The Fed's Great Turn: To Taper or Not To?

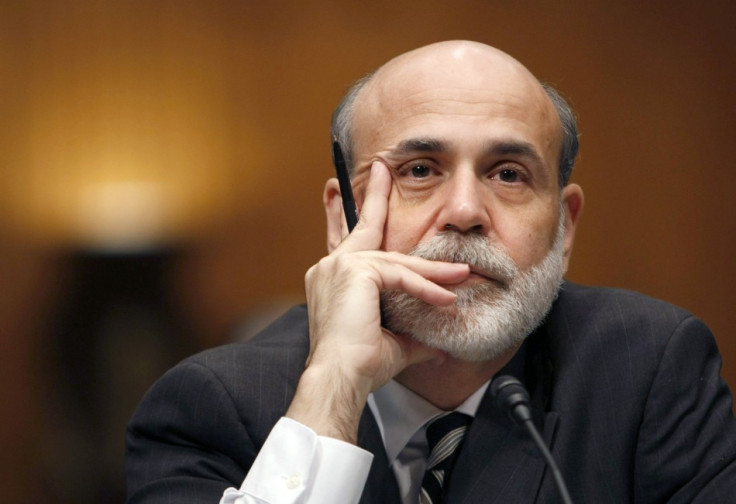

Any hint from Fed chairman Ben Bernanke that it's time to stop buying bonds and investing in securities has caused panic across the markets of the world.

The Fed has been pumping $85bn (£52.3bn, €61.8bn) per month into US Treasury bonds and mortgage-backed securities issued by government sponsored companies in the hope that this extra capital injection will reinvigorate the financial system.

The Fed now holds about $4tn of such assets, compared with around $800 billion before the financial crisis.

Mention of the word "taper" is fearful to markets propped by the policy, and institutional investors that are making profits from it. How and in what way the Fed should exit its current monetary policy has been the question driving analysts into a frenzy over the course of the year.

There have been so many claims and counter-claims about when and how the Fed should start tapering that when it finally does happen, the event could have as much excitement as an oil tanker making a U-turn.

Central banks and the tools they use to steer market expectations including the setting of interest rates, asset purchases and the new tool of forward guidance are actually crude.

They carry a veneer of sophistication but in actual fact are not as precise as the jargon which surrounds them suggests.

Divining what the Fed will do. and how it judges data that can be significantly revised upwards or downwards is an art and not a science, as is guessing when quantitative easing will end.

The market watchers will be closely inspecting what the Federal Open Market Committee (FOMC) will do over the course over the next couple of days.

Positive Data

Data from the United States has been positive and suggests that the Fed might decide to scale back its asset programme.

According to the Bureau of Labor Statistics, productivity in the US increased to the fastest pace in the three months up to September, which was the best result since the fourth quarter of 2009 to 3%.

And while the unemployment rate has been falling steadily, inflation remains below the 2% target.

This suggests that the US economy has a deflationary rather than inflationary problem.

IBTimes UK spoke to a number of analysts that believe that the FOMC will not start to reduce its asset programme at the current meeting, that concludes tomorrow.

Expert Views

David Madden, an analyst at IG, believes that chairman Ben Bernanke and his colleagues will not make a decision where they start the gradual tapering of quantitative easing.

"I am leaning slightly towards no taper. I just feel this is Ben Bernanke's last meeting as chairman of the Federal Reserve. I think that even though US unemployment has dropped down to 7%, I just feel that he does not want to rock the boat finishing his chairmanship of the Fed. We are approaching New Year and I think he will just leave as it is, business as usual for his last meeting as chairman of the Fed and pass it over to Janet Yellen in the New Year."

According to Madden, a combination of factors are weighing on Bernanke's mind including a politically charged climate and the need to see more consistently strong economic data.

The recent November jobs report, which said the unemployment rate fell to 7%, was delayed and affected by the partial government shutdown in October, as was the broader economy.

"We might have had some suspect numbers in the last couple of months which might lead to skewed number in the actual unemployment rate," said Madden.

He also pointed out that FOMC members will be wary of taking economic data immediately on its face value.

"I just feel that economic data is not always the most accurate. I do feel they would need a few months in the row to be quite solid. I think also we had a bit of upheaval in October with the shutdown. The US is even if it is recovering economically not politically stable enough yet.

"I think he [Bernanke] will look at the big picture rather than just his own area of expertise which is monetary policy such as political instability. I believe it is mid-February when the debt ceiling is up for discussion again and he does not want to rock the boat," he added.

Richard Hunter, head of equities at Hargreaves Lansdown, agreed with Madden that the FOMC will probably decide not to taper.

"I think the general consensus is that it is likely to be next year before we see tapering. The Fed have been quite clear in their deliberations. They will consider tapering only as and when the US economy can withstand it."

Hunter pointed out that it is important to remember that it is the FOMC which makes a decision on tapering and broader monetary policy, not just Bernanke.

"It is not just about Bernanke but the entire Federal Reserve Open Market Committee," he said.

However, unlike Madden, Hunter believed that the decision of the FOMC will be based entirely on where they consider the economy to be and not the political situation in the country that remains fragile.

"In theory those two conversations are separate. One is down to the politicians and one is down to the Fed. I think they will be mindful of it as Americans but it won't be a factor in their deliberations," he said.

© Copyright IBTimes 2025. All rights reserved.