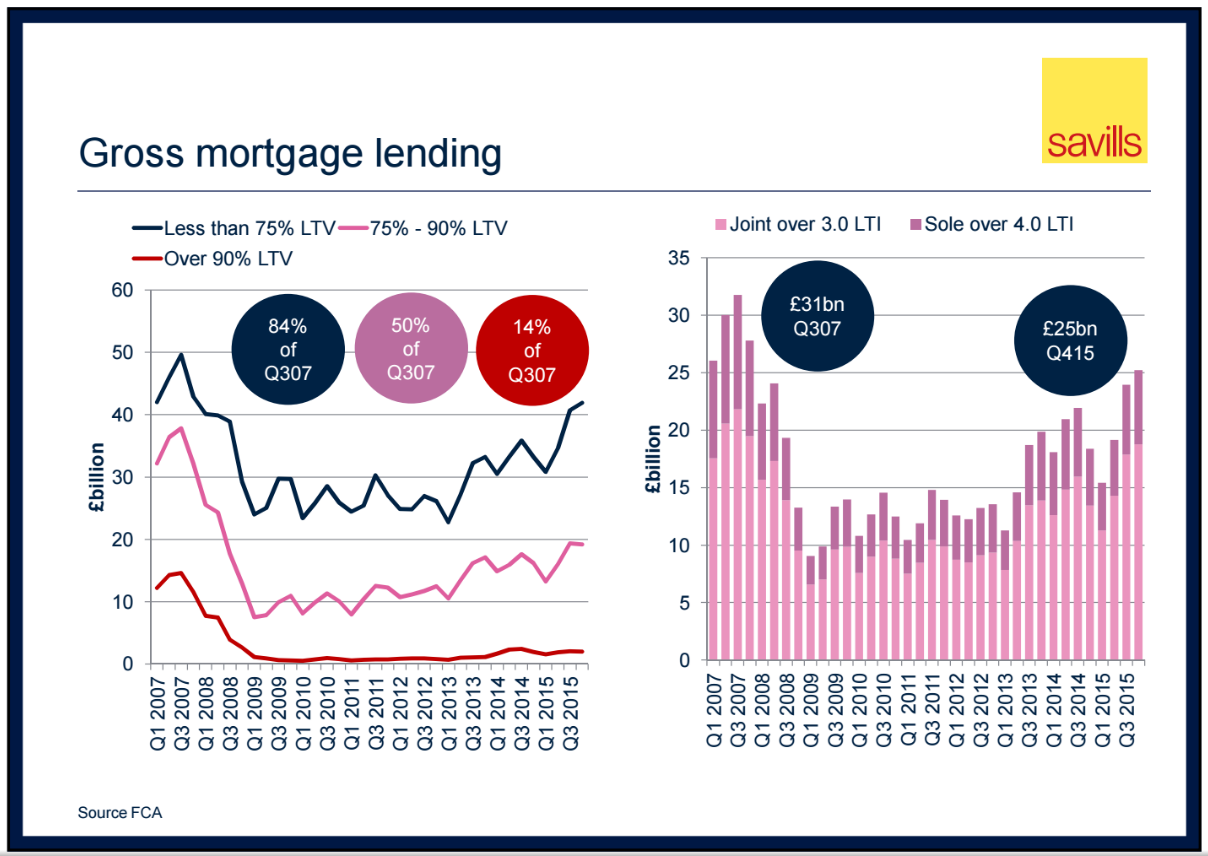

Among the new rules, imposed by both the Financial Conduct Authority (FCA) and the Bank of England, are restrictions on the portion of lending banks can make at a loan-to-income ratio higher than 4.5 times and much stricter affordability tests for borrowers.

"Overall, mortgage regulation has served its purpose, the key factors that preceded the 2007 crash are not present today, although we now face a different set of challenges including increasing housing delivery and a squeeze in rental supply," said Lucian Cook, head of UK residential research at Savills.

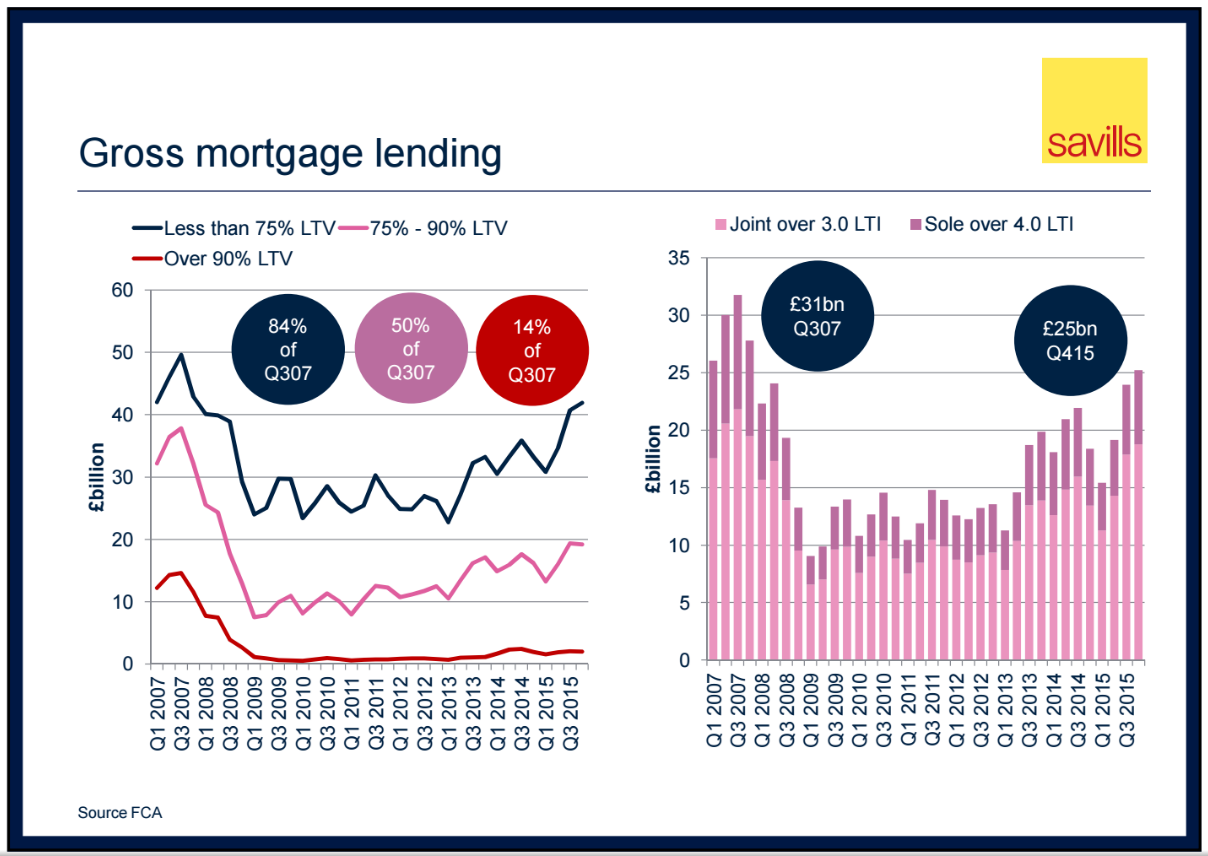

Savills highlighted that loan-to-values on mortgages for house purchases are now below their peak in 2007. The volume of loans worth 90% or more of the property's value accounted for just 2% of gross mortgage lending in the third quarter of 2015, according to FCA data, compared to its 14% peak in Q3 2007.

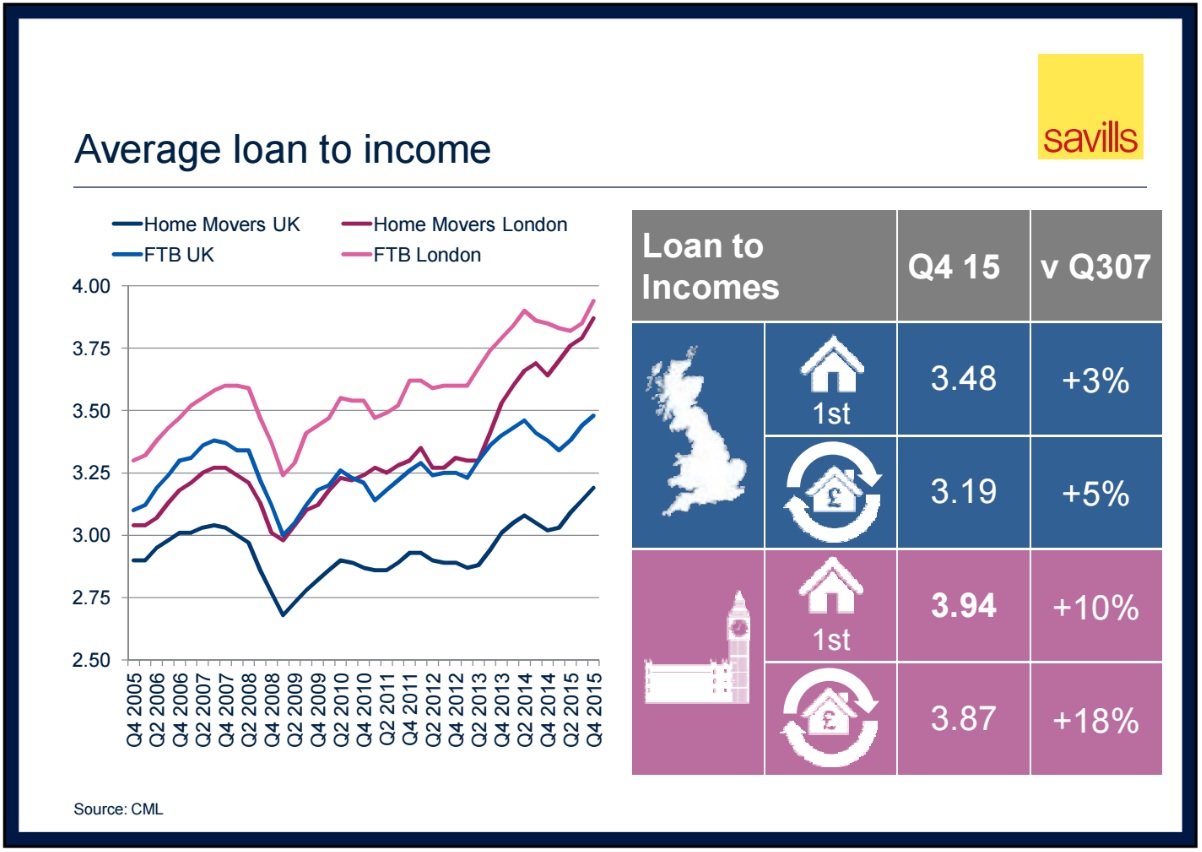

But loan-to-income multiples are rising as house price growth outstrips pay, a problem that is particularly acute in London. Data from the Council of Mortgage Lenders (CML) shows that between the third quarter of 2007 and the final quarter of 2015, the average loan-to-income ratio for home movers in London has risen by 18% to 3.87, compared to a 5% rise to 3.19 for the rest of the UK.

There is some concern that when the Bank of England moves to lift its base interest rate from the historic low of 0.5% — held there since 2009 to stimulate lending to the economy as it recovered from the financial crisis — those who stretched themselves to borrow more when mortgage credit was cheap are exposed to a shock as their repayments increase.

Cook said the high loans-to-incomes leave the market "vulnerable to an unexpected interest rate rise". Central bankers have sought to ease such fears by insisting any hikes will be gradual and incremental, and only begin when policymakers are confident the economy could cope. Rate-setters are also operating a "forward guidance" policy where they give implicit signals to the market about the future path of interest rates, an effort to encourage stability and confidence.

Halifax stated in its house price index for May 2016 that the average property value in the UK rose 9.2% over the year to £213,472. Highlighting the disparity between London and the rest of the country, a gap widened by the city's serious housing supply shortage, Halifax said property prices per square metre have risen by 432% in Greater London against a national average increase of 251% in the last 20 years.

Housebuilding in England is running short of demand, estimated to be around 250,000 new units a year. According to government statistics, there were 142,890 housing completions in the 12 months to December 2015, a 21% annual increase and a seven-year high. New housing starts also rose, though more slowly. There were 143,560 starts, a 6% rise year-on-year.

© Copyright IBTimes 2025. All rights reserved.