Britons weigh up borrowing £12.4bn in personal loans as rising inflation bites household budgets

The amount that Brits wanted to borrow last year amounts to £251 for every person in the country.

Britons wanted to borrow £12.4bn through personal loans last year, or £251 for every person in the country, reflecting how households are increasingly turning to debt to boost squeezed family budgets.

The average size of the loan request was £8,765 said price comparison group MoneySuperMarket, which analysed three million loan enquiries made across its websites in 2016.

The average size of loan lifted by £308, or 0.5%, in the two years to the end of the first quarter of 2017, with most people asking for cash to pay for weddings, holidays and new cars.

The rise in debt enquiries at MoneySuperMarket underplays the national average which saw personal loans and credit card debt jump by 10% last year, prompting concern from the Bank of England.

The rise comes amid wage growth falling behind rising inflation, cutting into the disposal income of shoppers.

The rise in credit suggests households are leaning on their credit cards and unsecured loans in order to keep spending.

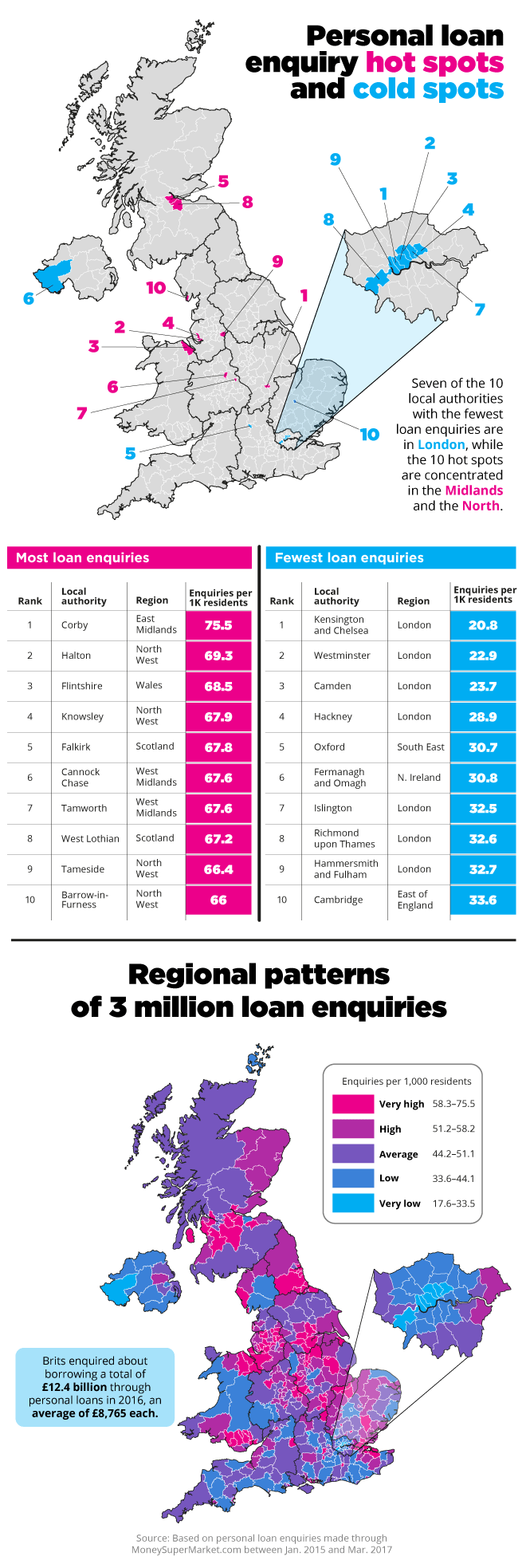

Corby in the East Midlands made the most loan enquiries between January 2015 and March 2017, generating 75.5 requests per 1,000 residents, which is 47% higher than the national average.

The least number of enquiries came from London's Kensington and Chelsea, generating 20.8 requests per 1,000 residents, coming in at 59% below the national average, in the survey called The Rise of the Personal Loan.

Although the average size of loan requested from someone in the Royal Borough was £14,699, some 64% higher than the country's average.

The capital accounted for 14 of the 20 local authorities in the country with the lowest loan enquiry rates.

Wedding days

Wedding loans saw the largest increase in the average amount enquirers wanted to borrow than any other purpose, rising 8.4% between 2015 and 2017. The average request was £7,461 to pay for their wedding, which is £589 more than two years ago.

However, the Bank of England is keen to clampdown on rising household debt levels.

Defaults on credit cards and personal loans "increased significantly" in the three months to the end of June, the Bank said last week in its second-quarter credit conditions survey.

The survey added that high street banks expected to cut the length of interest-free periods on credit card balance transfers, as they tightened credit quality thresholds in unsecured lending.

Last month the Bank told lenders to find a further £11.4bn ($14.7bn) over the next 18 months to beef up their finances against the risk of bad loans.

Kevin Pratt, consumer affairs expert at MoneySuperMarket, said: "Inflation is rising and is forecast to increase further, and there is some suggestion that the Bank of England might increase its base rate before the end of the year.

"That's why, if you're in the market for a loan, it's important to shop around to make sure you've got the lowest rate of interest you can find."

© Copyright IBTimes 2025. All rights reserved.