Exploring the Future Of FinTech Through Innovation And Ethics

The global FinTech market is projected to reach $1152.06 billion by 2032

The global FinTech market is projected to reach $1152.06 billion by 2032, garnering significant attention. At the heart of this transformation is the integration of cloud computing and artificial intelligence (AI), which drives innovation and enhances operational efficiency across organisations and economies. However, these technologies also bring complexities and ethical implications that pose significant challenges.

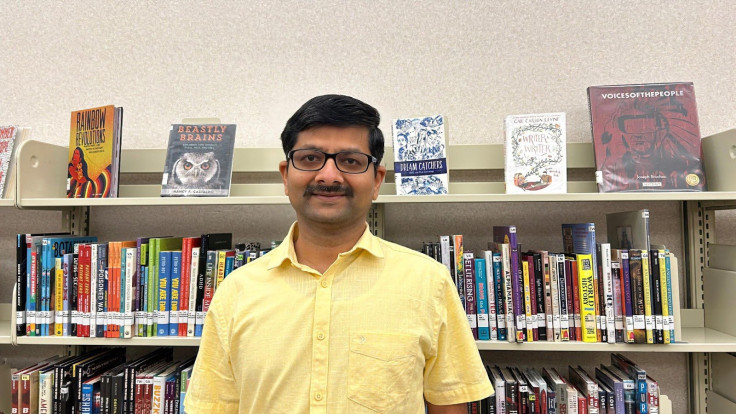

What obstacles does the FinTech industry face today? How are advancements in cloud computing, AI, and ethical considerations shaping its future? To explore these questions, I spoke with Purushotham Reddy, a seasoned IT professional with over two decades of experience in the FinTech sector.

His expertise in cloud migrations, AI integration, and dedication to community service offers invaluable insights into the evolving technological landscape and its broader societal impact.

Q: I'm honoured to have you with us today, Purushotham. With over two decades in the IT industry and a distinguished career at a Fortune 500 FinTech company in Virginia, your journey is truly inspiring for those looking to enter this sector. How did your educational background and early career choices influence your path in IT and FinTech?

Purushotham Reddy (PR): Thank you for having me and for your kind words. My academic journey began in R. Anantapuram, Andhra Pradesh, where I developed a passion for technology. My Bachelor's in Engineering from MS Ramaiah College of Engineering in Bangalore provided a strong technical foundation that shaped my career. Starting at Integra Micro Systems Inc. as a Senior Quality Engineer allowed me to sharpen my software development and quality assurance skills. These early experiences gave me a solid understanding of the IT landscape. They fueled my interest in FinTech, which I saw as a powerful force for positive change across socioeconomic groups.

Q: Throughout your tenure at companies like IBM, Motorola, and Capital One, you've held roles ranging from Senior Quality Analyst to Senior Software IT Engineer. Can you share some standout achievements or projects that have significantly influenced your professional development?

PR: Certainly. One of the most impactful projects I led was migrating mission-critical applications between AWS accounts. This complex initiative involved transferring various AWS resources, including S3 storage, RDS databases, and EC2 instances, while ensuring compliance and security standards were met. Collaborating with cross-functional teams—database administrators, pipeline teams, and application teams—was key to validating data migration and maintaining system reliability.

Another noteworthy achievement was developing automated backup validation tools using AWS Lambda and Step Functions. These tools created a workflow for generating and validating snapshots, enhancing data integrity for RDS, DynamoDB, and S3 buckets. This innovation reduced the risk of data loss and strengthened our cloud resilience, showcasing how AI and automation can enhance infrastructure reliability.

Q: The FinTech community is abuzz about your latest book, Edge to Cloud AI: Integrating Intelligent Systems Across Distributed Environments. What inspired you to author it, and what can readers expect to learn?

PR: The inspiration came from observing organisations' challenges when integrating AI from edge devices to cloud platforms. While AI holds immense potential, bridging edge computing with cloud resources is critical for optimising scalability and performance. In this book, I provide a comprehensive guide to integrating AI across distributed environments. Topics include security solutions, latency management, data preprocessing on edge devices, and maximising cloud resources for complex computations. Readers—whether students, professionals, or tech enthusiasts—will find real-world examples and actionable strategies to implement AI-driven systems effectively in FinTech.

Q: You've also significantly contributed to machine learning and cloud computing. Can you elaborate on some of your notable research and its impact on the industry?

PR: One of my recent papers focused on optimising database replication strategies using machine learning to enhance fault tolerance in multi-node database systems. This research has been well-received and offers valuable insights for improving system reliability.

Another study explored how AI-driven autonomous test case generation can revolutionise software testing by enabling intelligent decision-making. I'm also proud to hold a patent in this field and hope to continue producing research addressing some of FinTech's most complex challenges.

Q: Beyond your professional achievements, you're passionate about mentoring the next generation of technologists. Can you tell us about your involvement in initiatives like your company's Coders program?

PR: Through our company's Coders program, I teach programming languages like Python, Machine Learning, CSS, and HTML to local middle and high school students. Witnessing their enthusiasm and creativity as they tackle challenging tech problems is incredibly rewarding. By sharing my experiences and providing guidance, I hope to inspire them to pursue careers in technology and innovation.

Q: Balancing a high-profile career with authoring books and contributing to scholarly articles must require exceptional time management. How do you maintain this balance and stay motivated?

PR: It requires a disciplined approach and clear prioritisation. I allocate specific time blocks for professional responsibilities, writing, and research. Delegation and collaboration with dedicated teams also play a crucial role, allowing me to focus on high-impact tasks. Staying motivated comes from my passion for technology and its potential to drive positive change. Seeing tangible results, whether through successful projects or the insights shared in my writings, keeps me inspired. Additionally, engaging with the community through mentoring provides immense fulfilment.

Q: Finally, what advice would you offer aspiring professionals aiming to impact FinTech and technology significantly?

PR: I advise building a strong foundation in technical and business domains. In this competitive landscape, you can't go about without the other. Moreover, understanding how technologies solve real-world problems is essential. Embrace continuous learning as the FinTech landscape changes rapidly because of digital currencies. Always prioritise ethical considerations to ensure your work is practical but also responsible and fair.

For more details about Purushotham Reddy work and achievements, please visit his website.

Alex Rivers is a contributing gaming and casino writer with a passion for exploring industry trends, game strategies, and insider tips.

© Copyright IBTimes 2025. All rights reserved.