WSP Group FY Earnings Preview as Jefferies Gives it 'Buy' Rating

WSP Group Preliminary FY 2011 Results and Estimates

Ahead of the WSP Group's preliminary 2011 results, the UK top brokers Jefferies has recommended 'Buy' rating on the stock, while Espirito Santo has assigned 'Outperform' rating with a target price of 300 pence per share. The consultancy company is scheduled to report its results on February 27, 2012.

The group in 2011 had anticipated that its markets and trading patterns will remain the same was the case in 2010. With the exception of the further significant tightening seen in the UK public sector this broadly remains the case. The prospects for its U.K. public sector work, particularly Roads and Education, is uncertain and WSP believes it is now taking the appropriate further restructuring actions while the group continues to diversify its activities with increasing success into the regulated sectors of Rail and Water.

The consultancy group's experience and reputation in the private sector is providing increasing work and opportunities and it remains well positioned as the sector is recovering. It has a market lead position in Sweden where the economy grew strongly in 2010 and is forecast to repeat the same in 2011.

The group is seeing strong momentum both in the property and industrial sectors in Sweden and a public sector where investment remains significant and secure. This positive momentum is also being seen in its businesses in Norway and Germany although activity in Finland remains subdued. Whilst more recently showing signs of increased activity, the US private sector market remains broadly similar to last year's and its businesses continue to perform resiliently and are well placed to benefit from improving trading conditions.

The Property, Transport & Infrastructure, Environment & Energy and Management & Industrial Consultancy Group is seeing stability return to its business in the Middle East and it is cautiously bidding and reviewing major project opportunities, particularly in Qatar and Abu Dhabi, to complement its existing workload. Environment and Energy, whilst generally following the group's regional and sector trading trends, is increasingly diversifying its activities into other sectors including Renewable Energy and Oil & Gas and it believes this investment will provide both increased resilience and improved performance going forward.

The group's strategy of diversification across regions and sectors is providing a platform of resilience and opportunity. Despite the current uncertainty in the U.K. market, its traditional bias towards the private sector will serve it well as this sector progresses. It remains encouraged by the economic outlook in Sweden, which supports its significant operations, and elsewhere in the world its market standing, experience and financial strength will support its performance and position it well for the future as markets improve.

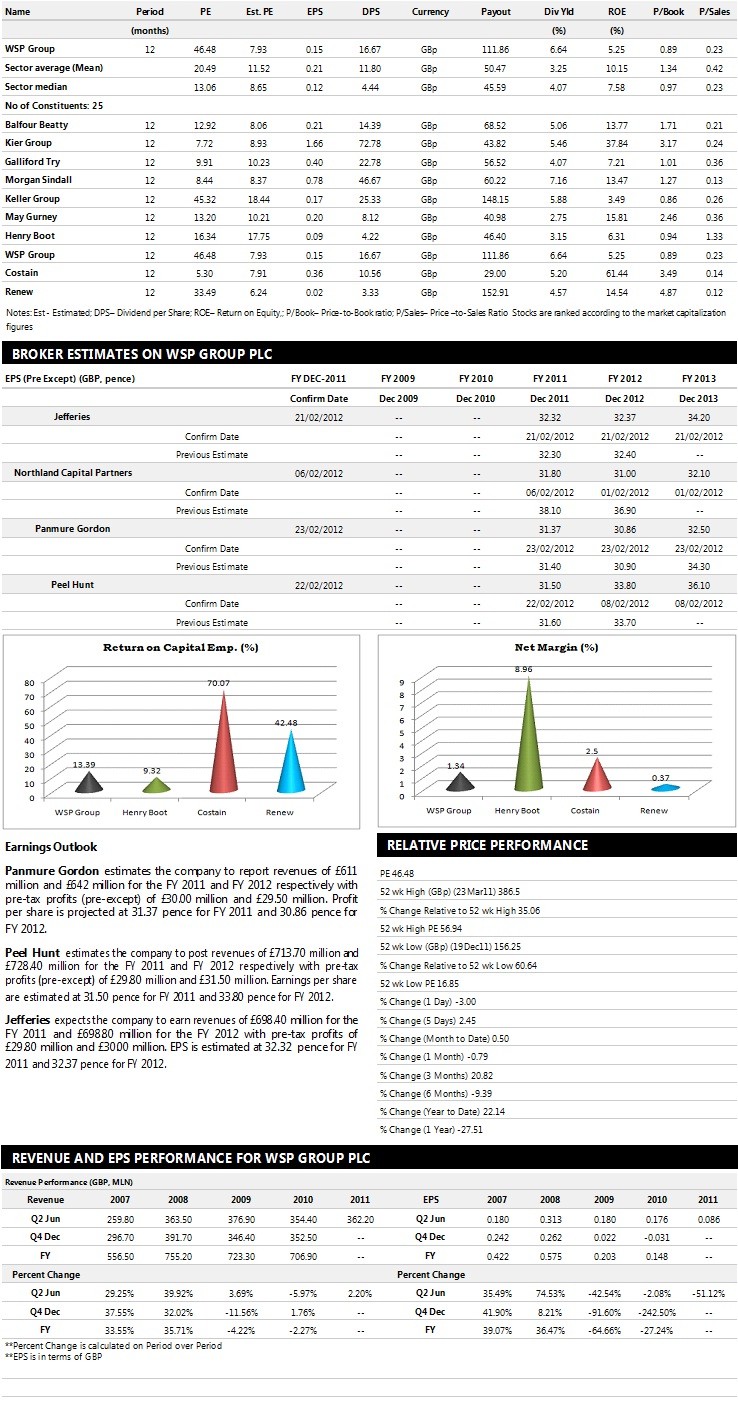

Below is the summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents ten companies based on market capitalization.

Brokers' Views:

- Jefferies assigns 'Buy' rating on the stock with a target price of 300 pence per share

- Espirito Santo Investment recommends 'Out Perform' rating on the stock with a target price of 300 pence

per share

- Panmure Gordon gives 'Hold' rating on the stock with a target price of 278 pence per share

- Peel Hunt recommends 'Sell' rating on the stock.

© Copyright IBTimes 2025. All rights reserved.