Euro fails below $1.1100 once again, FOMC minutes in focus

Euro has been trying to break above the 1.1100 resistance for the past several weeks in vain - Monday's miss was because the Markit services PMI for the US came in better than expected, while the European markets remained closed for Easter holidays.

EUR/USD traded as high as 1.1053 on 26 March, moving off the 12-year low of 1.0462 hit on 13 March. Monday's gains took it to as high as 1.1036 but then fell to 1.0922 by the close where it hovered much of early Tuesday.

The pair had a previous attempt upward in just five days after hitting last month's multi-year low but it did not go beyond 1.1041.

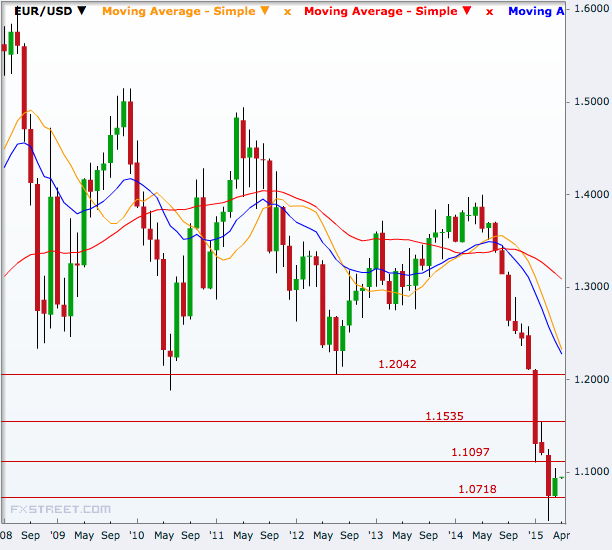

Technically, the pair is targeting 1.1097 on the upside which is endorsed by the 50-day moving average which comes at 1.1073. A break of that will open doors to 1.1261 and then 1.1535.

That said, only a break above the 1.2042 will significantly reverse the sharp decline in the common currency over the past several months. Euro fell more than 23% since June end to the March low but has so far strengthened 5.4% in April.

On the downside, EUR/USD has first support at 1.0718 and then there are no stops until the multi-year low of mid-March.

Similarly, the USD index has been successfully keeping above the 50-day moving average despite several attempts to break below the same over the past few weeks.

The dollar gauge had dropped to as low as 96.33 on Monday before rebounding to 97.22 and ending at 97.16. Monday's low was only a shade away from 96.17, the 26 March low which was its lowest since 5 March.

The US services outlook has improved according to the Markit PMI for March which has increased to 59.2 from 58.6 as per data on Monday. No major data are scheduled from the US on Tuesday and all eyes are therefore on the FOMC minutes on Wednesday.

As European markets have opened after last Thursday's closing there are nothing important in the data calendar for the region. The services PMI numbers by Markit for individual countries and for the region due on the hour are unlikely to make any impact.

© Copyright IBTimes 2025. All rights reserved.