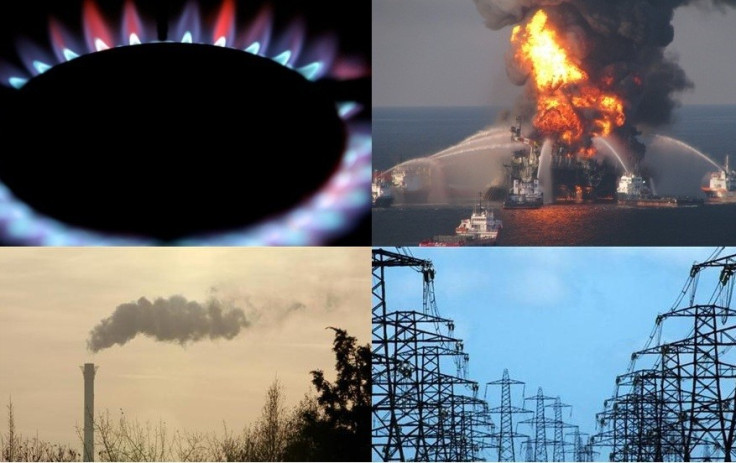

Top Energy Debacles & Scandals: Manipulation, Mis-Selling and Fraud

Ofgem revealed it is investigating six energy firms for failing to meet to the UK government's energy efficiency targets to protect the country's most vulnerable consumers.

However, this is not the first time Britain, Europe and the US have encountered a spate of energy scandals.

IBTimes UK decided to take a look at some of the largest energy market scandals to rock the world in recent history.

Mis-Selling Energy: SSE

UK regulators have turned up the heat on British energy companies over the last year.

At the beginning of April, SSE was hit by the largest fine ever imposed on an energy company by Ofgem.

The utility giant paid a £10.5m (€12.4m, $16.4m) fine for "prolonged and extensive" mis-selling of energy to consumers and was found to have had "failures at every stage of the sales process," across its telephone, in-store and doorstep selling activities.

Ofgem added that not only did SSE provide "misleading and unsubstantiated statements" to potential customers about prices and savings that could be made by switching to SSE but it had also failed to pay enough attention to compliance, which allowed the mis-selling to take place.

Tax Avoidance: RWE npower

One of the UK's largest energy suppliers revealed that it paid no UK corporation tax between 2009 and 2011.

Speaking in front of the at the Energy and Climate Change Select Committee, RWE npower chief executive Paul Massara justified the non-payment by saying it invested billions of pounds into building infrastructure and power plants which resulted in employment creation for Britain.

RWE npower's CEO also added that corporation tax liability was effectively wiped out by its investments in the UK, which have totalled £3bn for RWE npower since 2008 or £5bn at RWE group level.

Under UK tax law, corporations can claim tax allowances on certain purchases or investments made on business assets.

Carbon Markets: Carousel Tax Fraud

Each country gets allocated a certain number of carbon tax allowance permits, within a certain timeframe, in order to offset emissions.

This is traded on the primary and secondary market under the European Union Emissions Trading System (EU ETS).

However, in the carbon markets, tax evasion and fraud is rife.

Value-added-tax (VAT) 'carousel fraud' is where goods were imported VAT-free then sold on to domestic buyers at a price that includes VAT.

Currently, Deutsche Bank 's co-chief executive officer Juergen Fitschen and chief financial officer Stefan Krause are under investigation into a tax evasion scheme, involving the trading of carbon permits.

Deutsche Bank said in a statement to IBTimes UK that Fitschen and Krause "are involved in the investigations, as they signed the VAT statement for 2009. The bank corrected this a long time ago voluntarily. Unlike the Public Prosecutor's Office, Deutsche Bank is of the opinion that this correction took place in due time."

In 2011, a German court jailed six men over a €300m fraud selling carbon emission permits, through Deutsche Bank.

In the same year, Alexander Badle senior prosecutor for the Office of the Attorney General of Germany said in a statement that Germany has lost hundreds of €850m in tax revenues to frauds involving carbon emissions trading.

At the time, Badle said that 180 people were being investigated for their roles in carbon market tax fraud.

Over the years, there have been a number of investigations and arrests involving carousel fraud in the carbon markets.

In 2010, four people were formally charged by the Belgian authorities for money laundering in the trading of carbon emissions permits.

UK Gas Market Manipulation: Potential £300bn Wholesale Rigging

In November 2012, the Financial Services Authority (FSA) revealed it launched an investigation into allegations made by a whistleblower that UK traders were rigging wholesale gas prices.

Europe's largest gas market, the UK, is worth £300bn.

The allegations originated from a pre-recorded video interview with Seth Freedman from independent energy pricing house ICIS Heren with the Guardian newspaper.

In the interview, he said that "traders submitted erroneous bids and offers to skew the end-of-day price of a key gas contract."

Analysts at ICIS Heren, along with a number of other similar firms such as Platts and Argus, would call up traders and brokers daily to ask and receive bid prices on a number of energy markets across Europe, including gas, power, oil, carbon and other energy products, such as jet fuel.

However, whistleblowing Freedman was sacked by ICIS in January this year, after the group said it was forced to terminate his employment as he had lost the trust of his colleagues and the wider industry.

US Gas Market Manipulation: Amaranth Advisors

After making a series of bad bets on the price of natural gas in 2006, energy trader Brian Hunter from Amaranth Advisors lost $6.4bn, which led to the collapse of the hedge fund group in September that year.

The following year, the Commodity Futures Trading Commission (CFTC), which regulates trading in commodity futures and options in the US, charged Amaranth with attempting to manipulate the price of natural gas futures in February and April 2006.

The Federal Energy Regulatory Commission (FERC) also slammed Hunter with a $30m fine.

However, the scandal rumbles on.

Only two years ago, Amaranth settled with investors in a class action lawsuit for about $77m, while also paying a $7.5m fine to the CFTC.

In March this year, the US Court of Appeals for the District of Columbia Circuit ruled that the CFTC, not FERC, has the authority to fine Hunter.

It has therefore invalidated the $30m fine.

Power Market Manipulation: Banking on a Scandal?

Power companies can sell wholesale energy at market-based rates, or cost-based rates, which are usually lower.

However, late last year, Barclays became the latest bank to be investigated by US authorities over its power trading activities, after it announced a probe in its latest set of financial results.

While the bank revealed that FERC's Office of Enforcement has been investigating Barclays' power trading in the western US between 2006 and 2008, it is actually the second bank in 2012 to be under the spotlight for electricity markets related disputes.

Although, Barclays said it intends to "vigorously defend" allegations from FERC, after the regulator notified Barclays that it has authorised the issuance of a public Order to Show Cause and Notice of Proposed Penalties against Barclays in relation to this matter on 25 October, JP Morgan is facing some very similar charges from FERC.

Safety Scandal: Gulf of Mexico Oil Spill

When the Macondo oil well exploded on BP's Deepwater Horizon project, millions of barrels of oil spilled into the Gulf of Mexico.

The event in April 2010, not only resulted in one of the worst environmental disasters in history, it also unveiled a complicated network of operational risk and lax safety precautions.

Three years later, BP, as well as associated companies such as Transocean, is still paying the price in civil and criminal penalties.

Failed Fuel Hedging

Companies that use oil or fuel, effectively, gamble on where they see prices in a few months, or even a year's time.

Traditionally, airlines buy a substantial proportion of their fuel in advance, in order to mitigate rising costs.

Since the dramatic oil price swings in 2008, there have been a number of companies that have either scrapped or reduced their hedging programmes.

In 2008, oil reached highs of $147 a barrel and many airlines decided to lock in forward prices at around $120 a barrel to $130 a barrel in case oil prices continued to soar.

However, prices plummeted to around $40 a barrel the following year, leaving many airlines with a sizable write down in costs.

© Copyright IBTimes 2025. All rights reserved.