Edmund Shing: Véronique Laury aims to renovate and add value to B&Q and Screwfix owner Kingfisher

Kingfisher (UK code KGF), the owner of DIY businesses B&Q and Screwfix, has been taking flight over recent months, climbing from 286p in November 2014 to 374p today.

But what you may not realise is that Kingfisher's biggest business geographically is in fact not in the UK, but actually in France with the Castorama and Brico Depot Do-It-Yourself chains of stores. The company's chief executive, Véronique Laury, is also based in France and took the reins in January after previous boss Sir Ian Cheshire stepped down.

Kingfisher's performance of late can be best described as somewhat schizophrenic. On the one hand, its two UK businesses have been performing well, in particular the Screwfix catalogue/online building supplies division, which posted 25% year-on-year total sales growth in the third quarter (to end-September 2014).

However, on the other hand, the French Castorama and Brico Depot DIY chains of stores have suffered from a weak French DIY market, hit by a triple whammy of fragile consumer confidence, higher taxes and declining house prices. These factors have led to an 8% fall in French retail profit in the third quarter (adjusted for currency movements).

The good news for Kingfisher is French consumer confidence is now in fact surging and has touched a three-year high, due to falling petrol prices (boosting purchasing power) and unemployment that has finally started to decline (Figure 1).

Mr Bricolage

With some of these gains in French purchasing power likely to be found in better home improvement sales going forwards, combined with the ongoing restructuring programme ("Creating the Leader" self-help initiatives), Kingfisher's French profitability should turn around sooner rather than later.

Helping this rebound in French profitability is the recent acquisition of smaller French DIY retail chain Mr Bricolage, which should result in further cost savings across the group's three French operations from enhanced purchasing power and closing of weaker stores to focus on the most profitable sites. Kingfisher's management has already indicated this acquisition should boost the group's earnings per share, delivering welcome profit growth from the other side of the Channel.

UK DIY market looking sturdy

At the same time, the buoyant nature of the UK housing market and record high UK consumer confidence (at its highest level in 10 years) should continue to propel continued growth in the UK B&Q and Screwfix divisions, after strong 11% UK retail profit growth in the third quarter.

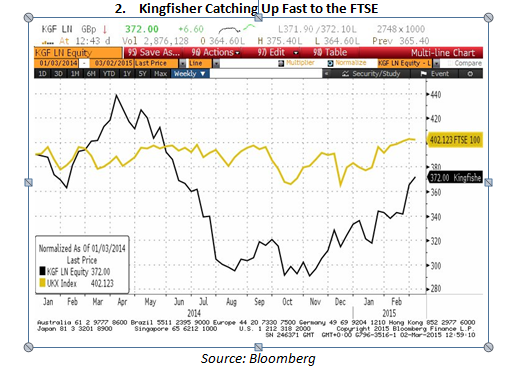

Up to now, the push-pull effects of weak French performance and strong UK performance have seen Kingfisher's share price go on a rollercoaster ride, falling from a 2014 high of 440p to a September-October low under 300p, before recovering of late to 374p (Figure 2). While it has lagged the FTSE 100 index over this period, it is catching up fast.

As part of ongoing restructuring, Kingfisher has already taken action to curb its money-losing operations outside of Europe, agreeing late in 2014 to sell 70% of its China operations (including 39 B&Q home improvement stores) to local supermarket giant Wumei for £140m. This sale has allowed Kingfisher to launch a £200m dividend and share buyback program spanning fiscal year 2014-15, with £180m already spent in 2014, and more to be spent going forwards.

Key to Kingfisher's fortunes going forwards will be the strategy update that Laury is to deliver in a month – this could prove a true catalyst for further upside in Kingfisher's shares, should her vision for Kingfisher, as DIY shopping habits change, prove revolutionary.

Takeover target?

The final wildcard that could play out in Kingfisher's favour is that it could become a takeover target (according to the Evening Standard), given its dominant position in European DIY retail, with private equity groups holding record amounts of cash and looking for potential companies to buy. All in all, Kingfisher shares may prove more alluring than the challenge of some weekend DIY.

Edmund Shing is the author of The Idle Investor (Harriman House), an expert columnist and a global equity fund manager at BCS AM. He holds a PhD in Artificial Intelligence.

© Copyright IBTimes 2025. All rights reserved.