Cryptoverse: Bitcoin digs in for a bumpy new year

Bitcoin's looking steady in 2023. But it's only been a week.

Bitcoin's looking steady in 2023. But it's only been a week.

Cryptocurrencies have crept into the new year, licking their wounds after the carnage of 2022. The overall global crypto market cap has risen 5% to $871 billion since Jan. 1, but it's still down over 57% from this time last year.

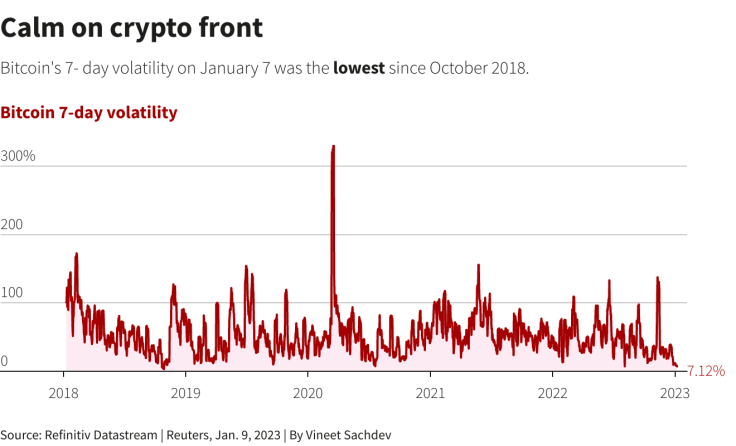

Bitcoin itself has gained 4.3% since the start of 2023, though stuck in a narrow range between $16,500 and $17,300. The world's biggest cryptocurrency is eerily subdued, with its 7-day volatility dropping to levels not seen since October 2018, according to Refinitiv Eikon data.

"It will be a year for the patient, as we do not anticipate prices nearing former all-time highs in 2023," said Vetle Lunde, senior analyst at Arcane Research.

Cryptocurrency spot trading volumes remain similarly muted after slumping about 48% in December versus the previous month to $544 billion, their lowest level since December 2019, CryptoCompare data showed.

While lower trading volumes are common around the turn of the year, the crypto market apathy has been exacerbated by a "general exodus" of active retail investors, according to Arcane Research.

For some market players, though, subdued sounds pretty good after the bitcoin bloodbath of 2022.

"I feel encouraged by the floor we've seen forming under bitcoin, it shows there's a lot of demand around $16,000 and $17,000 levels," said Callie Cox, investment analyst at investment platform eToro.

So what happens now?

Graphic: Calm on crypto front

THE BULL'S TALE

Marcus Sotiriou, analyst at digital asset broker GlobalBlock, pointed to tightening Bollinger bands - a technical indicator tracking price and volatility - on bitcoin charts.

The bands are at their tightest since July 2020, and such tightening has historically preceded aggressive moves to the upside for bitcoin, he added.

This possible scenario was echoed by Arcane Research's Lunde.

"These low volatility periods rarely last for long, and volatility compression periods have previously tended to be followed by sharp moves, even in stagnant markets," he said.

Additionally, funding rates for perpetual bitcoin futures have been positive since Dec. 19, according to Coinglass data, meaning traders are betting on prices to rise and will pay to keep their long positions open.

THE BEAR'S TALE

On the other hand, cryptocurrencies remain at the mercy of macroeconomic headwinds as worries whirl around a slowing global economy.

"The weaker economic outlook means people have less disposable income to invest in what they deem as risky assets like crypto," said GlobalBlock's Sotiriou.

Economic uncertainty could send investors running for the safety of the U.S. dollar, which tends to be inversely correlated to bitcoin, said Dalvir Mandara, quantitative researcher at MacroHive.

"The macro backdrop is still bearish for crypto," Mandara added in a note on Thursday.

Meanwhile, crypto corporates face the fallout from the collapse of Sam Bankman-Fried's FTX exchange.

Some major firms have started laying off employees in a bid to save costs, while Silvergate Bank reported an $8 billion drop in crypto-related deposits which sent its shares plunging nearly 43%.

Copyright Thomson Reuters. All rights reserved.