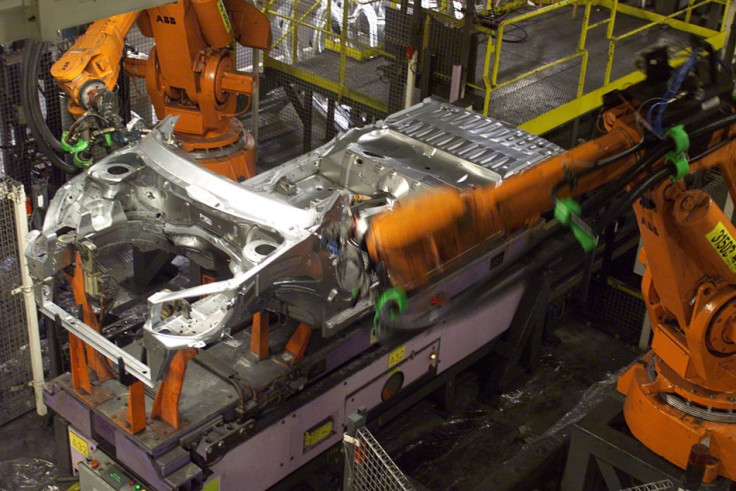

UK Manufacturing Sector Builds Momentum as Orders Hit Two-Year High

UK manufacturers have experienced a significant rise in production in August along with improved domestic and external demand, as the sector continued to support the ongoing economic recovery in the country.

In the the Confederation of British Industry's (CBI) latest monthly industrial trends survey, 25% more firms reported above-normal total order books and 26% reported below normal levels. That gives a rounded balance of 0%, above analysts' expectations of -8% and the highest figure since August 2011.

In the survey of over 400 manufacturers, 18% of respondents reported export orders above normal and 25% below normal, resulting in a net balance of -7%, the highest since June 2012.

Furthermore, output volumes were higher in twelve of the sixteen sub-sectors in the manufacturing industry, said the report from Britain's biggest business lobbyist.

Smaller sectors such as building materials, metal manufacture and electrical goods saw the strongest growth rates, with net balances of 49%, 51% and 51%, respectively.

"Manufacturers have seen a real upturn in fortunes this quarter, as output grew at its fastest pace for two years," Stephen Gifford, CBI director of economics, said.

"Domestic and export orders have rebounded almost across the board, and manufacturers expect this strength to continue during the next three months."

The net balance of respondents who expect that output will increase at an even faster pace in the next three months was 25%, which compares favourably against the long-run average 6%, the CBI said.

Higher Capital Expenditure from Small Manufacturers

A separate survey of small-and medium-sized manufacturers by the Manufacturing Advisory Service showed that firms are increasingly willing to invest in machinery, premises and staff, as the ongoing economic recovery continues to lift confidence.

Following a slowdown, the UK economy picked up the pace in its second quarter with 0.6% GDP growth, after a 0.3% expansion in the opening three months.

The Manufacturing Advisory Service survey, involving around 700 firms, showed a 12% year-on-year increase in the number of firms who are planning to spend more on new machinery and premises.

Firms were also increasingly willing to employ more staff with a net balance of 43%, up from 40% three months ago.

Remaining Risks

Despite its continued growth, the UK manufacturing sector still feels the pain of the global economic crisis. The CBI said that output prices are expected to remain flat over the next three months, the worst outlook since July 2012.

"UK manufacturers seem to be experiencing a build-up in momentum, but risks in the global economy still mean that it won't be plain-sailing for some time to come," said the report.

The slow recovery from the eurozone debt crisis is still a major problem for the economy. Furthermore, concerns over Britons' spending power remain as earnings growth continues to be sharply outpaced by inflation.

© Copyright IBTimes 2025. All rights reserved.