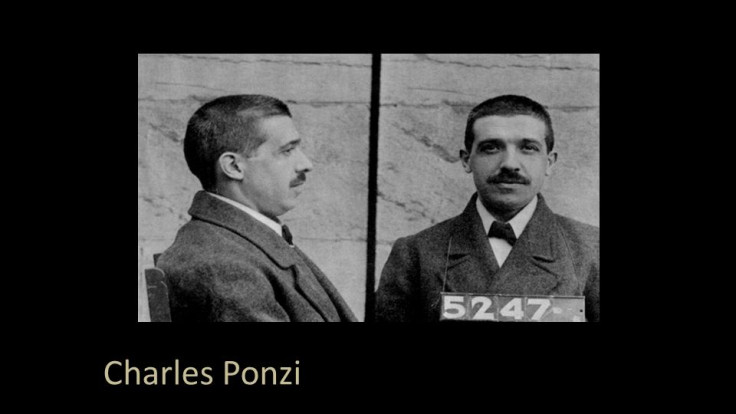

Who was Charles Ponzi and how did he become godfather of the Ponzi Scheme?

Charles Ponzi's name has become synonymous with double-dealing in business.

Charles Ponzi, the Italian convict who gave his name to financial scams, died 69 years ago today. His name has become synonymous with double-dealing in business, particularly since the 2008 financial crisis which exposed a number of swindles, the greatest of which was New York money manager Bernard Madoff defrauding clients of more than $50bn.

What is a Ponzi scheme?

Like most enduring plans – even criminal ones – it is very simple.

A businessman thinks of an eye-catching idea and promises high returns that an investor would never get from a savings account or ordinary share dealing.

Once you have convinced investors that your model can work – whatever it is – the swindle begins.

This is because the business is fictitious, and even if it did exist it would never pay the sort of returns promised.

A Ponzi scheme works because new investors pay the dividends of old ones. Cash is simply passed on to older backers from new members who join the scheme, minus a fat cut taken by those in charge of the scam.

The obvious flaw is that the scheme needs a constant stream of new investors to keep going. Once new investors dry up, the wheel stops spinning and policemen turn up at your door.

What scheme did Charles Ponzi - almost- pull off?

Ponzi's 1920 deception was based around international postal reply coupons, which at the time allowed customers in one country to buy a voucher redeemable for stamps in another country.

Ponzi, who lived in Boston, told backers that big money could be made from buying these coupons in bulk in one country and selling them in another where their postal value was higher.

He claimed he could make over 400 per cent profit on certain transactions and advertised in newspapers that he could "double money in 90 days".

For a while it worked. Cash poured in from backers lured by the promise of such high returns. At one point he was raking in $250,000 a day.

He briefly became a nationally famous businessman. His New York Times obituary said: "He lived high. People cheered him in the streets."

But federal investigators became suspicious and the Boston Post asked if such large profits could legitimately be made from such a low-margin business.

Under such scrutiny the supply of fresh backers dried up and the scheme quickly collapsed. Ponzi was declared bankrupt with debts of around $7m.

At its height the scam had raked in $15m, the equivalent of $190m today.

Ponzi was charged by the US government with using the mail to defraud and by the state of Massachusetts with larceny. He served five years in jail.

Who was Charles Ponzi?

Ponzi was born Carlo Pietro Giovanni Guglielmo in Parma, Italy, to a poor family in 1882. A slight, short man, at just over 5ft tall, he variously worked as a labourer, fruit peddler and waiter before emigrating to the US at the age of 23.

He continued to work at odd jobs before setting up an importing business and then moving onto his postal coupon scam.

A few years after his release from prison he went into a Florida land deal but was convicted of fraud and served another year in jail.

He was deported back to Italy in 1934 after he had served his time. But Ponzi left the country of his birth for Brazil just before the outbreak of the Second World War.

He eked out a living as an English teacher in South America's largest country but also had to rely on Brazil's unemployment benefit at times.

He died of a blood clot on the brain in a charity ward in Rio de Janeiro at the age of 71 in 1949. He was buried with the $75 he had managed to save for his own funeral.