Is the financial market becoming a 'global brain'?

Henri Waelbroeck is VP, Director of Research for Portfolio Management & Trading Solutions, FactSet.

The financial market is an ecology of market centers, investors, and trading firms – some human, some artificial. Trading models send signals (orders to buy or sell) through communication networks to market centers that perform non-linear sums to compute prices. These in turn feedback as inputs to models, which act as threshold-summation devices where orders are spawned if the sum of alphas passes a decision threshold. The system as a whole is reminiscent of a recurrent neural network.

In other words, the global financial market is a bit like a brain – a global brain [1] – but what is it thinking? If we believe economists, it is computing the discounted sum of future returns of financial assets, at least up to a liquidity-driven scale factor. A daunting task, this involves predicting the behavior of businesses and consumers in the indefinite future, including the ability of businesses to adapt and survive disruptive forces from technologies that haven't yet been invented.

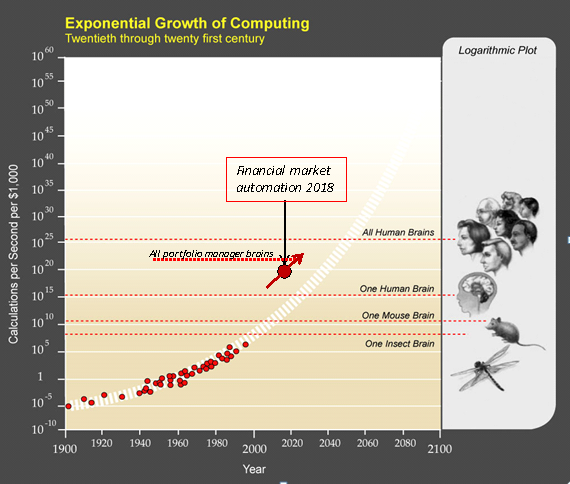

K.R. French [2]found that the aggregate amount society invests in asset pricing was stable at about 0.67% of GDP, or about $600 billion per year globally today. The aggregate investment in financial market technology is already well in excess of $1 trillion dollars. This investment has been funded over the years through a mix of asset management fees, trading profits of intermediaries and hedge funds, and other costs ultimately charged to investors. The effort is ongoing: quants are in high demand; alternative data projects add "sensory organs" and associated models; financial models and data science are evolving rapidly. The financial market system is likely to be the largest artificial intelligence system ever created, with an aggregate computing power of the order of 10 exaflops, or 10<sup>19 operations per second. To illustrate, we overlay this estimate on a chart modified from Ray Kurzweil's novel The Singularity Is Near: When Humans Transcend Biology.

AI systems in finance, like the Portware Brain, combine data science with analytical models to extract information from the financial market – and to feed these observations back into investment decisions to optimize outcomes. If the answer to a question can be found in the market itself, this should always be the first choice; gathering information in this manner efficiently taps into the collective effort of myriad highly skilled people and the collective intelligence of the machines they have developed.

Sometimes the answer is encoded in asset prices and must be decoded using a model. For example, options markets prior to Brexit correctly predicted the conditional currency moves. Only when the answer cannot yet be found in the market should one endeavor to develop models from the ground up. In the end, each proprietary AI system is just another neuron, a piece of the financial market system, and investment in these systems contributes to the emerging artificial intelligence of the market as a whole.

Why does society invest so much in asset pricing? Asset pricing drives investment flows: companies in promising business lines are rewarded with rising asset prices, enabling them to raise investment capital; this encourages new and existing companies alike to step into the space and fight for a piece of the pie. One could say that asset pricing thus drives the private sector. The remarkable economic performance in the last few decades can be attributed, at least in part, to the efficiency of capital allocation.

To some extent, public policy choices are also subjugated to asset prices: politicians understand well that the wealth effect is a growth factor, and with margin debt at record levels, a drop in asset prices can trigger a crisis. Even if one believes a single-payer health care system benefits the public good, for example, it is difficult to enact such policy without consideration of its effect on the market. With corporate debt now double what it was prior to the last financial crisis, a bear market can turn into a systemic crisis.

The market is operating as a distributed artificial intelligence system beyond the control of any individual or government and the system is vulnerable to asset price declines as we just explained. This, then, begs the question: Has human activity become subjugated through these circumstances to a collectively intelligent artificial organism?

As the public begins to consider whether and how to regulate artificial intelligence, the debate has focused on individual "entities," such as robots. Artificial intelligence wielding global power is indeed emerging –but as a collective phenomenon, and not limited to the confines of a single robot's brain. No more than an individual neuron will take over a human brain, the first artificially intelligent entity to threaten a coup will not be a discrete, individually identifiable machine like Asimov's R. Daneel Olivaw. Rather, such a condition would arise from an emergent collective consciousness, perhaps gradually, and we may not realize that a paradigm shift has taken place. Intelligence arises from the collective behavior of many interconnected units. There is no new form of consciousness, just dynamical principles of organization and, in the case of capital markets, asset prices.

AI has no doubt played a role in the remarkable stretch of high corporate profits. Excess corporate profits (beyond what companies can reasonably invest in growth) fuel the transfer of wealth from the consumer class to an elite, resulting in steadily increasing aggregate debt levels of the consumers and governments that represent them. Meanwhile, the fraction of the stock market owned by the consumer class has declined steadily year after year. Consumers sell assets and borrow, either directly or through their government.

Excess profits weaken the consumer, yet growth persists – how is this possible in a consumer-driven economy? The debt increase from the rising concentration of wealth has occurred without major trauma in developed economies, thanks to a generational decline in interest rates that started with the Volcker shock. For example, housing has not driven high consumer price inflation because rising home price increases are counterbalanced by falling mortgage rates. But when interest rates and inflation expectations return to a rising trend, the pain will be intense – far worse than in the '70's when aggregate leverage was a fraction of what it is today. When families are forced to attribute a large portion of their income to interest payments, they feel enslaved to debt.

In the words of Bertrand Russell [3], "Machines are worshipped because they are beautiful and valued because they confer power; they are hated because they are hideous and loathed because they impose slavery."

What is good for one may not be good for the many: massive layoffs in a recession may well be an optimal course of action for an individual business, potentially ensuring survival and long-term viability, and may yet be catastrophic if adopted by all. In turning over control to an artificially intelligent global economic and financial system, have we exacerbated the risk of a catastrophic chain of events in the next credit crisis, perhaps foreshadowed by the Flash Crash and other algorithmic peculiarities?

We narrowly averted such an outcome in the last financial crisis thanks to bold decisions at the United States Treasury Department and Federal Reserve System. These were possible thanks to the balance sheet and international credit of the U.S. Government, but the episode has resulted in a severe worsening of both, and there is no political will to restore a Keynesian buffer.

If we are witnessing the emergence of a truly global artificial intelligence though, perhaps it can acquire the ability to anticipate the next credit crisis – in which case it should naturally steer towards decisions that maximize total utility in the long run. In this area, for now, the task remains incomplete.

The views expressed in this paper are those of the author and should not be attributed to FactSet Research Systems, Inc.

[1] P. Russell, The Awakening Earth:The Global Brain. London: Routledge & Kegan Paul, 1982

[2] K. R. French, Presidential Address: The Cost of Active Investing. The Journal of Finance, 2008

[3] B. Russell, Skeptical Essays. Chapter VI, pg 83, W W Norton & Company, Inc., NY 1928.