India's Central bank Leaves Rates Unchanged but Eases Rules to Spur Lending

The Reserve Bank of India (RBI) left its key policy rate on hold at its policy review on 3 June but eased rules to encourage bank lending.

The latter is set to be well received in New Delhi, where Prime Minister Narendra Modi's pro-business regime has a mandate to revive growth in Asia's third-largest economy.

Governor Raghuram Rajan on Tuesday left the key policy rate unchanged at 8%, as was widely expected.

But he reduced the amount banks need to invest in government securities -- called the statutory liquidity ratio (SLR) -- by half a percentage point to 22.5% of deposits starting in mid-June.

The RBI hinted that it will not hike interest rates further provided inflationary pressures continue to abate.

In a bid to prevent the rupee from escalating too much, the RBI increased the amount of cash Indians can remit abroad, to $125,000 (£74,595, €91,965) from $75,000. The decision takes away some of the pressure on the rupee, stemming from dollar inflows that are making the currency stronger and exports difficult.

"A reduction in the required SLR will give banks more freedom to expand credit to the non-Government sector. However, the Reserve Bank is also cognisant of the significant on-going financing needs of the Government. Therefore, the SLR is reduced by 0.50 per cent of NDTL, with any further change dependent on the likely path of fiscal consolidation," Rajan said in his bi-monthly monetary policy statement, the first since the formation of the Modi government.

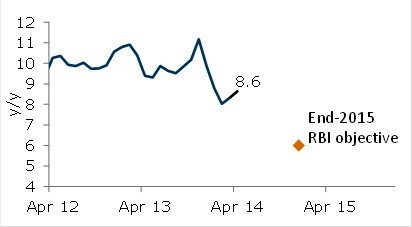

"The Reserve Bank remains committed to keeping the economy on a disinflationary course, taking CPI inflation to 8% by January 2015 and 6% by January 2016. If the economy stays on this course, further policy tightening will not be warranted. On the other hand, if disinflation, adjusting for base effects, is faster than currently anticipated, it will provide headroom for an easing of the policy stance.

"Contingent upon the desired inflation outcome, the April projection of real GDP growth from 4.7% in 2013-14 to a range of 5-6% in 2014-15 is retained with risks evenly balanced around the central estimate of 5.5%..." Rajan added.

ANZ Research said in a note: "[3 June's] dovish turn does open up possibility of a rate cut towards the end of 2014 but we believe that even if RBI does cut rates, it will likely have to reverse that in 2015. We agree with RBI's assessment that CPI inflation is likely to edge lower perhaps from June till end-2014.

"But RBI has been re-iterating that it wants to get inflation lower from 8% to 6% by end-2015. That, we think, is likely to be challenging because 1. Food inflation seems to have structurally moved higher over the years 2. Growth is likely to recover, so there'll be less slack in the economy 3. Continued upward price adjustments for government-controlled prices (fuels, fertilisers, power)."

"In addition to the obvious (monsoon/El Nino developments), we will be looking out for any hints by the government to improve food supply (for eg. by selling from its large stocks of wheat and rice). The latter is something RBI mentioned [on 3 June] while talking of downside risks to inflation," ANZ added.

© Copyright IBTimes 2025. All rights reserved.