Cyprus Crisis: Bailout Deal Faces Several Tests Before Completion

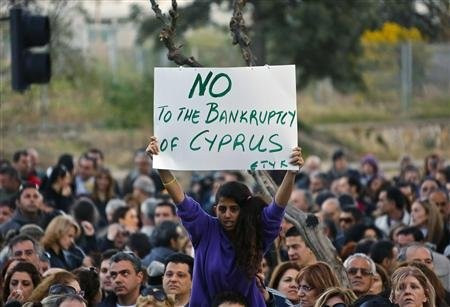

Cyprus faces a tense few weeks as it struggles to hold together its teetering banking sector long enough to secure formal approval for its €17bn bailout but some are questioning whether the island economy can ever recover from its financial near-meltdown.

Lawmakers in Germany, Finland and the Netherlands will likely need to debate and approve their taxpayers' contribution to the fifth Eurozone bailout in three years even after Sunday's agreement to fund the lion's share of the rescue with a substantial levy on Cyprus-based depositors. Yet even with the blessing of the region's champions of austerity, the financial penalties imposed and the future demands extracted from Cyprus could permanently damage the country's ability to return to anything close to its pre-crisis potential.

"Cyprus' financial crisis will have profound long-term negative consequences for the sovereign even if it successfully resolves this past weekend's political crisis and the impasse with the euro area," said Moody's Investors Service analyst Sara Carlson in a note published Monday. "The potentially irreparable damage to the country's current drivers of economic growth leaves its ability to sustain its current debt highly in doubt. Even in the best-case scenario, where the Cypriot parliament passes and implements measures that the euro area governments of the (Troika) find acceptable, the sovereign will remain at risk of default and exit from the euro area for a prolonged period."

Moody's notes that the decimation of the banking sector will hamstring the county's largest economic growth engine and hit the only sector - professional services - that made positive contribution to GDP last year. It says Cyprus runs the risk of sovereign debt default and exit from the single currency even if it's able to weather the current crisis. Societe Generale economists anticipate a 20 percent drop in real GDP by 2017.

"The challenges for Cyprus are immense, but Cyprus can count on the European Union to support it," said European Commission President Jose Manuel Barroso in a statement released Monday. "We want to alleviate the social consequences of the economic shock by mobilising funds from European Union instruments and by supporting the Cypriot authorities' efforts to restore financial, economic and social stability. We will bring in further expertise to facilitate the emergence of new sources of economic activity."

Germany's finance minister, Wolfgang Schauble, said that he was optimistic his colleagues in the Bundestag would approve Germany's share of the expected €10bn in Eurozone loans which will arrive in Nicosia via the region's permanent bailout fund, the European Stability Mechanism. German Federal Constitutional Court's ruled last year that, in effect, any new capital commitment from German taxpayers to future bailouts needed the approval of parliament. Two votes will be required: one to assess the need for a Cyprus bailout and the other for formally approve the conditionality. Schauble said the votes may not be scheduled until after lawmakers return from the Easter holiday break during the week of 15 April.

The European Central Bank's continued support - via the Emergency Liquidity Assistance programme - will also be critical for Cyprus in the days and weeks ahead. The ECB threatened to cut off access to the programme, used by the Central Bank of Cyprus to provide crucial lending to its commercial banks, by the end of play Monday if a satisfactory deal could not be agreed over the weekend.

However, even if the programme is extended beyond Monday, ECB officials will need to be certain that the country's banks - and most importantly, its largest, the Bank of Cyprus - remain solvent. Delays in parliamentary votes in Germany and elsewhere could accelerate the need for new capital before it can be legally disbursed by the ESM. And even with the capital controls put into place over the weekend by Cypriot lawmakers, banks face the risk of deposit flight that could multiply their current financial stresses.

Furthermore, given that a significant number of the large (ie over €100,000) deposits that will be subject to haircuts of 30 percent or more or wiped out altogether are held by small and medium-sized Cyprus-based firms (SMEs), analysts expect even deeper stresses on bank capital. Two thirds of the loan exposure of the country's three biggest lenders are to SMEs, larger corporations and the construction industry, according to Barclays research. The ratio of bad loans within the Bank of Cyprus' balance sheet in 22.9 percent and exploded by as much as 4.5 percent in the first nine months of last year.

"We do not expect this rate of (bad loans) to slow down in 2013," Barclays analysts wrote. "The size of the asset quality problem underpins the issues for the Cypriot banks. A credible recapitalisation of the banking sector, in our view, should fully reflect a robust stress test of the loan books."

Cyprus may, however, benefit from one aspect of the weekend's negotiations: Russian anger. Estimates indicate that as much as a third of the €68bn in Cypriot bank deposits were held by Russian companies and individual savers - a large portion of which will be wiped out completely with the agreed wind-down of Cyprus Popular Bank.

Russia's prime minister, Dmitry Medvedev, has been quoted by local news agencies as having described the depositors' bail-in as "theft", telling Agence France-Presse that "we need to comprehend what the outcome of this situation will be and what consequences it will have for the international financial and monetary system but also for our interests."

Cyprus' finance minister, Michael Sarris, returned from Moscow last week having failed to renegotiate terms of a €2.5bn bilateral loan. However, Russia's President, Vladimir Putin, is said to have told his government to revisit the topic following Sunday's agreement between Cypriot President Nicos Anastasiades and Eurogroup head Jeroen Dijsselbloem.

© Copyright IBTimes 2025. All rights reserved.