Big data experts see new pastures in private equity and unlisted companies

Rado Lipuš, CEO, Neudata, is excited about private equity and look-throughs into unlisted companies.

The value that can be extracted from a growing wealth of data across boundless sectors is only just beginning to be grasped. If you look at search engines, or digital commerce platforms, an almost direct relationship exists between the amount of data users willingly give up and the value this has. There is also the added fact that those with the most data at their disposal will probably have the best AI in the future, making them nigh-on invincible.

In the case of finance, data of one sort or another has always held intrinsic value. People who trade in the zero-sum game of capital markets all need to have a Bloomberg terminal, or Thomson Reuters data, and look at lots of traditional price information, earnings estimates and so on.

In addition to this, large quant funds have established in-house data science teams performing deep exploration of newer and larger data, and now this trend is spreading to traditional asset managers as well.

Alternative data being leveraged might include esoteric datasets like satellite data, GPS, IoT data used in industry or farming. It might also include so-called exhaust data, a by-product of industries like ecommerce, such as emailed transaction receipts. Another area is sentiment data which has become popular with the advent of social media. And in some cases these datasets can then be combined.

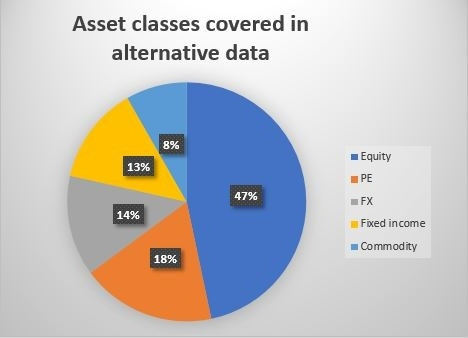

Generally these insights are used to make predictions about listed stocks, but they can also be of interest in areas such as private equity, relating to private, unlisted companies.

Rado Lipuš, CEO, Neudata, which allows money managers to outsource part of the data science function performed in-house by large quant funds, thinks look-throughs into unlisted companies for private equity firms is an interesting new area.

He said: "If you think about it, a lot of the data we see relates to non-listed stocks. It could be Uber or other fintechs or startups, or just privately held companies in various sectors.

"You have a lot of data on those; if they handle transactions, if there are receipts, if they have location data points. We see that you could use that data really effectively for things like private equity purposes, evaluations and so on.

"And also for industry trends; combing listed and unlisted information, which typically you don't find on major platforms. I think that's going to be a big theme.

"I believe alternative data's use cases go beyond the investment community and can also be consumed by corporate firms, most likely in the form of reports (insights) and not in a raw or aggregated (structured and cleansed) way."

Building useful models for private companies like Uber is tricky, because there are no standardised, audited numbers to regress against. But this wealth of data can be leveraged in a number of ways.

Lipuš continued: "Uber has issued debt, convertible debt and independent alternative data will be very handy for valuation and peer analysis, also interesting to debt issuers/underwriters, rating agencies. And of course the investors, the family offices, the institutional investors can conduct their own independent industry and peer comparables.

"Similarly, investors in listed companies which are similar to non-listed Ubers, or other industry specific firms, can inspect market share, growth, comparable accounting ratios and valuations, etc."

Lipuš added that when he started out with Neudata, he was unsure how many clients and data providers he would be servicing; now he is inundated and hiring staff across Europe and US to cope with demand. He pointed to the sheer proliferation. For example, the recent tie-up between hedge fund CargoMetrics and shipping giant Maersk is a new interesting development.

"I think we are also seeing an acceleration of interest by more traditional asset managers with typically more fundamental driven strategies, so of the transition from the fundamental into the quantamental or quant strategies.

"It's still the early days, but people are getting on with it. They can do processing and back-testing in minutes which took them before months. Suddenly the quants are saying, look this is coming from all corners now. Can we get a budget please and can you fund more people and so on."

Newsweek's AI and Data Science in Capital Markets conference on December 6-7 in New York is the most important gathering of experts in Artificial Intelligence and Machine Learning in trading. Join us for two days of talks, workshops and networking sessions with key industry players.

© Copyright IBTimes 2025. All rights reserved.