Data Week Ahead: RBNZ to Hike Rate, UK Unemployment Rate Seen Lower and China CPI to Quicken

The data calendar for next week is not so heavy broadly with US and Eurozone having practically nothing major to wait for. GDP estimate by NIESR and ILO unemployment rate for UK are important for that economy while rate decisions in Japan and New Zealand are unlikely to surprise markets. China CPI is the most important from Asia.

Important central bank meetings in the week ahead are happening in Japan and New Zealand. The Reserve Bank of New Zealand (RBNZ) is widely expected to hike its benchmark lending rate to 3.25% from 3.0% at its review on Wednesday but the Bank of Japan (BoJ) is expected to keep its main rate at 0.1% on Friday. Other central banks setting their rates are Indonesia, Korea, Israel and Chile - none of them are seen altering the policy this time.

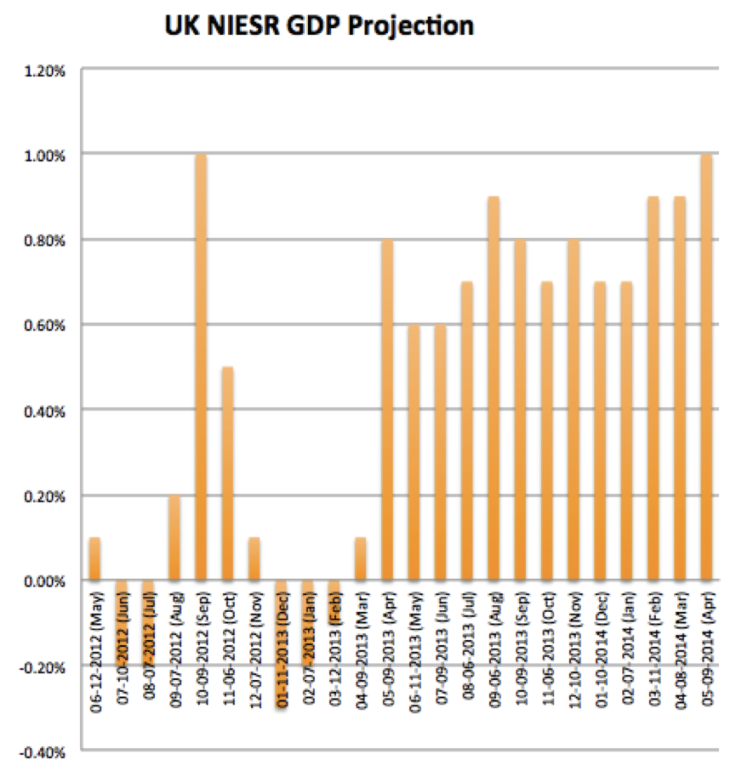

From UK, Tuesday's NIESR GDP estimate and Wednesday's ILO employment data will be the most watched numbers. Analysts expect the unemployment rate to decrease to 6.7% from 6.8%. Monday's BRC retail sales monitor, Tuesday's industrial production and Friday's RICS Housing Price Balance are other data points from the country. April industrial output is seen increasing by 0.3% m/m after falling 0.1% in the previous month.

There is nothing major from the US and Eurozone this week. In the US, Friday's producer price index and Reuters/Michigan consumer sentiment index are the numbers that will be watched apart from the weekly jobless claims. Initial claims for the 6 June week are seen easing to 306,000 from 312,000 in the week before.

For Eurozone, Thursday's industrial production and Friday's trade balance and employment change are unlikely to be significant for markets. Individually, German, French and Italian CPI data and GDP figures from Italy will be watched but they too are not likely to be significant market drivers.

Major data points from Australia are employment data on Thursday and National Australia Bank's Business Confidence on Tuesday, both for May. Market expects employment to increase by 10,000, less than the April addition of 14,200. Consensus for unemployment rate is 5.9% from 5.8% prior. Wednesday's Westpac consumer confidence index is another number to watch.

Thursday's Business New Zealand PMI is another data from New Zealand apart from the RBNZ policy next week.

The Norwegian and Swedish consumer price index on Tuesday and Thursday respectively and Tuesday's Swiss unemployment data are the other data releases from the G10 space.

China's consumer price inflation on Tuesday will be a crucial signal from Asia this week, which is important for its major trading partners like Australia. Median expectation for May CPI is 2.4% y/y, sharply higher from the 1.8% printed in April. Industrial production and trade balance are other numbers to be watched from the world's third largest economy.

© Copyright IBTimes 2025. All rights reserved.