Financial crisis II: Will debt-laden emerging economies explode when interest rates rise?

When the International Monetary Fund issues a warning with the word "trillions" attached, you should probably take notice.

The IMF reckons there is $3.3tn (£2.16tn, €2.93tn) in what it calls "overborrowing" in fragile emerging markets, from China to Turkey. But this is only the amount in US dollar-denominated debt held in emerging markets (EMs). In fact, over a decade the overall level of corporate debt in EM economies has rocketed. In 2004, the corporate debt of non-financials was $4tn. By 2014, the IMF said it had soared past $18tn in total. Corporate balance sheets are stretched to their limits.

Companies and individuals in EMs have made the most of recent low-interest rates in Western economies, particularly the US, where cheap credit is helping them recover from the worst financial crash in history. EM companies have laden themselves with bag-loads of debt, like financial buckaroos, to fund rapid growth in their home economies. To pay back these debts, they rely on foreign money pouring in. But stark problems are surfacing, problems threatening to blow another hole in the global economy, which is more and more reliant on the stability of EMs.

"The debt levels in emerging market economies always pose a downside risk," Philip Shaw, chief economist at Investec Economics, told IBTimes UK. "But what warrants especially close attention is the fact that emerging market economies are weakening, in particular those with a high concentration of commodities exports, and therefore that heightens the possible risks coming from emerging market debt. Particularly in an environment where one would expect the Fed to raise US interest rates over the next few months."

China's rapid growth is slowing faster than expected. Brazil is in recession. But beyond the big names are other EM economies which are increasingly struggling, from sanctions-slapped Russia which is bogged down with war in Ukraine and now Syria; to Venezuela's hyperinflation; to political turmoil in Turkey; to Malaysia's vast exposure to falling commodity prices, in particular petroleum and palm oil. Others are also juggling difficult economic issues. This cocktail of EM woes spilled over into the world's stock markets, pulling them down to their worst three-month performance in four years between July and September.

"The problem here is that these countries are dependent on foreign capital inflows to fund these debts," William Jackson, senior emerging markets economist at Capital Economics, told IBTimes UK. "So if there were any spike in investor risk aversion which caused capital flows to dry up, they would struggle to roll these over. In this regard, rate hikes by the US Federal Reserve would be one obvious trigger, although there could be others (e.g. concerns about a much sharper slowdown in China, fresh debt problems in Europe). In that event, borrowers would either have to face much higher interest rates, or sell domestic assets, which would put pressure on their currencies."

Some emerging markets have been forced to weaken their currencies already in a bid to prop up their exports, such as China, where poor trade data prompted a weakening of the yen so its goods would be more attractive to foreign buyers. Falling commodity prices will put pressure on commodity-dependent EM governments to inject stimulus, weakening their currencies too. But weaker domestic currencies will make it much more expensive for leveraged corporates to pay their external debts – as will the looming tightening of monetary policy in the US and UK, which will increase the values of the dollar and sterling.

A looming emerging markets credit crunch?

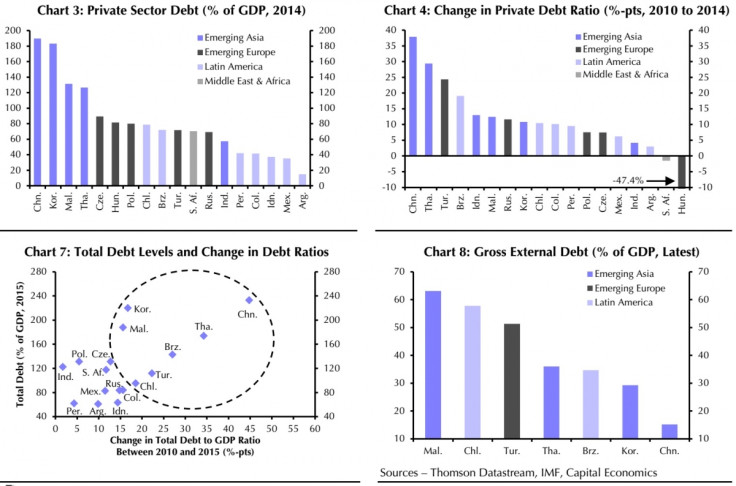

Capital Economics has highlighted seven emerging markets that it believes are most vulnerable because of sharp increases in their debt-to-GDP ratios: China, Thailand, Brazil, Korea, Malaysia, Turkey and Chile. In a research note, it said that risks are mitigated in some markets more than others, such as large foreign currency reserves. China, for example, has relatively low exposure to external debt and a strong central government which can act quickly in response to crises. But in Brazil, the problems are made worse by a weak government which is struggling to control its budget deficit.

China is the world's second largest economy, soon to overtake the US as the largest. "China is a risk because of the size of the economy rather than an intensity of the potential problem there," Investec's Shaw said. Investec's Jackson said an explosion in domestic Chinese debt is the biggest concern because many households have borrowed money to invest in the burgeoning stock market – only to lose out amid the recent turmoil on the Shanghai Composite, when a share price bubble burst.

"Here, I think the concern is not so much that, say, Fed rate hikes could cause problems in rolling over debts," Jackson said. "Instead, the problem is that domestic lending booms on the scale seen in China, as well as other countries such as Turkey, Thailand and Brazil, tend to result in rising non-performing loans. This hurts banks' capital and causes credit growth to slow sharply."

More broadly than China, if debt-loaded corporates start sinking, it could trigger a serious credit crunch across EMs, which would hobble growth and harm the global economy. Banks in EMs are up to their eyeballs with corporate debt. And if EM economies weaken, the prices of assets used as collateral against borrowing by corporates will fall.

"Therefore, shocks to the corporate sector could quickly spill over to the financial sector and generate a vicious cycle as banks curtail lending," said the IMF in its October 2015 report on global financial stability. "Decreased loan supply would then lower aggregate demand and collateral values, further reducing access to finance and thereby economic activity, and in turn, increasing losses to the financial sector."

Stay 'accommodative'

Analysts and investors are watching EMs closely. They know that any shocks or crises will cause tremors, perhaps even earthquakes, far beyond their borders. That is why the IMF said policymakers the world over must remain alert to these risks when considering what to do with their interest rates and quantitative easing programmes. The IMF called for central banks to remain "accommodative", meaning keep rates low and the money pumps flowing.

Vulnerabilities in emerging markets are important, given their significance to the global economy, as are the role of global markets in transmitting shocks to other emerging markets and to advanced economies.

But it also called for work on financial sector reforms to be completed, especially in Europe, so banks and the regulatory system are equipped to cope with the shocks of the future – and are not caught off-guard like they were at the dawn of the financial crisis. Moreover, they should once-and-for-all deal with the toxic loans still sitting in banks to free up €600bn (£441bn) of lending.

China should get on with freeing its financial markets, said the IMF, and getting its companies to shed their burdensome debts. All of these must form part of what the IMF calls a global "collective effort" to stave off what could be another financial crisis, this time stemming from emerging markets.

And EMs must try to maintain investor confidence, said the IMF, by being prudent about their public finances, keeping a close eye on the state of their corporates and banks, and the "nimble and judicious" reaction by policymakers to any outbreaks of contagion.

One wrong move by any policymaker – such as hiking interest rates too much or too early -- could cost the world economy as much as 3% in lost output, in the IMF's worst scenario. As central bankers are keen on saying, their decisions are finely balanced. And no decision is more finely balanced than that which could wipe hundreds of billions of dollars from the global economy.

"Vulnerabilities in emerging markets are important, given their significance to the global economy, as are the role of global markets in transmitting shocks to other emerging markets and to advanced economies," said José Viñals, financial counsellor and head of the IMF's Monetary and Capital Markets Department. "The recent financial market turmoil is a demonstration of this materialisation of risks."

© Copyright IBTimes 2025. All rights reserved.