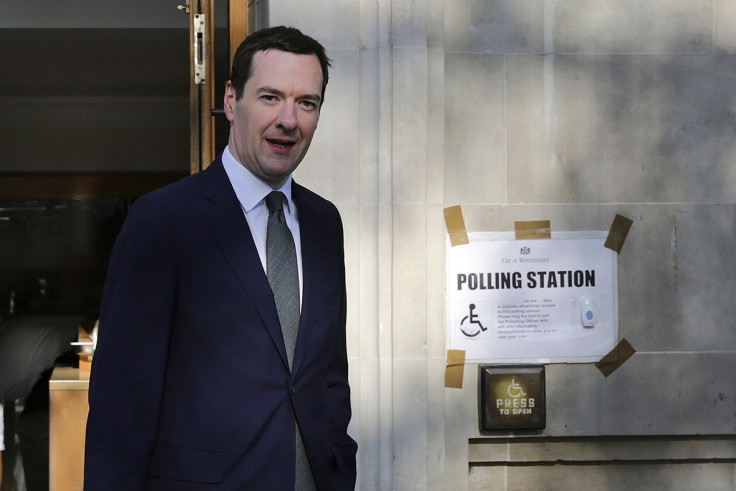

EU Referendum: George Osborne says Brexit could cause house prices to drop 18%

Chancellor George Osborne has said that house prices could fall by up to 18% in two years if the UK decides to leave the European Union. The chancellor, speaking at a G7 meeting in Japan on 21 May, said that a Brexit would cause an "immediate economic shock" if Great Britain leaves the EU after the referendum on 23 June.

Osborne told the meeting of the world's seven most advanced economies that if the Leave campaign secures the referendum vote, growth in house prices will be cut and by 2018 homes could be worth 10%-18% less than now. He also said that mortgages would also become more expensive and first-time buyers would find it more difficult to get on the housing ladder.

The chancellor's claims were immediately rejected by energy minister and Conservative MP Andrea Leadsom, who is supporting the Vote Leave, who said that the "perilous state of the euro" was more of a concern for British citizens who are deciding whether the country should stay in the EU.

The Treasury is set to publish a report next week outlining the possible drop in house prices, Osborne said. The report follows the International Monetary Fund's 13 May warning that Brexit could cause a "sharp drop" in house prices.

"If we leave the European Union, there will be an immediate economic shock that will hit financial markets," Osborne told the BBC. "People will not know what the future looks like. And in the long term, the country and the people in the country are going to be poorer.

"That affects the value of people's homes. And at the same time, first-time buyers are hit because mortgage rates go up, and mortgages become more difficult to get. So it's a lose-lose situation," he added.

Vote Leave claim that lower house prices would help first-time buyers and those renting to eventually buy. Leadsom said: "This is an extraordinary claim and I'm amazed that Treasury civil servants would be prepared to make it.

"The truth is that the greatest threat to the economy is the perilous state of the euro; staying in the EU means locking ourselves to a currency zone – which Mervyn King, ex-governor of the Bank of England, has rightly warned 'could explode'."

Osborne's comments echo those made by the National Association of Estate Agents. In its report, released earlier in the week as Osborne made his comments, said that Brexit could cut the price of the average UK home by £2,200 by 2018.

In April, Standard & Poor's (S&P) warned that house prices may tumble if Britain chooses to exit the European Union. In a report, the credit agency's analysts said Brexit "could potentially reverse the significant boost to real estate asset values that the UK, and London in particular, has experienced in recent years".

Credit rating agency Moody's has said that reducing immigration to Britain would cut competition for housing and slow house and rental inflation.

© Copyright IBTimes 2025. All rights reserved.