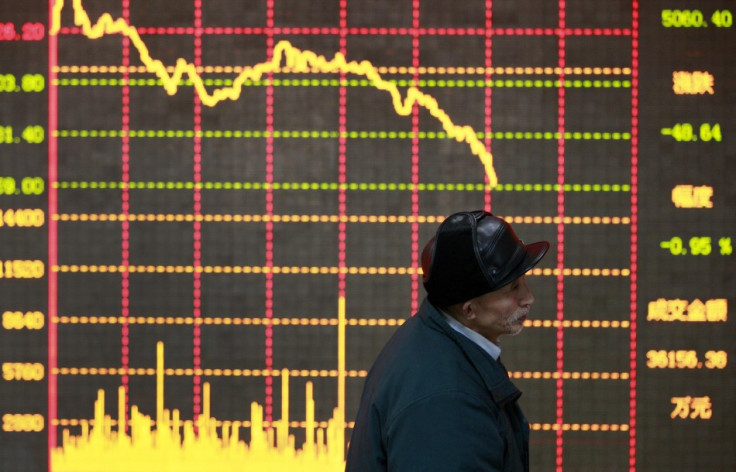

Asian Stocks Decline on Italy Election Concerns

Asian stocks fell in the morning, tracking US stocks, as inconclusive Italian election results sparked fresh concerns on the eurozone's recovery efforts.

Japan's Nikkei average index traded 1.37 percent or 160.22 points lower to 11502.30 while South Korea's KOSPI was down 0.25 percent or 5.11 points to 2004.41. Australia's S&P/ASX 200 slipped 0.61 percent or 30.70 points to 5025.10.

Hong Kong's Hang Seng index fell 0.50 percent or 113.39 points to 22706.69. Bucking the regional trend, the Shanghai Composite Index gained 0.42 percent or 9.83 points to 2335.64.

The stage was set for a weak performance across the regional markets after US stocks closed with losses as concerns on Italian elections and the upcoming spending cuts decisions dampened sentiments.

Final results of the Italian elections are expected to be released soon, but exit polls tracking the results had already pointed to a split outcome with no party managing to get enough numbers to form a government. According to Reuters, after almost all the votes have been counted, the Italian interior ministry has said that the centre-left coalition will win the majority in the lower house, but upper house will remain deadlocked.

No party or coalition has managed a majority in the Senate which is crucial when it comes to approving new legislation. A potentially divided parliament has stoked economic concerns and raised doubts on the euro area's recovery prospects.

"Volatility is the name of the game once again as traders become jittery about the eurozone crisis re-igniting after inconclusive Italian elections," said Jason Hughes, head of premium client management at IG Markets in Singapore.

"Last night's traders witnessed the worst possible outcome for Italy as no party achieved majority and a coalition government is now an option. This raised fears that much-needed austerity measures for Italy could stall due to political infighting."

Tokyo investors' sentiments remained weak as the yen showed signs of strengthening against the dollar overnight. Earlier in the day the Japanese currency managed to claw back some of its losses trading at 92.43 yen, but this was still way below the 94 yen mark topped early this week.

Major Movers

Japanese exporters retreated from recent highs on the yen's strength. Camera-maker Nikon fell 2.42 percent while Sony Corp was down 2.32 percent. Fujitsu slipped 3.05 percent.

South Korean exporters too traded lower. Automobile major Hyundai was down 0.47 percent while rival Kia slipped 0.73 percent.

Resource stocks fell in Hong Kong. Citic Pacific was down 1.76 percent while Aluminum Corp of China dropped 1.75 percent. CNOOC fell 1.17 percent.

Australian mining stocks also fell. Rio Tinto was down 0.56 percent while BHP Billiton fell 1.11 percent.

© Copyright IBTimes 2025. All rights reserved.