Ultra-Low Interest Rates Mean Your Cash Could Use a Workout

While ultra-low interest rates are a boon for mortgage borrowers, they are a curse for the legions of savers who have seen their cash returns collapse.

Six years into supposed economic recovery after the seismic shock of the global financial crisis, the FTSE 100 index has gained 80% from the 2009 low to the present date.

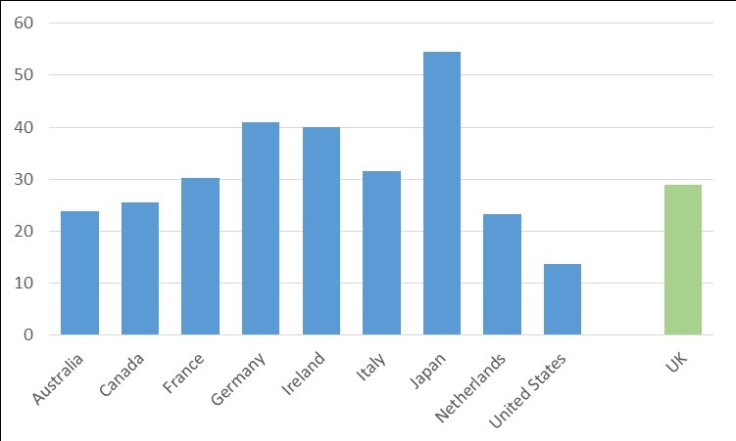

You might have thought that retail investors would have been enjoying this impressive stock market performance. But in fact, not nearly as much as you might have thought, because according to the OECD, UK households have continued to hold very high levels of cash – some 29% of all their financial assets (excluding housing), in common with retail investors across Europe and Japan (Figure 1).

1: UK Households Still Have 29% of All Financial Assets in Cash

Source: OECD, National Accounts at a Glance, 2014

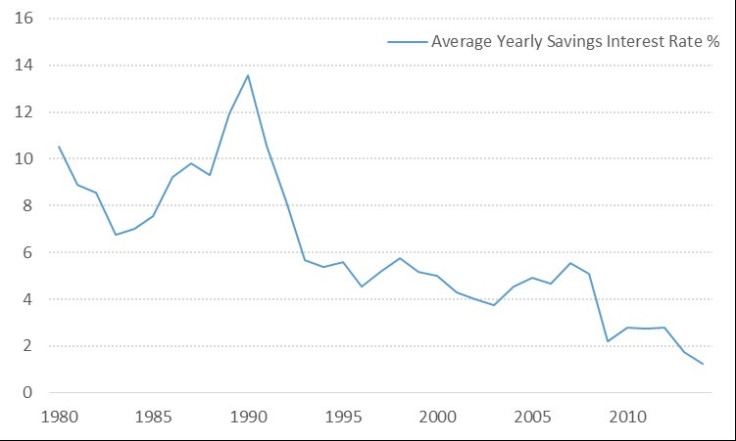

Clearly, the scars of the last two bear markets in 2000 and 2008 still run deep. But instant-access cash savings rates have never been as low as they are today in post-war Britain: in fact, they have been on a steady decline really since the height of the last property boom in 1990, falling from a heady 13.6% to 1.25% on average today (Figure 2).

2: Cash Savings Rates Have Not Been This Low in Post-War Britain

Source: swanlowpark.co.uk

It is obvious that a 1.25% interest rate is not enough to preserve the value of your savings in real terms even when shielded from tax in a cash NISA, when average UK inflation has run at 1.8% on the CPI measure this year, and an even worse 2.5% on the old RPI measure.

If you insist in keeping some of your savings in cash, then I can recommend hunting out Regular Saver bank accounts at HSBC, First Direct, Lloyds Bank and Nationwide which all pay up to 6% p.a. on regular savings of up to £250 per month. Attractive interest rates to be sure, but only available on relatively limited amounts.

Attractive Income from the Stock Market

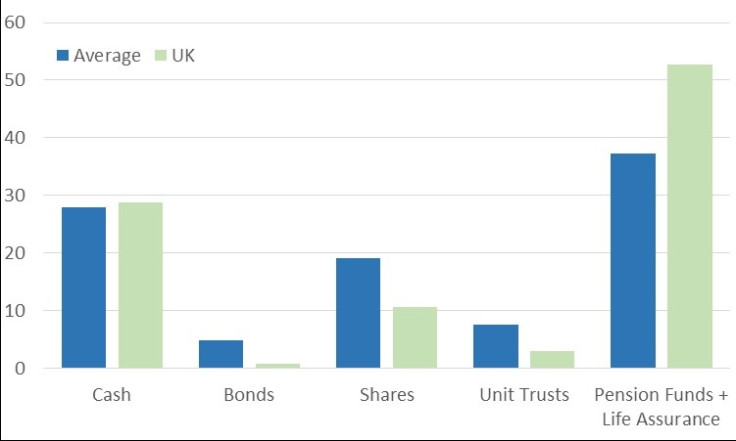

A second route to higher income is through the stock market, where dividend payments have in general been growing consistently since 2009. UK households are relatively under-invested in shares at 10% of total financial assets, compared to other developed countries (Figure 3).

3: UK Investors' Exposure to Shares is Below Average

Source: OECD, National Accounts at a Glance, 2014

To identify potentially attractive income stocks, I have used Stockopedia's excellent stock screening service to identify UK large-cap companies that offer:

- an attractive combination of good value and quality (based on a combination of different valuation, profitability and risk measures), as represented by the Stockopedia Quality Value Rank (scored out of a maximum 100), and

- a high dividend yield (paid half-yearly or quarterly) of well over 5%.

I have picked out five different UK companies which come out at the top of this ranking from a range of different industries, including house building, insurance and oil & gas (Figure 4):

4: Five UK Large-Cap Stocks With High Yields and High Quality + Value Scores

Source: www.stockopedia.co.uk

The Benefits of Dividend Yield Plus Growth

A portfolio containing equal amounts of each of these five stocks would yield well over 5% and would also participate in any stock market advance. Remember in addition that company dividends tend to grow over time, potentially giving the income investor an even higher yield on initial investment over time.

Alternatively, if you just want to buy a single fund to benefit from this combination of high dividend yield plus future dividend growth, you could invest in the SPDR S&P UK Dividend Aristocrats exchange-traded fund (LSE code: UKDV), which invests in a diversified portfolio of higher-dividend yielding UK stocks. To qualify for inclusion in this fund, a UK stock must offer a high dividend yield and must also have grown its dividend consistently over the past 10 years. The current dividend yield on this fund is over 4%, with an annual management charge of only 0.30%.

Both of these investment solutions will give you a far better annual yield on your savings, and should see that yield rise over time too as dividend payments grow – a good alternative to leaving your money in low-yielding cash!

© Copyright IBTimes 2025. All rights reserved.