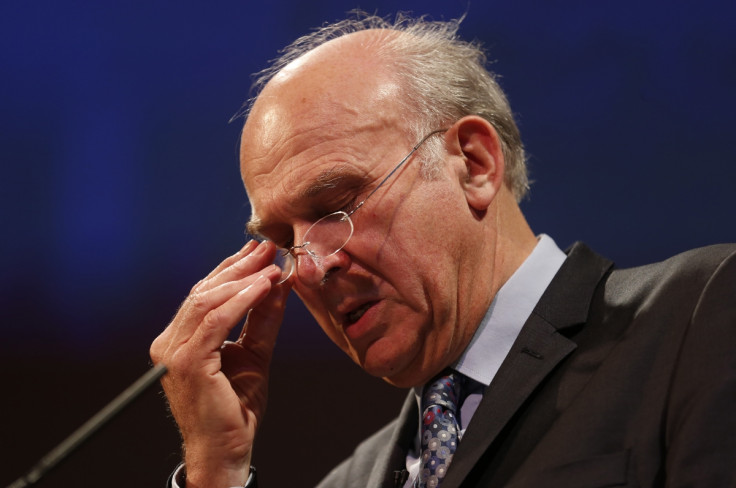

Vince Cable Targeted over Coalition's Royal Mail Shares 'Car Boot Sale'

Business secretary Vince Cable's reputation as the economics guru who saw the crash coming and could virtually walk on water has suffered a massive setback in the wake of the Royal Mail "car boot sale" of shares and calls for his resignation.

The affair has tainted his reputation to such an extent that any Labour figures considering him as a possible future chancellor in a Miliband-led coalition are rapidly rethinking.

And David Cameron will once again be relieved that it is a Liberal Democrat minister who is taking the fall and distracting attention away from the fact that the Tories were just as eager to rid themselves of the historic institution.

In a shocking report, the National Audit Office confirmed what many have been saying for months - that Cable sold off Royal Mail on the cheap, allowing speculative City investors to make a killing while ripping off taxpayers.

The City looks after its own. This was a car boot sale and only one group of people grabbed the bargains, and it wasn't taxpayers. We won't easily forgive Cable for this.

In plain language, it said that Cable and the government were so desperate to get rid of the troublesome institution that they were ready to sell it at a knockdown price - whatever the consequences for the public.

All warnings, and there were many, that the 330p share price was too low were ignored as ministers, led by Cable, claimed threats of industrial action and an investor boycott could torpedo the sale before it was even launched.

As it turned out, industrial action was called off and investors who threatened not to get involved unless the share price was low, and whose warnings were underpinned by City advisers, made a killing as the share price rocketed.

As one Labour MP said: "The City looks after its own. This was a car boot sale and only one group of people grabbed the bargains, and it wasn't taxpayers. We won't easily forgive Cable for this."

Quizzed by the business committee of MPs at the time of the sale, Cable dismissed all the stories about the sell off as "froth" and said it would be months before the market settled down and the proper share price was established.

Almost six months since the sale and the share price is 70% higher than last October's price. There is evidence that, despite reassurances only long-term investors were being sought: speculative investors including hedge funds looking for a quick profit pitched in and got what they wanted, with bells on.

Meanwhile, as the country continues to struggle through austerity, the taxpayer was landed with a £1bn bill.

Labour's Chuka Umunna branded the report a "damning indictment of this botched Royal Mail privatisation".

And both the Communication Workers' Union and the campaign group Save Our Royal Mail called on Cable to resign over the "ministerial incompetence".

But while Cable is in the frame, the blame goes much wider and Tory minister Michael Fallon has been robust in his defence of the sale.

The bottom line is that the government was desperate to privatise Royal Mail and get it off its books, despite the fact it had started showing a profit. And it was painfully aware that previous attempts by ministers, including Tory Michael Heseltine and Labour's Peter Mandelson, had failed.

All attention will now focus on future decisions over staffing, mail delivery services and the institution's remaining property portfolio for signs that customers are losing out as the new owners seek to maximise profits and keep share prices high.

Government ministers, and Cable in particular, may yet find this affair is far from over.

© Copyright IBTimes 2025. All rights reserved.