US Unemployment Rate Stable at 7.8% in December

Economy adds 155,000 jobs in the month

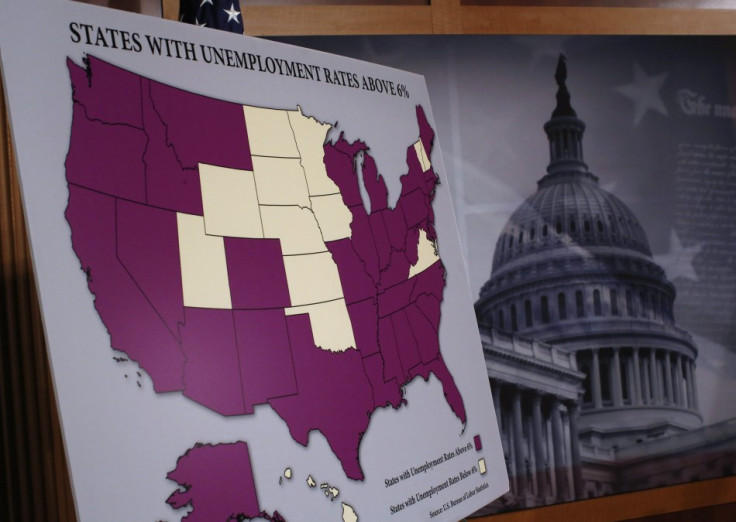

The US economy has added 155,000 jobs in December, but the unemployment rate remained steady at 7.8 percent, according to official data.

Sectors such as healthcare, manufacturing, construction and food services were the major job creators while the public sector shred 13,000 jobs.

In December, employment increased in health care by 45,000, food services and drinking places by 38,000, construction by 30,000, and manufacturing by 25,000.

However, the number of unemployed people was stable at 12.2 million.

There was no major improvement in retail, mining and logging, transportation and warehousing, financial activities, and professional and businesses services.

The December new jobs figure is slightly above the average 153,000 jobs created per month in both 2012 and 2011, as the economy needs to add about 90,000 jobs per month to keep up with population growth.

The November jobless rate was revised up to 7.8 percent from 7.7 percent, said the Labor Department .

These are the first data released after the government passed a bill to avoid the so-called "fiscal cliff", resulting from spending cuts and tax rises worth $600bn (£370bn, €459bn). The proposed spending cuts and tax rises could have thrown the US back into recession and sent the unemployment rate to higher levels.

However, negotiations over spending cuts and raising the legal cap on government's borrowing are yet to be concluded. If the borrowing cap is not increased, the government is set to run out of money by February.

The market reaction to the employment report was negligible with the yield on 10-year Treasuries recorded a slight decline. The dollar weakened against the euro reversing the gains seen earlier.

Some analysts noted that the labour market remains lacklustre and the weakness could result in the continuation of Quantitative Easing (QE) by the Federal Reserve.

"If the weak state of affairs in the labour market continues throughout most of this year, as we expect, then it is hard to see the Fed dialling back or stopping its QE purchases as some officials currently envisage," said John Higgins and Paul Ashworth of Capital Economics.

"We might have anticipated a pick-up in employment growth in early 2013 if the fiscal cliff was avoided, but not now that there is a potentially damaging fight over the debt ceiling coming soon."

Meanwhile, analysts from ANZ Research expect the Fed to continue with its asset buyback programme, as the December data did nothing to alter the Federal Open Market Committee's central forecast for an unemployment rate of 7.4-7.7% for 2013.

"For the market's worst-case fears about an abrupt ending or tempering of the Fed's USD85bn per month asset purchases a sharp drop in the participation rate and/or rapid acceleration in jobs growth above 200k per month would seem necessary, assuming inflation and inflation expectations remain in check. Neither of these labour market scenarios look likely in the near term," said Amber Rabinov and Brian Martin from ANZ Research.

© Copyright IBTimes 2025. All rights reserved.