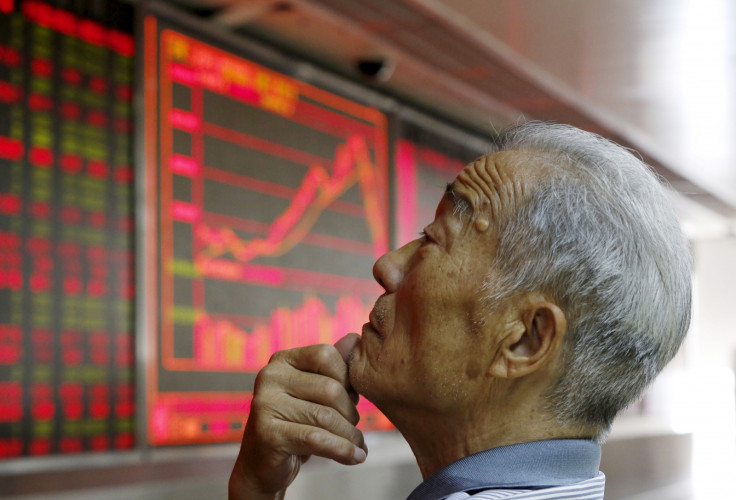

FTSE 100 at lowest since 2013 as markets panic over China's downfall on 'Black Monday'

The FTSE 100 fell below the 6,000 mark for the first time since 2013 as global stock markets have responded to the free fall of shares in Asia on what has been dubbed 'Black Monday'.

After the Shanghai Composite, China's benchmark index, lost all its gains made in 2015 by falling more than 8%, investors panicked about the future of the market.

The fall was worse than expected. Investors has been hopeful that efforts from the Chinese government could stem the rout.

Japan's Nikkei suffered its biggest drop since June 2013, panic selling and a shift to safe haven investments caused other stock markets to plummet as well. Hong Kong's Hang Sheng lost 4.6% and dropped to 21,378.

The FTSE 100 dropped by 2.6% to 5,950. It was the first time the UK blue chip index dropped below the 6,000 mark since early 2013, and it is a 16% decline from its high of 7,100 in April.

Germany's DAX fell by 320 points below the 10,000 points mark, dropping more than 20% since its high in April 2015, while France's CAC 40 lost around 3.2% over the weekend.

"It's a very disappointing day for investors," Ric Spooner, chief market analyst at CMC Markets said on Bloomberg TV. "We're right back to where we were back in 2013. Look, what's going on is, essentially it's all about China at this stage. The market is having a bit of a think about the risk there."

Meanwhile, the market in India was one that perhaps responded the most severely to the loss of momentum in China. Its benchmark Sensex lost 16,000 points on Monday (24 August), while the Rupee dropped to a two-year low, trading at Rs66,7 against the dollar.

The shocking falls in Asia, although predicted by the fall in copper according to some, were fuelled by the earlier decline in the value of the Yuan. After the Chinese Central Bank gave permission to pension funds to invest in shares.

Commodity prices, which have suffered immensely in July and August, are expected to feel the burn indirectly from China's falling demand because of its struggling economy.

You were warned! Dr. Copper, the metal with the PhD, saw #China market sell-off coming. pic.twitter.com/SCiq5xIcHV

— Holger Zschaepitz (@Schuldensuehner) August 24, 2015© Copyright IBTimes 2025. All rights reserved.