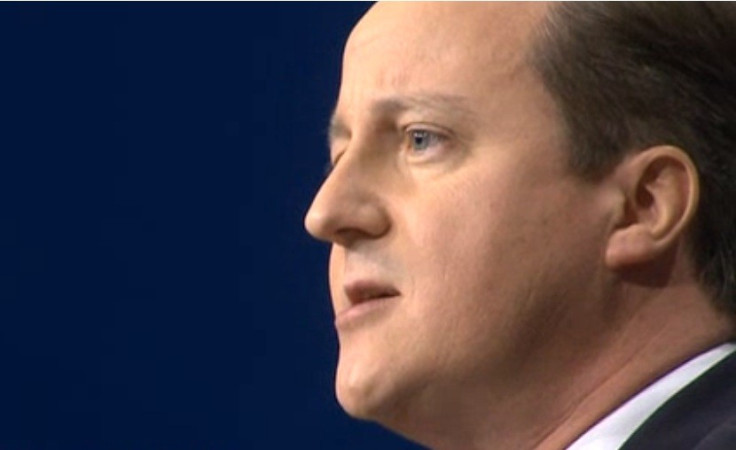

Tax Evasion Fight: David Cameron Creates Public Register of Secretive UK Company Owners [VIDEO]

Britain will create a publicly available central register of companies' beneficial owners in a bid to remove the cloak of secrecy over some firms and bolster the fight against tax avoidance and evasion.

A beneficial owner is a person who enjoys the benefits of ownership even though title of the asset is in another name.

Prime Minister David Cameron revealed the new register in a speech to the Open Government Partnership 2013 conference. It follows an agreement by G8 leaders to create national registers of beneficial owners so they can share such information in the fight against tax dodgers and international fraudsters.

As it stands, beneficial owners of companies can be shielded from public view by UK rules that allow for complex ownership structures. The new transparency will allow people to see precisely whose money is going where.

"To keep corporate taxes low, you've got to keep corporate taxes coming in. As I've put it, no tax base - no low tax case. So that's why we need to shine a spotlight on who owns what and where money is really flowing," Cameron said.

"Some people will question whether it's right to make this register public. Surely we could get the same effect just by compiling the information and using it within government?

"Now, of course we in government will use this data to pursue those who break the rules. And we're going to do it relentlessly. But there are so many wider benefits to making this information available to everyone.

"It's better for businesses here, who will be able to better identify who really owns the companies they're trading with. It's better for developing countries, who will have easy access to all this data, without submitting endless requests for each line of enquiry.

"And it's better for us all to have an open system which everyone has access to. The more eyes that look at this information, the more accurate it will be."

He concluded: "This is a complete world first on transparency and I'm proud Britain is leading the way. And today I call on the rest of the world to join us in this journey."

Industry groups broadly welcomed the government's new register.

"Businesses back the creation of a beneficial ownership register which will support efforts to promote transparency and stamp out illicit financial activity," said Katja Hall, chief policy director of the Confederation of British Industry (CBI), the country's biggest business lobbyist.

"The real prize is the ability to track ownership information around the world. Now that the UK has chosen to make this a public register, ensuring that others follow our lead will be critical to its success and to maintaining a level playing field."

However, tax expert and reform campaigner Richard Murphy, who runs the Tax Research UK organisation, warned that the register could be a "damp squib".

"Don't get me wrong: this is a massive step forward and one I have argued in favour of for a long, long time. So today marks a campaigning win for Tax Research UK and many organisations - especially Global Witness - who have worked on this issue," wrote Murphy on his website.

"But - and that preface demanded a but - the devil will be in the detail and I remain worried. If we have a public registry but with companies being required to provide the data without any corroborating evidence, and with Companies House with its current incredibly limited resources and almost total inability to prosecute being the sole enforcement agency for this register, this will be a PR exercise and nothing more.

"Sure, 90% of companies will publish their beneficial owners - but they will be the ones where legal and beneficial ownership is the same.

"It is the other 10% who are the problem and many of those will actively seek loopholes in an arrangement if there is no way of proving if what they declare is right or wrong and the agency responsible for doing so is denied the resources it needs to enforce the law."

© Copyright IBTimes 2025. All rights reserved.