China's Services Sector Grows at Fastest Pace in 15 Months

Activity in China's services sector accelerated at its fastest pace in 15 months in June, according to a survey.

The HSBC/Markit services purchasing managers' index (PMI) bounced back to 53.1 in June from 50.7 in May, well above the 50-point threshold that demarcates an expansion from contracting activity.

In addition, in a sign that the world's second-largest economy is gathering some internal strength, a gauge of new business jumped to 53.8 in June, the strongest expansion since January 2013.

"Total new work expanded at a accelerated and robust pace at service providers in June, [just as] manufacturers [witnessed] the first increase in new business for five months. Furthermore, the expansion of new orders at service providers was the strongest since January 2013. As a result, new work rose solidly at the composite level," the HSBC/Markit survey noted

"Service sector firms increased their payroll numbers for the tenth successive month in June, and at the second-fastest rate in 2014 so far... [But] staff numbers fell again at manufacturing companies, albeit at the slowest rate in three months. Consequently, employment at the composite level was little-changed from the previous month in June," it added.

Qu Hongbin, chief economist for China at HSBC, said in a statement: "The expansion in the service sector reinforces the recovery seen in the manufacturing sector, and signalled a broad-based improvement over the month. We think the economy is slowly turning around, and expect the recovery to remain supported by accommodative policies on both the fiscal and monetary fronts over the coming months. The slowdown in the property market still poses downside risks, however, and may warrant further easing measures in 2H 2014."

Cai Jin, a vice-president at the China Federation of Logistics and Purchasing – which compiles the official PMI – said in a statement on the agency's official Weibo account: "We should especially note the evident rebound in services businesses related to manufacturing activities.

Big rebound

"New orders from commodity retailers showed a big rebound, indicating that the stabilising growth momentum in the factory sector is filtering into the services industry."

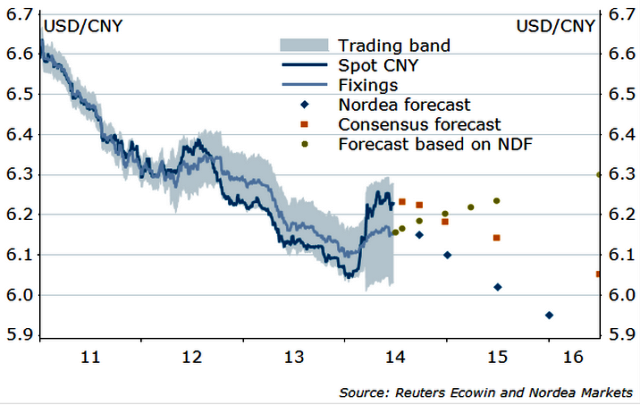

RBC Capital Markets said in a note to clients: "CNH was a modest outperformer. China's final service PMI came in at 55.0 (no consensus) while HSBC's final reading increased from 50.7 to 53.1, bringing the composite PMI up from 50.2 to 52.4, a 15-month high. The USD/CNY fix of 6.1581 was up 32 pips from [2 July], but lower than model predictions."

Nordea Markets said in a note: "The current CNY depreciation is a result of PBoC intervention to discourage one-way speculation in the CNY. It has been effective, as the estimated hot money inflows in May fell sharply to $3bn.

"Given the wider trading band and Beijing's wish for a flexible currency, CNY volatility will increase from here. Uncertainty remains high in the near term."

The services sector accounted for 45% of China's GDP in 2012 and roughly half of all jobs in the world's most populous nation.

© Copyright IBTimes 2025. All rights reserved.