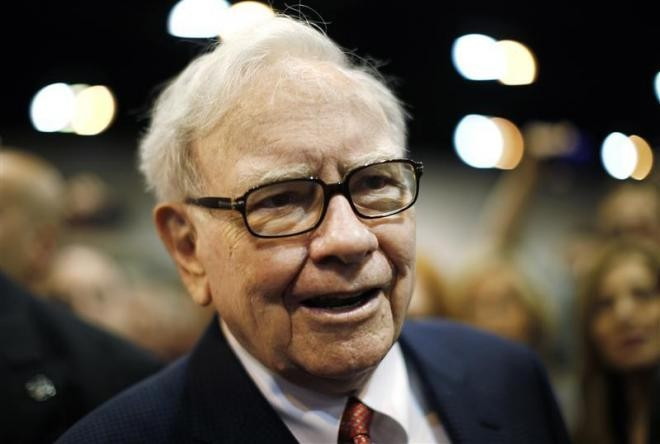

Warren Buffett's Berkshire Hathaway to Be Goldman Sachs' Sixth-Largest Shareholder

US billionaire Warren Buffett's Berkshire Hathaway is set to receive more than $2bn in Goldman Sachs stock through warrants acquired at the height of the financial crisis in 2008.

Berkshire is to receive about 13.1 million shares in Goldman Sachs after opting to convert warrants into shares.

The deal will make Berkshire the sixth largest stockholder in the investment banking giant, with a 2.91% stake.

Berkshire agreed in March to swap warrants for Goldman stock. The revised deal gives Berkshire a much smaller stake but would not require it to allot any capital to redeem the warrants.

The initial deal, inked in 2008 after Berkshire invested $5bn in Goldman, gave Berkshire warrants to purchase about 43.5 million Goldman shares for $5bn or $115 per share. That would have given Berkshire a 9% stake and would have made it Goldman's largest stockholder.

"Buffett used his position as a 'white knight' and his reputation to prop up an institution at a time of crisis," Richard Cook, co-founder of Cook & Bynum Capital Management, which owns Berkshire shares, told Bloomberg.

"Goldman Sachs is almost certainly better off for it, even though it was very expensive. And certainly Berkshire shareholders are better off," Cook added.

Berkshire Hathaway invested in Goldman Sachs five years ago, to support the bank after Lehman Brothers went bankrupt and Merrill Lynch agreed to sell itself to Bank of America.

The Berkshire investment and funds from the US government helped stabilise Goldman Sachs, which repaid taxpayers in 2009.

Buffett, the world's third-richest person, has a net worth of around $55bn. At the end of 2012, US-based Berkshire had $47bn of cash on its books.

© Copyright IBTimes 2025. All rights reserved.