Fifa in Crisis: Corruption scandal highlights 'complicity' of global banking system

The Fifa corruption scandal highlights the complicity of the global banking system, allowing shell companies to move bribe money around the globe, according to financial reform organisation Jubilee USA Network.

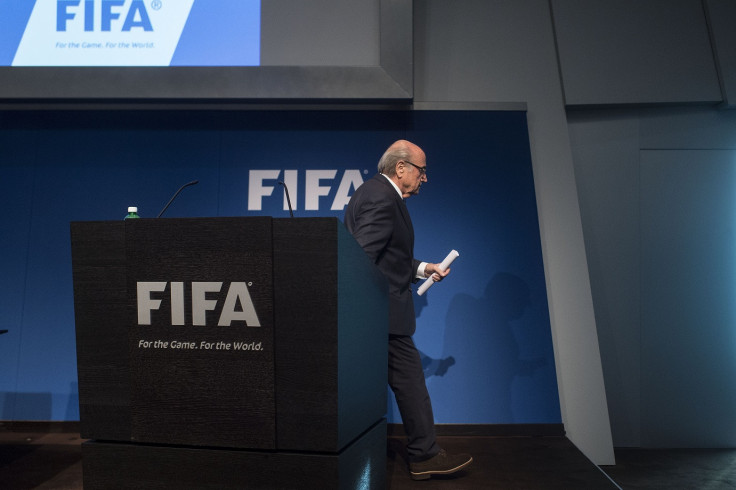

Amid intense pressure, Sepp Blatter earlier announced his resignation as the president of the international soccer governing body, after leading the association for 17 years.

The resignation came after Swiss authorities arrested seven Fifa executives as part of an FBI probe that indicted 14 people on bribery and corruption charges. Twenty-six banks are named in the indictment, including major US firms such as Citigroup and JP Morgan Chase.

"This level of corruption was only possible with the complicity of the global banking system," said Eric LeCompte, executive director at Jubilee USA Network.

"The FIFA scandal shines a light on how corruption is protected and supported by US banks."

More than $150m (£97.7bn, €133bn) in Fifa bribes flowed through the US financial system, indicating the need for reforms and stricter transparency laws in the country.

While US investigators are still determining if any banks broke US law, experts indicate that the transactions were likely structured to avoid triggering US anti-money laundering alarms.

The indictment also alleges that defendants used shell companies to move bribe money around the globe. The US is currently one of the easiest countries in the world in which to open a shell company without disclosing the company's true owner, according to Jubilee USA, which supports the Incorporation Transparency and Law Enforcement Assistance Act – a bipartisan legislation in the US to address shell companies.

"We need stronger transparency laws to ensure that criminals can't move money around the world," noted LeCompte. "There is bipartisan legislation to do just that and Congress should pass it immediately."

Jubilee USA added that the developing world loses nearly $1tn each year to corruption, crime and tax evasion. The so-called "illicit financial flows," are largely facilitated by gaps in international money-laundering and transparency rules, according to the group.

© Copyright IBTimes 2025. All rights reserved.