Investors Find Relief in Fed's Ben Bernanke's QE Revelations

Now that the 'genie' is out of the bottle, any hint of slower asset purchase programme tapering means that just about everything goes up while the dollar falls.

And vice versa.

This means that anything that looks like 'good' US economic data is good for the dollar but bad for equities, bonds, commodities and other currencies.

The situation is not quite as monolithic as it sounds.

Emerging market equities, bonds and currencies and also Gold are at one end of the volatility spectrum while US, UK and Japanese equities are at the other, especially companies with strong trading performances. In other words some sort of logic is being applied amidst some rather wild volatility.

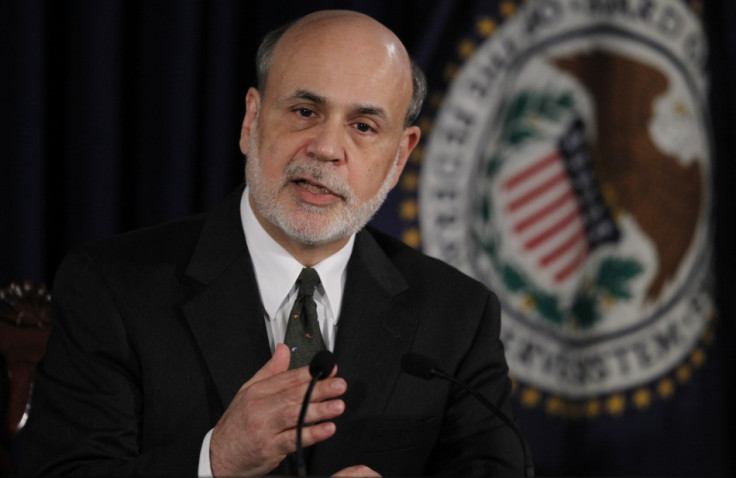

Big Ben Strikes the Right Notes

Federal Reserve Chairman Ben Bernanke is a hero to many with only a few exceptions, notably amongst the Republican Party (GOP) who once thought he was one of them.

If anyone knows how to 'remove the punch bowl' of monetary easing it is him and we are getting a masterclass.

He has first made sure everyone really is awake to the reality that the Fed cannot indefinitely sustain asset purchases at the rate of $85bn (€65bn, £56bn) per month.

He would have anticipated the shock and horror this would unleash, even though it was blindingly obvious to those willing to see.

The next step has been to play down the pace of the inevitable tapering process, thereby making asset prices perk up again and avoiding excessive dollar appreciation (not that he would ever admit to an exchange rate policy, of course!)

Despite his mellifluous efforts, investors are already even more fixated with the Non-Farm Payrolls and the headline unemployment rate (first Friday of each month) and weekly claims (every Thursday except public holidays).

Put the dates in your diaries now and, while you do that, start fretting over the statistics for employment and economic inactivity (those not looking for work).

China Not Saving the World

Some confusion remains as to whether the Chinese government has again cut its growth target to 7% from 7.5% but either level reflects official acceptance that domestic demand cannot replace slowing exports.

The IMF remains slightly more optimistic but further cuts in its latest forecasts for both 2013 (down 0.3% to 7.8%) and 2014 (down 0.6% to 7.7%) tell the same story.

There may, however, be renewed fretting over lack of growth in China and the Economic Monetary Union (EMU) area and equities and bonds in Southern Europe could well have another soft week.

Gold and oil look ripe for some profit-taking as the punters have done much better than they can have hoped over the last ten days (longer for oil).

After all, tapering will start soon enough which should knock gold and it is hard to see any imminent mismatch between supply and demand for oil.

Meanwhile, speeches from the Federal Open Market Committee (FOMC) participants will get the most attention.

The latest minutes reveal that opinions vary considerably and just the regular dissent from the Kansas Fed. This week's data on retail sales and industrial production should be solid enough, which means they are unlikely to have much impact.

This means that the US and most other equity markets should make further progress while bond yields should stabilise.

Alastair Winter is the Chief Economist at Daniel Stewart & Co

© Copyright IBTimes 2025. All rights reserved.