British Sugar Giant Accused of Tax Avoidance

Sweet deals for ABF leave a sour taste in Zambia

A multinational British sugar producer has been accused of unprincipled tax avoidance by taking action to avoid paying millions of pounds in tax in one of the world's poorest countries, despite making record profits.

The subsidiary of Associated British Foods, manufacturer of Silver Spoon sugar, Twinings tea, Kingsmill bread, Primark clothing and Ryvita crackers, paid almost no corporation tax in Zambia between 2007-12, a year-long investigation by anti-poverty group ActionAid has revealed.

Instead, Zambia Sugar engaged in a sophisticated series of transactions that allowed it to shield more than $13.8m a year -a third of its pre-tax profits - by siphoning the money into sister companies in tax havens such as Ireland, Mauritius and the Netherlands.

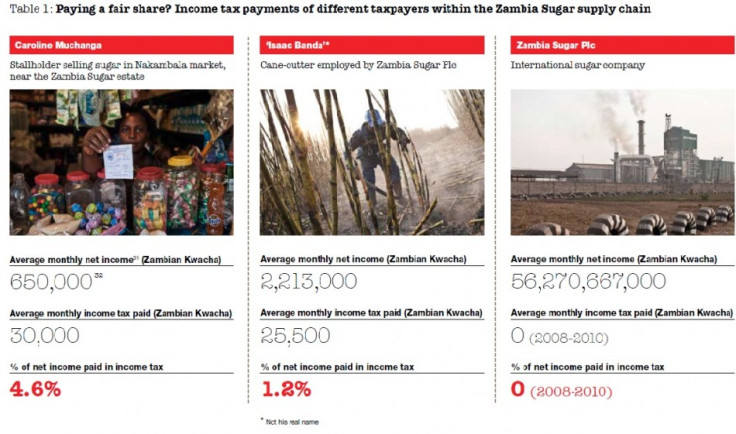

Zambia Sugar posted a record $123m in pre-tax profits profits in 2012, but paid less than 0.5% in corporation tax between 2007 and 2012. Between 2008 and 2010, it paid no corporation tax at all.

The company said capital allowances granted by the Zambian authorities allowed it to reduce its tax burden to finance expansion at its Mazakuba sugar plantation, soon to be Africa's biggest sugar mill. With its expanded capacity, Zambia Sugar expects to increase exports to exceed the 400,000 tonnes of sugar it produced this year for its European and African markets.

"As a direct result of our investment in Zambia since 2008, the availability of substantial capital allowances has led to virtually no corporate tax being payable," the company said.

But ActionAid's report reveals how the company made a series of complex transactions to reduce Zambia Sugar's taxable profits, while also avoiding taxes levied on foreign payments.

The report highlights how Zambia Sugar reduced its tax liability by funnelling annual payments of $2.6m in the form of "purchasing and management fees" to an Irish sister company which has repeatedly stated in its accounts that it has no employees, according to its accounts. A bilateral treaty between Zambia and Ireland means no tax is due.

ABF called this an "accounting error", and said it actually employs 20 people in Ireland doing "real work". However, the company's latest accounts, filed on 28 January, repeat the "error".

When ActionAid visited the offices in Dublin, neither the telephone operator nor receptionist had heard of the company.

Zambia Sugar also pays $3m a year to a sister company in Mauritius for access to "trade contacts with customers in the European sugar market, transportation of sugar to Europe, foreign currency management and the availability of cost effective credit terms".

But when ActionAid called the director of the Mauritius holding company, they were told the company only had one employee. "It's me," the director said.

ActionAid's report will put pressure on George Osborne, the chancellor, to address the issue of international tax loopholes and corporate tax avoidance at the G20 meeting of world leaders this week, and at the G8 in June.

The report's co-author, Chris Jordan, a tax specialist at ActionAid, said: "This is a really shocking case where the ABF group has gone to great lengths to ensure it pays virtually no corporation tax in a very poor country.

"Tax avoidance is not victimless financial engineering. In Zambia 45 percent of children are malnourished and two-thirds of the population live on less than $2 a day."

The total money ABF shielded from Zambian tax is 14 times larger than the UK's entire food aid budget to the country, where malnutrition and disease are the main causes of infant mortality.

The total loss to tax avoidance by multinationals in the developing world is estimated by campaigners to be around £70bn a year, enough to save the lives of 85,000 children under the age of five in the world's poorest countries every 12 months.

ActionAid called ABF's actions "scandalous".

"As we've seen with Starbucks and Amazon, many big companies are not paying their fair share of tax," it said.

"ActionAid has found evidence that Associated British Foods has used a range of loopholes to avoid paying taxes, shifting profits into tax havens and getting huge tax breaks.

"This has cost Zambia an estimated US$27 million since 2007. That's enough to put an extra 48,000 children in school, or help end hunger in the country. Zambia needs this money to tackle poverty and free itself from a dependence on aid.

"Business can be a force for good in Africa, but this is massively undermined when a company doesn't pay its fair share in tax."

Deputy prime minister Nick Clegg, who will visit Africa this week, said on Thursday that tackling those "gaming the system, seeking to play us all for fools" will be a priority for the UK government when it chairs the G8.

Sir Malcolm Bruce, chair of the cross-party Commons select committee on international development, said: "I would like to think Associated British Foods' board will now say, 'Are we really being fair to the Zambians?'"

Lord Oakeshott, the Liberal Democrat peer and a former economist for the Kenyan ministry of finance, said: "We must start by changing the law here, so big businesses like ABF must show the tax they actually pay in each country where they operate, and explain fully in each case why it is so far below the headline corporation or profits tax rate."

Ivan Lewis MP, the shadow international development secretary, said rhetoric needed to be matched by action. "ActionAid's report underlines the urgent need for David Cameron and George Osborne to match their tough talk on tax avoidance with meaningful action."

A spokesman for ABF's subsidiary company, Illovo, the immediate owner of Zambia Sugar, rejected ActionAid's claims.

"We deny emphatically that Illovo is engaged in anything illegal, immoral or in any way designed to reduce the tax rightly payable to the Zambian government," Illovo said in a statement.

"We are proud of Zambia Sugar and the major contribution it makes to the Zambian economy. Since 2008 Illovo has invested £150m to double the production capacity in Zambia and so create the largest sugar mill in Africa.

This mill and related activities provide employment for more than 5,000 people. Capital allowances on this investment have resulted in no corporate tax being payable since the investment was made.

"The availability of these allowances, used by governments all over the world, has nothing to do with tax avoidance. African governments should be as free as any other to attract investors.

"Payments made by Zambia Sugar for the services of third-party contractors, expatriate personnel in Zambia and export services provided by Illovo, are made at cost. There is no artificial reduction in profit in Zambia Sugar.

"These payments are made to overseas companies, largely for historical reasons, and are not driven by tax considerations. ActionAid could not be more mistaken."

Associated British Foods' group revenue in 2012 was £12.3 billion ($19.4bn).

© Copyright IBTimes 2025. All rights reserved.