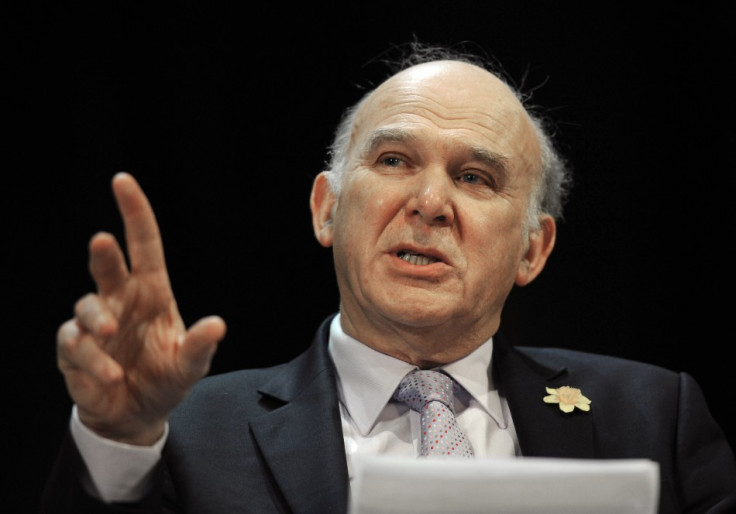

Should UK Adopt Vince Cable's Wealth Tax on Mansions? [ANALYSIS]

In the build-up to Chancellor George Osborne's 21 March budget, the two component parties of the coalition government are engaged in a fierce public policy battle.

Calls on the government to scrap the 50p top tax rate by businesses and high earners have been met with sympathy by the Conservatives and trepidation by the Liberal Democrats.

As the parties fight about how taxes can be cut and, if they are slashed, who should reap the benefits, tax relief for British workers is looking inevitable.

Liberal Democrats favour wealth taxes and want to lift the threshold on earnings to £10,000 before people start having to cough up to Revenue and Customs.

But this is not possible, argues Osborne, without cuts elsewhere. Borrowing more money to pay for this cannot happen, he says, as getting the country's budget deficit down is the top priority.

Reports have surfaced that the Lib Dems would compromise by accepting scrapping the 50p tax rate if a new tax on the wealthy were introduced as a means of raising the threshold.

"There is a broad understanding that if the 50p rate were to go - and I and my colleagues are not ideologically wedded to it - it should be replaced by taxation of wealth," Vince Cable, Lib Dem business secretary, told BBC Radio 4's Today programme.

"The wealthy people of the UK have got to pay their share, particularly in times of economic difficulty."

A wealth tax would be a way of taxing the rich on their assets, rather than their income.

One such device already in operation is the inheritance tax, in which an heir to an estate worth more than £325,000 must pay 40 percent tax on any amount over that base figure. For example, an estate worth £425,000 will be taxed £40,000 on the £100,000 difference.

But many experts have lined up against more wealth taxes.

"Certain features of inheritance tax, capital gains tax, stamp duties, council tax and business rates are unfair or inefficient or both," said the Mirrlees Review, a probe into UK taxation headed by Sir James Mirrlees, a Nobel Prize-winning economist.

"It has been argued that individuals benefit directly from holding wealth (as opposed to just spending it) and that the status and power it brings mean that additional taxation of wealth is appropriate" the review said.

"Even if one accepts this argument, it is debatable whether a tax on all wealth is the right way to tax such benefits. It is costly to administer, might raise little revenue, and could operate unfairly and inefficiently."

Liberal Democrats maintain that Cable's suggestion of a "mansion tax" is an effective revenue-generating wealth tax.

It would see a 1 percent tax applied to homes worth more than £2m.

"There are a vast numbers of extraordinarily valuable properties around the country netting very large gains for their owners, many of whom come from abroad and are not taxed at all," Cable said.

"The idea is to appeal to the green-eyed monster in those of us for whom owning a £2m home is little more than a dream," wrote Alistair Heath, editor of daily financial freesheet City AM.

"Waging war on the rich is popular - but that doesn't make it right or economically sensible.

"A wealth tax is even more destructive of the core principles of private property than an ultra-graduated income tax.

"It breaches the core principle that once someone has earned money (and paid tax on it) it is then theirs to keep."

Heath also argues that there are "crippling" practical flaws to a wealth tax.

"Someone who owns a £1.9m house with no mortgage will not pay the tax; someone in a £2m house with a £2m mortgage (and no wealth at all) will pay it," he says.

"A wealth tax is the best way to destroy our most vital asset - Britain's historic respect for property rights. It must be resisted."

© Copyright IBTimes 2025. All rights reserved.