Brazil's Real Falls to Seven-Month Low as Central Bank Prepares to Rate Cutting Cycle

The Brazilian real is trading at a seven-month low as the economy braces for a rate cutting cycle sooner rather than later.

USD/BRL rallied to 2.4138 on Tuesday, its highest since 13 February, translating to a 0.6% drop in the local currency against the greenback. It was despite a day of broad dollar weakness.

The real has fallen more than 7.3% so far this month compared to the 2.8% fall in Chile's and the 4% drop in Colombia's currencies.

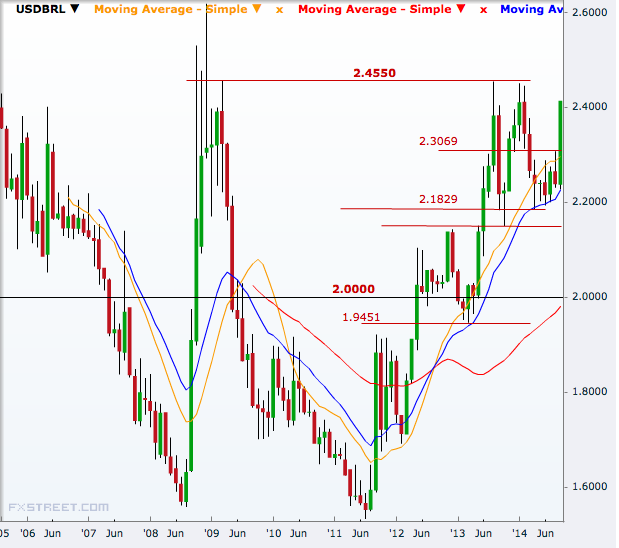

The real is not far away from a six-year low - a break above 2.45 in the pair to that level. (See the chart below)

Rate Cues

At the 3 September meeting, Brazil's central bank left the selic rate, the main policy rate, at 11%. It was the fourth straight meeting where the rate was left unchanged after it was upped 25 basis points to the current level in April.

Now that the high interest rate has finally dragged the inflation rate lower in July, the central bank is likely to switch to the easing cycle as soon as the next review on 29 October as the impact of tight policy on the growth has been severe.

Brazil contracted 0.6% in the second quarter as investment and government expenditure fell, but at the same time, the annual inflation rate slowed for the first time in six months to 6.5% in July.

The central bank had raised the selic rate nine times in the one year through April this year, as curbing inflation was high on its agenda despite weak growth.

In the previous two months, the central bank had announced some measures to ease liquidity in the banking system aiming to boost investment as high inflation prevented it from cutting the lending rates.

The bank said on 25 July that it would inject nearly 30bn real ($13.63bn) into the economy. On 20 August it cut reserve requirements on term deposits.

Data Points

The HSBC manufacturing PMI index released on 1 September showed business activity improved modestly in August, a rebound following the disruptions caused by the Fifa World Cup.

The index rose from 49.1 in July to 50.2 in August – the first above-50 reading since March, on the back of a sizeable rebound in production, HSBC said.

"However, new orders remain flat relative to the last month, suggesting that the outlook for the sector remains weak," said Andre Loes, the bank's Brazil economist.

The September PMI will be released on 1 October.

The immediate economic data point from Brazil is the May unemployment rate, due on 25 September followed by the August bank lending data on 26th, September consumer confidence on 29th and August budget balance on 30th.

USD/BRL Technical Analysis

On the higher side, the next important level is 2.455, a break of which will take the pair to a six-year high. Then the December 2008 peak of 2.6185 will be in focus.

On the downside, the pair will first aim 2.3069 and then 2.1829. But only a decisive break below the 2 mark will weaken the uptrend since early 2011. If it happens, the first level to target will be 1.9451.

© Copyright IBTimes 2025. All rights reserved.