Woman Is Paying $700 Monthly For A Tesla She Can't Drive: 'Go Get Gap Insurance!'

Gap insurance covers the gap between a car's depreciated value and loan balance

Update: Article was updated to clarify purchase of used Tesla.

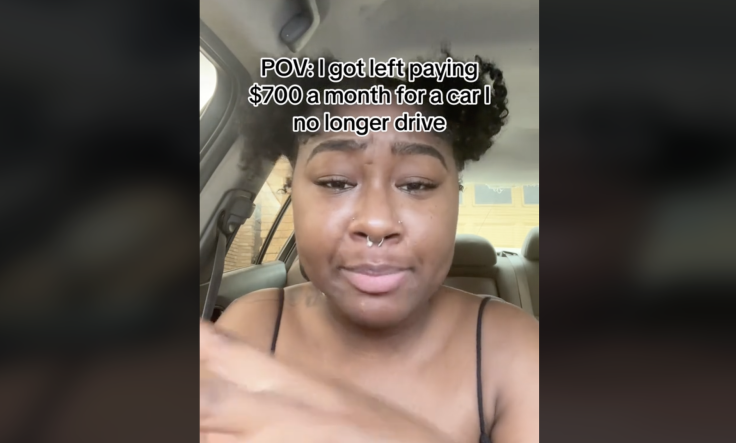

In June 2024, Drea purchased a secondhand Tesla for her birthday, thrilled to own a prized electric car. However, she soon discovered a significant financial pitfall: she hadn't purchased gap insurance. This crucial coverage bridges the gap between a car's depreciated value and the remaining loan balance if an accident occurs and the car is written off.

Drea's lack of gap insurance became a harsh reality when she was involved in an accident. Despite having standard insurance, the payout was insufficient to cover the remaining loan balance. This left her with $700 monthly payments for a car she could no longer drive. Drea's situation underscores the importance of gap insurance for new car owners, as it protects against the financial burden of paying off a loan for a depreciated or undriveable vehicle.

Sharing Her Experience

Sharing her experience on social media, Drea's story serves as a stark reminder to consider all aspects of car insurance coverage when financing a new vehicle. She acknowledged the importance of gap insurance, which is typically recommended for new car purchases to cover the depreciation gap between the car's value and the remaining loan balance.

"Okay, that's common knowledge, but this is my first time purchasing the car by myself, going out and doing everything on my own, so I didn't, I did not go get gap insurance," she explained. "I don't care how much it costs. I don't care what you have to do, go get gap insurance." Drea reiterated that this was her first time buying a car entirely on her own, as her previous vehicle was a cash purchase. She concluded by acknowledging her newfound appreciation for gap insurance, stating that it would be a non-negotiable purchase for future car purchases.

Why Consider Gap Insurance?

@dreahtx Let me make the mistake for yall, so yall dont have to 😭 #fyp #gapinsurance #carinsurance #tesla #newcar ♬ original sound - Drea

Drea's experience highlights the importance of gap insurance for new car owners. Let's explore this concept further to understand how it can protect car owners.

What is Gap Insurance?

Gap insurance is a type of car insurance coverage that helps cover the difference between the amount you owe on your car loan and the car's depreciated value if your vehicle is totalled or stolen. For instance, if your car is written off in an accident and the insurance payout is less than the outstanding loan amount, gap insurance will cover the shortfall.

When Should You Get Gap Insurance?

Gap insurance is particularly useful for new cars, which depreciate quickly. According to Kelley Blue Book, a new car can lose 20 percent or more of its value within the first year. This rapid depreciation can leave you owing more on your loan than the car's current market value. Gap insurance is advisable if:

- You have a high loan balance relative to the car's value.

- You financed your car with a small down payment.

- You lease your vehicle.

- Your loan term is longer than 48 months.

How to Obtain Gap Insurance

Gap insurance can be purchased through several channels:

- Car Dealerships: Many dealerships offer gap insurance at the time of purchase. However, this can be more expensive than other options.

- Insurance Companies: Many auto insurance providers offer gap insurance as an add-on to your existing policy. This is often a more cost-effective option.

- Lenders: Some lenders provide gap insurance as part of their loan packages.

Understanding Gap Coverage

Gap insurance fills the gap between your car's depreciated value and your remaining loan balance in the event of a total loss. Here's a breakdown:

Scenario:

You buy a new car for £25,000 with a loan. After a year, it depreciates to £19,000, but you still owe £20,000. Your collision coverage pays £19,000, leaving a £1,000 gap on your loan. Gap insurance covers that £1,000 difference, helping you settle your loan without an out-of-pocket expense.

A Cautionary Tale for Tesla Owners

Drea's experience serves as an important reminder for new car owners to consider gap insurance. This coverage can prevent significant financial hardship by covering the difference between a car's depreciated value and the remaining loan balance in the event of an accident. As cars, particularly high-value electric vehicles like Teslas, continue to evolve, understanding and investing in comprehensive insurance coverage, including gap insurance, is crucial.

© Copyright IBTimes 2025. All rights reserved.