Eurozone Stimulus: QE Remains an Option, Says ECB's Vitor Constancio

The European Central Bank (ECB) could roll out an asset purchase programme similar to what central banks in the US, the UK and Japan have attempted should the eurozone economy hit a major stumbling block, vice-president Vitor Constancio has said.

Constancio's comments suggest the ECB is prepared to jump in if inflation expectations start falling.

Constancio, speaking in London a day after the ECB cut rates, also said the central bank will most likely not know the efficacy of its latest stimulus measures until the end of 2014, after banks have had the chance to take up its cheap loans.

"For the type of contingencies and challenges we face now, what we did [on 5 June], we think, is enough. If some downward shock were to create a much deteriorated situation then we will have to think about all sorts of unconventional policies," Constancio said, reported Reuters.

"Only after the second tranche in December of the initial allowance of the new facility will we then gauge the impact," Constancio said on the sidelines of an IIF conference.

"Because by then the comprehensive assessment (AQR) will be completed and banks will know what their situation is," he added, referring to the ECB's examination of banks' balance sheets.

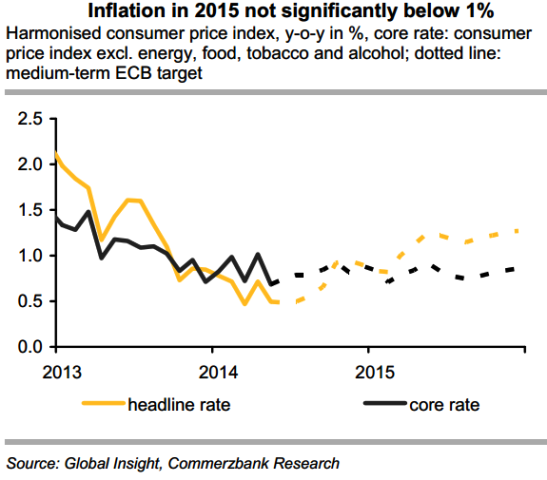

Commerzbank Corporates & Markets said in a note: "Eurozone inflation is low but probably not low enough to push the ECB towards QE. Currently, we see a 40% probability of such an outcome. However, if inflation rates significantly fall short of expectations during the summer we would elevate QE into our baseline scenario.

"Markets in any case are set to continue speculating on asset purchases until it becomes clear that by the fourth quarter, the QE window will have closed. By that point, expectations of higher US key rates are likely to cause a depreciation of EUR-USD. This, in turn, argues for higher inflation rates in Europe."

The ECB on 5 June cut its main refinancing rate by 10 basis points to 0.15% and the overnight deposit rate to -0.1%.

A negative deposit rate means the central bank will now charge banks for holding their money overnight – the move aims to entice banks into lending more and reduce a deflation risk.

© Copyright IBTimes 2025. All rights reserved.