'We want to pay more taxes': 400 billionaires and millionaires urge Congress dump reforms

One signatory branded tax cut plan "absurd".

Hundreds of US millionaires and billionaires have urged Republicans in Congress not to cut their taxes.

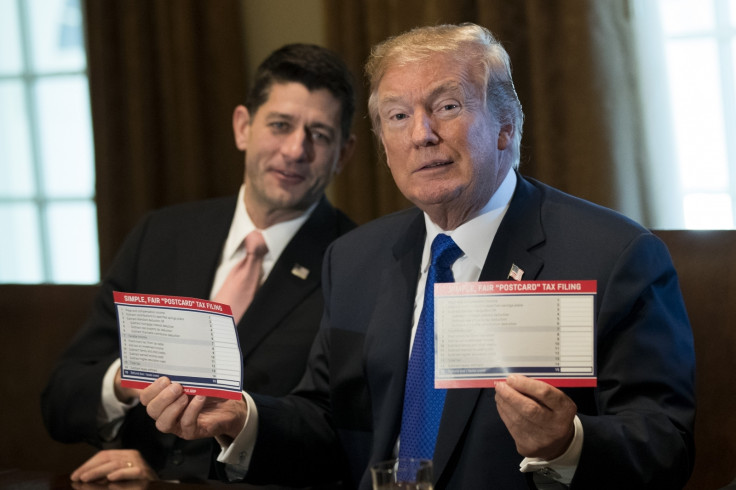

The move comes amid a planned tax overhaul that could see huge tax cuts that would add around $1.5tn to the US debt burden.

But some of the wealthiest Americans have pleaded with Congress not to go ahead with the tax reforms, claiming the timing was wrong with debt rising and inequality at its highest levels for nearly 100 years.

In the letter, from the group called Responsible Wealth, over 400 millionaires have said the tax plan would "disproportionately benefit wealthy individuals and corporation" which would mean that "wealthy people could pay a lower tax rate than many middle-class families and transfer massive inheritances to their heirs tax-free".

Some of the signatories included the founders of Ben & Jerry's ice cream, Ben Cohen and Jerry Greenfield, billionaire George Soros, philanthropist Steven Rockefeller and fashion designer Eileen Fisher.

The Washington Post reported that many of the signatories had at least $1.5m in assets or earned at least $250,000 per annum.

Bob Crandall, a former American Airlines chief executive, whose name is on the letter said that a tax cut for the wealthy was "absurd" and criticised Republicans who suggested that the US government couldn't "afford" to spend money

In a bid to counter the growing US debt, the group called on Congress to "raise our taxes to bring in additional much-needed revenue and to restore investments to vital services".

Republican congressmen are hoping to get Trump's tax plan onto his desk to be signed by the end of the year, following a series of humiliating defeats in their bid to repeal and replace Obamacare.

The efforts focused on healthcare has meant that no major reforms have been passed since Trump entered the White House, which is often meant to be the congressional honeymoon period for a new president.