EU referendum: Brexit could cost British workers a month's salary by 2020, OECD warns

Leaving the European Union could deal a serious blow to British workers' pockets, the head of the Organisation for Economic Co-operation and Development (OECD) warned on Wednesday (27 April).

Speaking to the BBC, Angel Gurria, the secretary-general of the organisation, said a Brexit could cost the average British household the equivalent of a month's salary by 2020 and warned anti-Europe campaigners were simply indulging in wishful thinking.

"We made a whole series of calculations and we came out saying Brexit is a tax [...] It's equivalent to roughly missing on one month's income within four years and then it carries on [...] and there's a consistent loss," he said.

"This is not wishful thinking, which we believe that the Brexit camp has in many cases been assuming on a number of things that, you know, could go in their way. There is no kind of deal that could go better by yourselves than you would be in the company of the Europeans."

Last week, the Treasury warned that British households could be £4,300 worse off every year in the event of Britain exiting the EU at the 23 June referendum. Earlier in April, the International Monetary Fund warned that a Brexit would deal a severe blow to the global economy, while US President Barack Obama stressed Britain had a crucial role to play within the European Union.

Obama added the UK would be at the "back of the queue" for any trade deal with the US if the country broke away from the EU. However, supporters of the 'Leave' campaign, which include London Mayor Boris Johnson, have dismissed the warnings as scaremongering tactics.

"I think it is absolutely ridiculous that the UK is now being told it has to go to the back of the queue for any free trade deal," Johnson said.

"For us to be bullied in this way, I don't want to exaggerate, for people to say we are going to be unable to cope on our own is absolutely wrong."

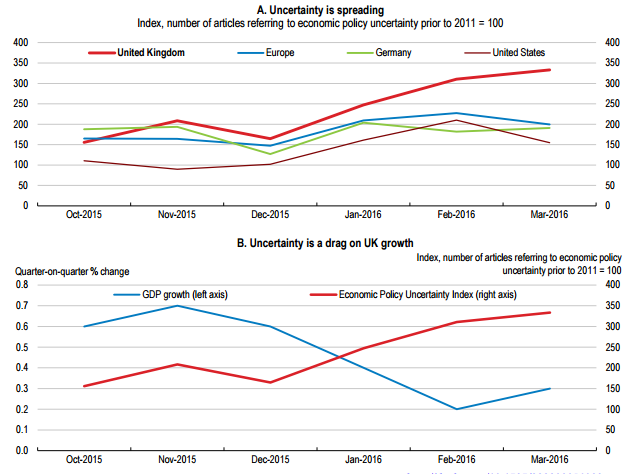

In its report, the OECD added the uncertainty generated by the upcoming referendum was already taking its toll on financial markets.

"The cost of insuring UK public debt against sovereign default has been rising since 14 October, when the President of the European Commission first warned about only limited progress in negotiations with the UK," the organisation said in a statement.

"Credit default swap spreads remain low relative to the financial crisis period, but their increase since mid-October is significant and higher than for peers."

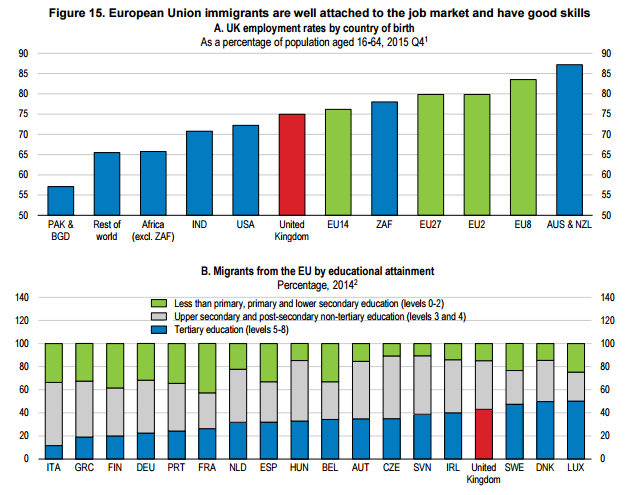

One of the crucial issues surrounding the referendum is the impact of immigration to the UK but the OECD said migrants, in particular those arriving from the 28-country bloc, have provided a significant boost to the UK economy. "EU immigrants have higher employment rates than natives and almost all other migrant groups," it said.

"Migrants from countries that acceded to the EU in 2004 (EU8 countries) have a higher employment rate than EU migrants in general. They also have a better education than in most other EU countries."

© Copyright IBTimes 2025. All rights reserved.