China's Economic Growth Faces Slowest Pace in 23 Years [VIDEO]

China's economic growth could pullback by its slowest pace in 23 years after the country posted a drop in gross domestic product for the second quarter compared with the previous three months.

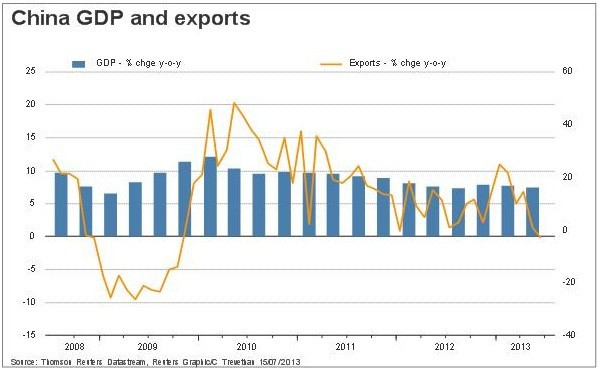

GDP rose 7.5% in the April-June period from a year earlier, lower than the previous quarter's 7.7% growth, according to the National Bureau of Statistics. Economists also expected the economy to expand by 7.5% in the second quarter as lower factory output and weak export demand stunted growth.

The weak growth was attributed to declining industrial production and worsening export conditions. While industrial production grew 8.9% on year in June compared to 9.2% in May, export orders fell by 3.1% in June compared to a 1% growth in May.

Investment growth has been affected by the weakness in exports. Fixed-asset investment excluding rural households increased 20.1% in the January-to-June period from a year earlier, compared with the 20.2% median estimate in a Bloomberg survey and a 20.4% gain in the first five months.

"The key reason behind this softness was weak exports and the impact of this on investment and sentiment in manufacturing," said analysts at RBS.

Government Policies

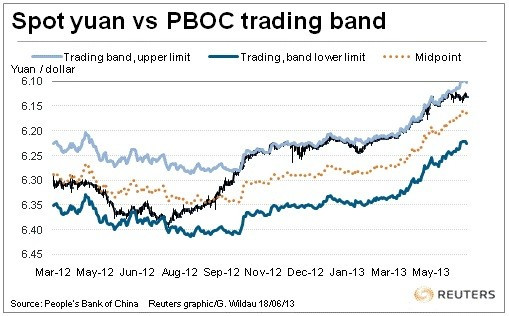

The Chinese government is currently trying to control credit expansion to avoid a deep financial crisis. However, the country's monetary policy inaction and mistakes, in handling the surging interbank rates, also contributed to the slowdown, said a range of analysts.

Meanwhile, Chinese authorities are now accepting a slower pace of expansion. China's Finance Minister Lou Jiwei had earlier indicated that the country's annual economic growth will fall short of its target due to restructuring.

China's current leadership is trying to implement a more sustainable growth model in the country with a series of structural economic changes.

Lou noted that China's economy will not make a hard landing and a slower economic rate is necessary for restructuring. He added that the country will grow less than 7.7% in the first half and a growth rate as low as 6.5% may be tolerable in the future.

"We don't think 6.5% or 7% will be a big problem," said Lou.

The government has set a target of 7.5% growth for fiscal year 2013, the lowest rate of expansion in more than two decades.

Last Week, the International Monetary Fund cut its estimate for China's growth in 2013 to 7.8%. Furthermore, investment banks Goldman Sachs Group, HSBC Holdings and Barclays reduced their estimates to 7.4%, which would be the weakest pace since 1990.

Hard Landing Risks

The strong shadow banking system in the world's second-largest economy is troubling the authorities as they fear a hard landing in the economy.

"We see little scope for upside surprises as Chinese policymakers continue their tough love stance on taming credit," said analysts at Societe Generale Group.

"In our opinion, Chinese policymakers still have the ability to steer clear of a hard landing; however, should they give into the temptation of an easy monetary fix to higher growth rates, then we believe that hard landing risks would correspondingly increase under the burden of a shadow banking system that could ultimately turn even uglier."

RBS analysts said that they expect the government to ensure core bank lending growth remains solid even as non-bank lending growth slows.

"Such an approach-reducing growth of shadow banking but ensuring enough core bank lending-will limit the negative impact on overall growth," they said.

Problems of Unemployment and High Market Rates

The lower growth rate and the government's insistence on sustainable growth have some downside risks, say economists.

The unemployment pressure is expected to increase because of lost trade competitiveness and a record increase in the number of new graduates entering the job market this year.

In addition, high money market rates and deleveraging by commercial banks will spill over to the real estate sector, with the small and medium enterprises experiencing big troubles, increasing the volatility of the sector.

Prompt policy actions including a long overdue interest rate cut from government are required to head off such risks, according to analysts at ANZ Research.

"Monetary policy must change to reflect the rapidly changing domestic and external conditions," they said.

© Copyright IBTimes 2025. All rights reserved.