Whitbread Mulls Over Rapid Brand Expansion, Confident to Outperform

Whitbread Trading Update

Whitbread, which owns Premier Inn, Costa, Beefeater and Brewers Fayre, is confident that it will continue to outperform in the challenging consumer economy based on the strength of its brands and its customer propositions.

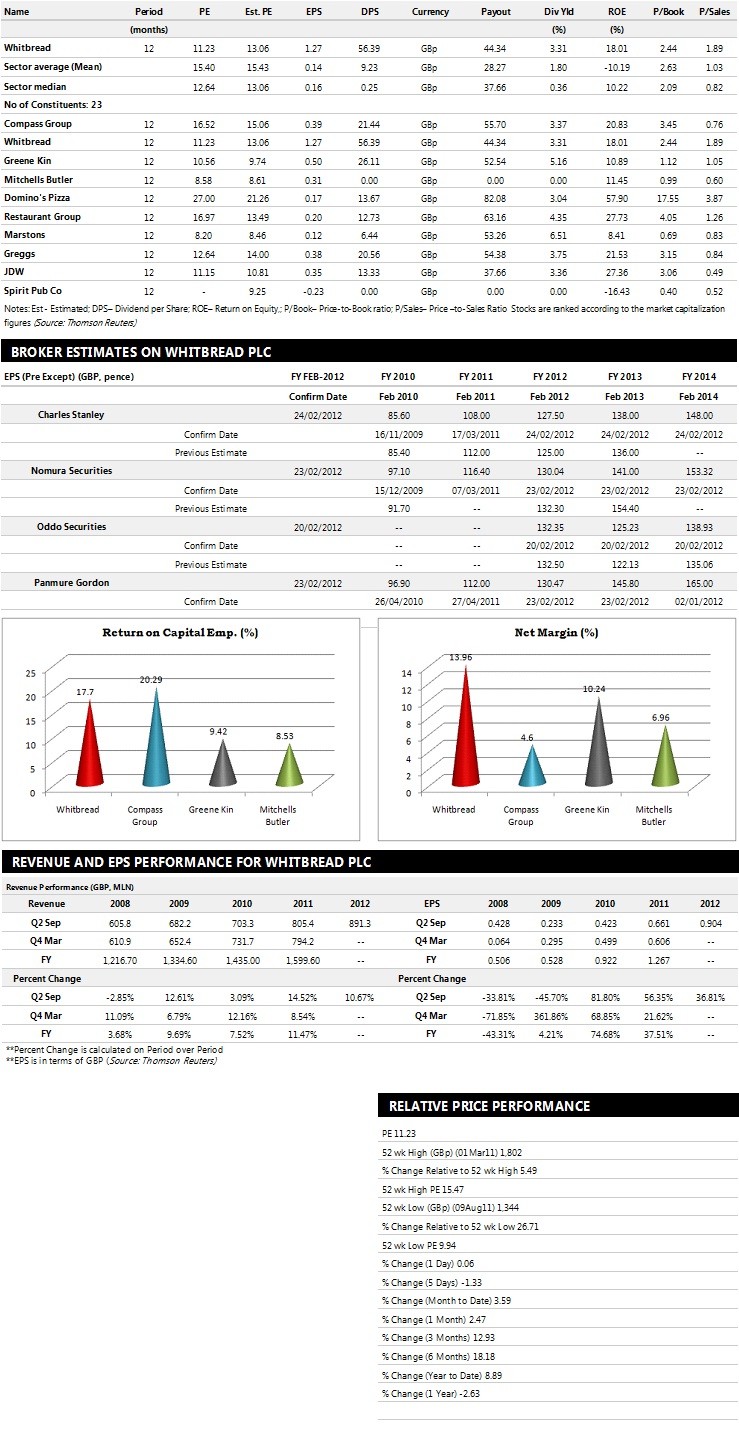

Analysts from Panmure Gordon and Nomura Securities recommend to "Hold" and "Buy"' ratings as the Group is scheduled to release its trading update on February 28, 2012.

The company's reports reveal that the group's emphasis is on giving customers value for money, winning market share and keeping a tight control of costs. It sees a significant opportunity for building on its good returns on capital and the availability of quality sites.

Whitbread is already growing faster and will add around 4,000 new Premier Inn UK rooms and around 300 Costa stores this year and it has set new five year milestones. These milestones will increase the number of Premier Inn UK rooms

by 50 percent to 65,000 and double the size of Costa to 3,500 stores worldwide over the next five years, in addition to its existing goal of expanding Costa Express to 3,000 units. This is an exciting and profitable plan to build on its success and to create substantial value for its shareholders.

For 2011/12, a number of changes has been made to the WIN card measures. The guest recommend measures for Premier Inn and Restaurants will be based on a net scoring system, which is widely considered to be a more robust measurement.

Costa's brand preference score will be based on the YouGov quarterly usage and attitude survey. There will also be new targets for brand expansion for Premier Inn and Costa. The cash flow hurdle for incentive payouts in 2010/11 has been replaced by a return on capital hurdle, while the health and safety hurdle has been made tougher, with a number of "autofail" questions being identified in the health and safety audit.

The UK's biggest budget hotel chain was awarded the "World's Leading Budget Hotel Brand" at the World Travel Awards 2011, beating off strong competition from the likes of Best Western, Travelodge and Holiday Inn Express.

Premier Inn is nearing completion of a new 120 bedroom hotel and restaurant in central High Wycombe, Buckinghamshire. The new Premier Inn High Wycombe Central is set to open on March 5 and represents another successful development for the fast-expanding budget hotel chain.

Brokers' Views:

- Panmure Gordon gives "Hold" rating on the stock with a target price of 1800 pence per share

- Numis Securities assigns "Buy" rating on the stock with a target price of 2100 pence per share.

- Nomura Securities recommends "Out Perform" rating on the stock with a target price of 1990 pence per share.

- Charles Stanley gives "Out Perform" rating on the stock.

- Peel Hunt gives "Buy" rating on the stock with a target price of 1938 pence per share.

Earnings Outlook:

- Panmure Gordon estimates the company to report revenues of £1,759 million and £1,898 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £313.30 million and £337.50 million. Profit per share is

projected at 130.47 pence for FY 2012 and 145.80 pence for FY 2013.

- Nomura Securities estimates the company to post revenues of £1,768 million and £1,907 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £315 million and £336 million. Earnings per share are

estimated at 130.04 pence for FY 2012 and 140.00 pence for FY 2013.

- Oddo Securities expects the Group to earn revenues of £1,749 million for the FY 2012 and £1,866 million for the FY 2013 with pre-tax profits of £303 million and £306 million. EPS is estimated at 132.35 pence for FY 2012 and 125.23 pence for FY 2013.

Below is the summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents ten companies based on market capitalization.

© Copyright IBTimes 2025. All rights reserved.