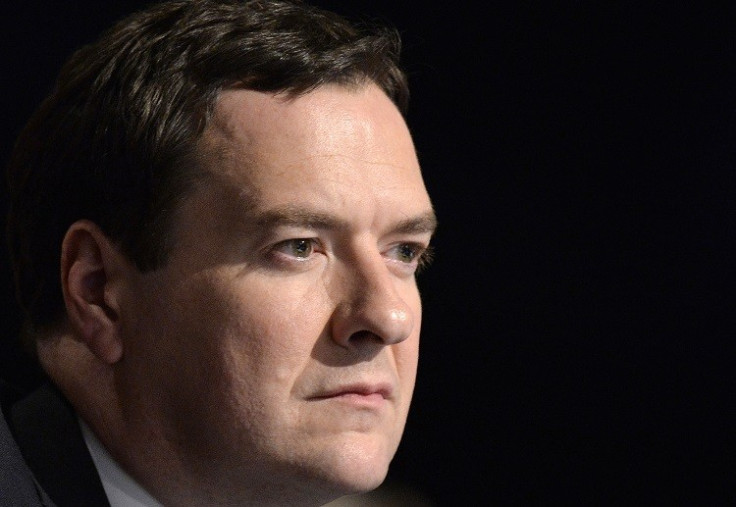

Tax Evasion Crackdown: George Osborne Signs Cayman Islands Bank Account Information Sharing Deal

Sweat will be pouring down the brows of British taxpayers who hide their money from Her Majesty's Revenue and Customs in the Cayman Islands as Chancellor George Osborne signs an account information sharing deal with the secretive Crown dependency in the Caribbean.

The Cayman Islands is a tax free jurisdiction where no income or capital gains tax is levied on money that flows through the tiny state, which has become the darling of tax avoiders but the bane of authorities across the world.

Efforts to crack down on tax avoidance, evasion and money laundering have been ramped up since the G8 summit in Lough Erne, Northern Ireland, where world leaders agreed on a declaration of commitments on how to tackle the issue.

"The UK has led the way in creating a new global standard for tax transparency and automatic tax information sharing. This was at the heart of our G8 agenda this year and today's agreement builds on the progress we have already made," said Osborne.

"We welcome this signing with the Cayman Islands, the first Overseas Territory to sign this type of agreement with the UK. This demonstrates our shared commitment to tackling tax evasion.

"Alongside the significant investment that this Government has made in HMRC's anti-avoidance and evasion work, these agreements will help them to clamp down further on those individuals who seek to hide their assets offshore."

He added: "Our message is very clear: it is only fair that people pay the tax they owe. If you are trying to evade tax, we are coming after you."

Under the deal with the Cayman Islands, financial information on UK taxpayers with accounts in the safe haven will be automatically shared with HMRC. It is the 31st jurisdiction to have signed up to the initiative.

It is difficult to accurately assess how much money the UK economy loses out on because of aggressive tax avoidance and evasion. The country's National Audit Office said £5bn was lost through tax avoidance schemes alone in the 2010/11 year.

© Copyright IBTimes 2025. All rights reserved.