Donald Trump victory could cost American economy $2 trillion

Economists says Trump's low taxes and mass deportations will hurt competitiveness of US economy.

A Donald Trump victory this week could cost the US economy over $2trn (£807bn), as well as sending incalculable shivers across global markets.

The Republican Presidential candidate's combination of policies – including tax cuts, mass deportations of illegal immigrants and ripping up existing trade agreements – could set America back $2.1trn, said US-based think tank Macroeconomic Advisers.

The body said last month the country's main benchmark, the S&P 500, is expected to fall 7% on a Trump presidency as investors see his economic policies as worse off for US growth—making it riskier to buy stocks.

Roughly seven million illegal immigrants work in the US, and if they left would shrink the labour market, potentially pushing up wages.

Tump has spoken against trade deals which he says disadvantage US producers. He has disparaged the North American Free Trade Agreement with Mexico and Canada, and is against the proposed Trans Pacific Partnership, which aims to cut tariffs between the US and 11 other nations around the world.

The Republican candidate has also called for action on what he calls America's unfair trade arrangements with China.

If Americans opt to vote for a commander-in-chief who wants to roll back large parts of America's globalised economy, that could see horrified traders rolling selling off US stocks and the dollar in the first few trading sessions after the result comes in.

A weak dollar

US research group the Brookings Institution estimates that the fall could be between 10% and 15%, which would easily pitch the slump as one of the biggest the US market has ever suffered.

However, in similar fashion to the Brexit aftermath in the UK, American stocks could soon rebound, while a devalued dollar acts as a cushion making US shares cheap for international investors. In this scenario the US Federal Reserve is likely to decide against raising interest rates, in a bid to buoy the economy. This would support stock prices further, as cheap cash favours investors.

But a weak dollar would have ramifications around the world. A lower dollar would lead to a stronger yen and euro, pushing up the prices of European and Japanese assets at a time when governments want to encourage anaemic trade.

However, this environment should come as a relief to emerging markets, where currencies have only recently started to recover after a long sell-off. It would make the debts these nations have accumulated, usually denominated in dollars, easier to service.

US banks would find themselves under pressure after a Trump victory, as Republicans have pledged to reinstate the Glass-Steagall Act, a Depression-era law that kept main street lenders from entering more risky investment banking.

The repeal of that law in 1999 led to the large mergers, resulting in the formation of giants such as JPMorgan Chase and Citigroup. Ironically, this position is close to the views of Democratic radical Bernie Sanders.

But there would be winners under a Trump Presidency. He has promised to build up the military and update weapons systems, boosting defence firms.

A Trump win would also be good news for industries Democratic challenger Hilary Clinton has in her sights. She has promised to back spending on alternative energy, like solar and wind, at the expense of oil, gas and coal power.

Clinton has also vowed to battle pharmaceutical giants in a bid to lower medicine prices.

An unknown quantity

Economists add that stocks with a domestic US focus such as utilities and telecom might do well under Trump, as well as smaller mid-tier firms who rely less on international trade.

Another research group Oxford Economics said in September the US economy could be $1trn smaller than otherwise expected in 2021 if Trump wins.

Under its baseline scenario, Oxford Economics expects US gross domestic product, the value of all goods and services produced in the economy, to grow at a fairly constant rate of around 2% from 2017, reaching $18.5trn in 2021.

But if Trump is elected and succeeds in implementing his policies, the UK think tank predicts growth would slow significantly, falling near zero in 2019, and reducing overall GDP to $17.5trn.

Under Trump risks appear greater because he is an unknown quantity. The mantra of traders is that markets abhor uncertainty.

But if Trump is elected they had better get used to that, because with a man as volatile as the Republican candidate most days of his Presidency will veer into new territory.

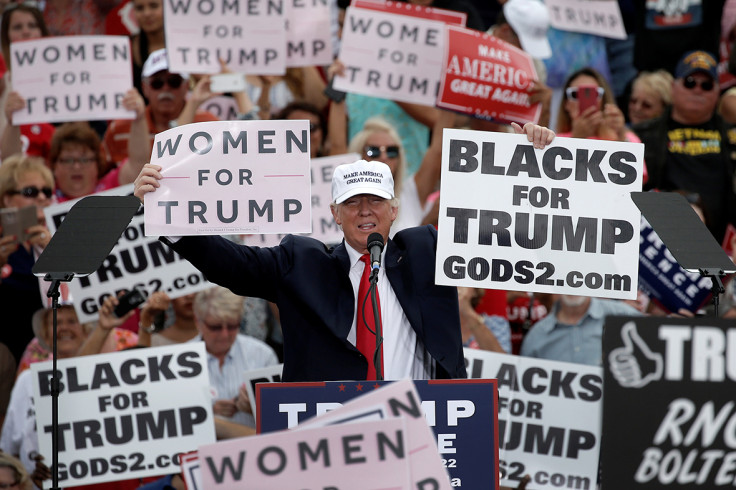

As Trump, and his supporters say, he is not coming to defend the status quo.

© Copyright IBTimes 2025. All rights reserved.