Fed Reserve QE Tapering is Positive for Pension Scheme Deficits

It will come as a welcome, and perhaps a surprising relief to many, that despite the largest monthly fall in asset values since January 2009, pension scheme deficits also experienced their largest monthly fall over the last 10 months.

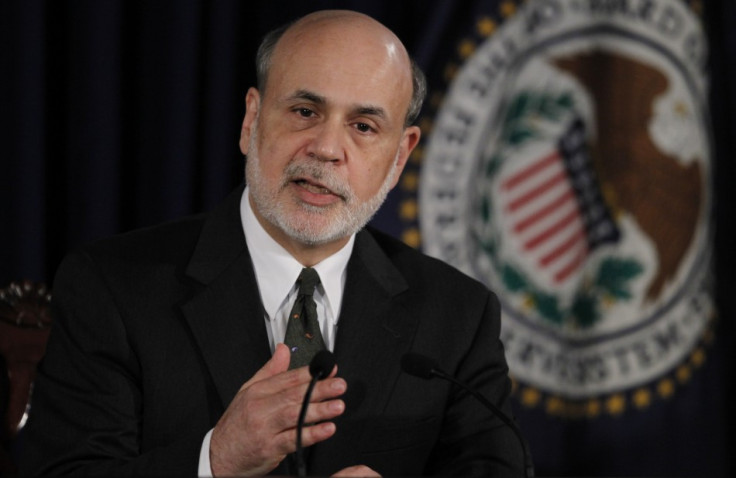

Recent statements from the Chairman of the US Federal Reserve, Ben Bernanke, that quantitative easing may have to come to an end at some point, triggered falls in asset values across the globe.

Mercer's Pensions Risk Survey data shows that the accounting deficit of defined benefit pension schemes for UK companies also reduced over the month of June.

Asset values fell by £15bn (£9.8bn, $11.5bn) over the month to £542bn, from £557bn in the previous month.

However, liability values fell to £624bn by the end of June from £655bn at the end of May.

The fall in equity markets around the world was the most visible aspect of this.

However, an equally material aspect for pension schemes was the fall in both government and high quality corporate bond prices, with a corresponding increase in yields on those assets.

Financial Strategy

The rise in these bond yields reduced liability values calculated for company accounting purposes.

Although the experience on bond yields over this month has been positive, it does highlight that the sensitivity to long-term interest rates is typically the most significant risk to pension scheme deficits.

Over the last month government bond yields and high quality corporate bond yields have increased offering some potential buying opportunities for pension schemes.

However, some parts of the yield curve offer better value so that it is important to consider how to implement these opportunities.

Additionally, for schemes who already have substantial holdings in bonds, the balance between inflation linked bonds and nominal bonds should be reviewed as interest rate and inflation expectations change It will be interesting to see how markets continue to evolve over the next few months, particularly with Mark Carney taking up his new post as Governor of the Bank of England.

Trustees and sponsors will need to monitor this carefully, and should be prepared to act quickly if necessary

Ali Tayyebi is the head of Defined Benefit (DB) Risk in the UK for consulting firm Mercer and Adrian Hartshorn is a senior partner in Mercer's Financial Strategy Group.

© Copyright IBTimes 2025. All rights reserved.