UK Should Not Join Euro, Says British Peer

UK mortgage markets are totally unsuited for a euro type currency, a leading British peer and economist has warned.

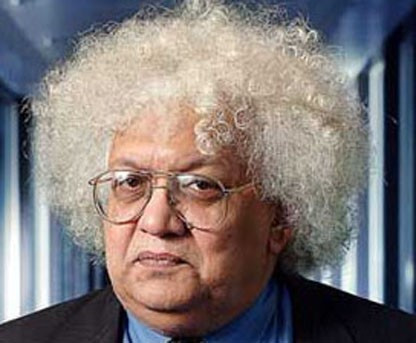

In an exclusive chat with the IB Times, Lord Meghnad Desai has said that the UK should not join the euro. "There has been a long debate going back to the late 1990's during which the issues were thrashed out. The UK has done well to stay out," he said.

The Labour peer's remarks came nearly a fortnight after former British prime minister Tony Blair admitted on the BBC's Andrew Marr Show that Gordon Brown had been right to push hard for the UK not to go into the euro when he was Chancellor.

The impact of the potential collapse of the euro on markets and economies worldwide is impossible to estimate properly, Lord Desai has said. "It depends on whether all the 17 euro countries leave simultaneously or the weaker ones leave first and then the stronger ones. It may also split into a strong euro and a weak euro zones. In any case the disruption to India's and Asia's export markets will be serious. But eventually the growing markets are going to be not in Europe but in Asia, Africa and Latin America," he has added.

Fears of a eurozone meltdown heightened early this week with Germany's failure to sell a full tranche of new debt to the capital markets, forcing the central bank to step in. Experts say that the sovereign debt crisis is now showing clear signs of spreading to the very heart of the eurozone.

© Copyright IBTimes 2025. All rights reserved.