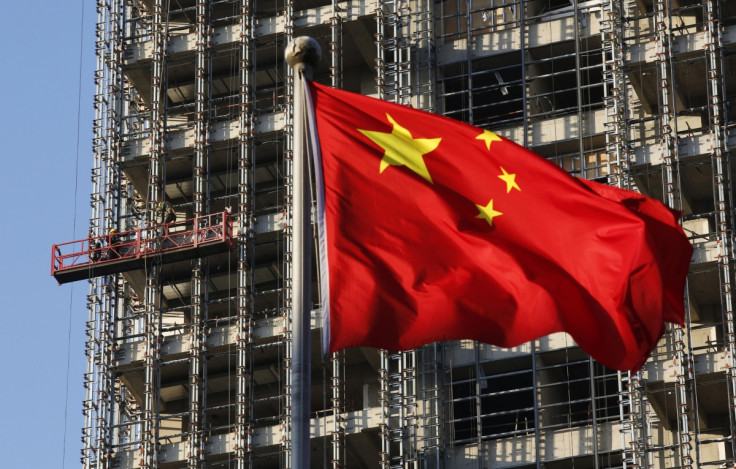

Asia's richest woman loses half her wealth due to China's property crisis

She had inherited her fortune from her father, Yang Guoqiang, in 2005.

Yang Huiyan, the richest woman in Asia, has lost more than half of her wealth due to the ongoing property market crisis in China.

Huiyan, 41, controls China's largest real estate developer, Country Garden Holdings. She had inherited her fortune from her father, Yang Guoqiang, in 2005. She became Asia's richest woman in 2007 when the company went public. Her father had founded the company in Foshan, Guangdong province, in 1992.

Her net worth has come down to $11 billion from nearly $24 billion in just a year, according to the Bloomberg Billionaires Index. The decline in her net worth has narrowed the wealth gap between Huiyan and her fellow female billionaires in the country.

Fan Hongwei, who chairs Hengli Petrochemical, is just $100 million away from surpassing Huiyan in wealth and becoming the richest woman in Asia.

The country's real estate sector is struggling because of the debt default crisis. Country Garden is among the firms that have been badly hit by the debt crisis. Its stock dropped 15% on Wednesday after the company announced that it would issue new stock to raise funds and repay debts.

It has become China's second-most indebted developer after Evergrande Group. It has debts of $220bn as of the end of 2021.

"The company still has significant debts and recorded slower month-on-month growth in June sales even though China resumed work," Kenny Ng, a strategist at Everbright Securities International in Hong Kong, told Bloomberg.

The real estate crisis in China is only expected to escalate, with buyers threatening developers by saying that they would stop paying mortgages if their homes were not finished on time.

The boycotts have also made banks more cautious, which are scared of issuing new mortgages. This could further dent the property market and make it difficult for the property market to bounce back.

"Without sales, many more developers will collapse, which is both a financial and an economic threat," said Capital Economics analysts.

S&P Global Ratings stated in a recent report that China's property sales could drop by a third this year because of mortgage strikes. Several media reports have claimed that the government is now preparing a bailout of the sector that could cost 300 billion yuan ($44 billion).