No 10 Struggles to Dampen Lazard Row in Royal Mail Sale

One of the key government advisers accused by MPs of contributing to the massive underpricing of the Royal Mail share price at its sale, allowing so-called preferred investors to make a killing at taxpayers' expense, was the chief executive of Lazard, William Rucker.

It has now emerged that the very same company, Lazard, was one of the preferred investors, allowed to buy shares before others, who made a quick £8m profit for clients by selling off its shares within days of the privatisation.

Two separate arms of the firm kept "Chinese walls" between them and there is no suggestion of any wrongdoing.

But the perception of an "institutional masonic lodge", as one MP has put it, has grown and is starting to do real damage to the government.

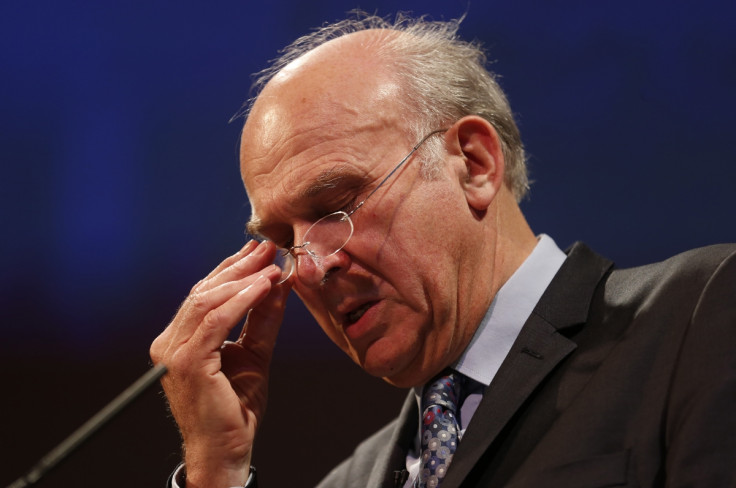

Rucker appeared alongside business secretary Vince Cable at a confrontational meeting of a Commons committee investigating the sale on Tuesday. He repeatedly insisted the sale price of £3.30 a share had been right, even though they rose to £4.70 within days.

It almost feels to me like an institutional masonic lodge.

The MPs demanded the list of the names of those bidders selected by ministers to buy a 22% of the institution before anyone else which had previously remained secret for reasons of "commercial confidentiality".

But, as the names began to leak, Cable has finally published the full list. And it includes a number of well-known hedge funds and none other than Lazard Asset Management.

And, far from being the long-term investors promised to offer the institution stability, it showed a number, including Lazard, had sold their shares almost instantly when they went through the roof. In LAM's case, that gave them a quick £8m profit.

Cable had already been forced to agree with Labour committee member Katy Clarke when she asked him during the evidence session if some investors favoured by him had sold shares instantly "to make a quick buck".

Cable said he did not like the pejorative language but added: "yes, that is what happened," adding it was the way markets worked.

It is one rule if you deliver the chancellor's best man speech and another if you deliver his post.

Now, Rucker has insisted the famous "Chinese Walls" between his arm of the firm and the asset management arm had been robust and fully operational. And there has been no suggestion of any wrongdoing.

He told a separate committee also investigating the sale: "When we became aware, having been hired, that Lazard Asset Management were on a list of investors the Royal Mail were talking to, we made it quite clear that we should have no input whatsoever into any discussions about allocations for LAM.

"The Chinese wall is complete and utter. We have had no contact throughout," he said.

But the public accounts committee chair, Labour's Margaret Hodge, while accepting there had been no breach of the rules, said the entire affair felt wrong. "It almost feels to me like an institutional masonic lodge," she said.

The list also showed that another hedge fund given the shares option was Lansdowne Partners, whose management committee includes Peter Davies, who was chancellor George Osborne's best man.

That led to Ed Miliband attacking the prime minister over the sale during question time on Wednesday claiming: "It is one rule if you deliver the chancellor's best man speech and another if you deliver his post."

What no one is suggesting, however, is that any rules were broken or that the "Chinese Walls" did not work.

But there is the huge issue of perception and the way the general public will view the affair and whether it feeds into the Labour attack that Cameron always stands up for the rich and powerful and his "mates" in the City.

What is absolutely without dispute is the fact that some very big institutions made some very large profits out of the sell-off and then walked away.

Whether or not the sale price of the shares was too low and whether Cable and his minister had been persuaded to pitch them at that price by their advisers is what the investigations are attempting to decide.

What should be worrying the government and Cable in particular, though, is the fact that the public is likely to have made up its own mind already, based on those pretty powerful perceptions.

© Copyright IBTimes 2025. All rights reserved.