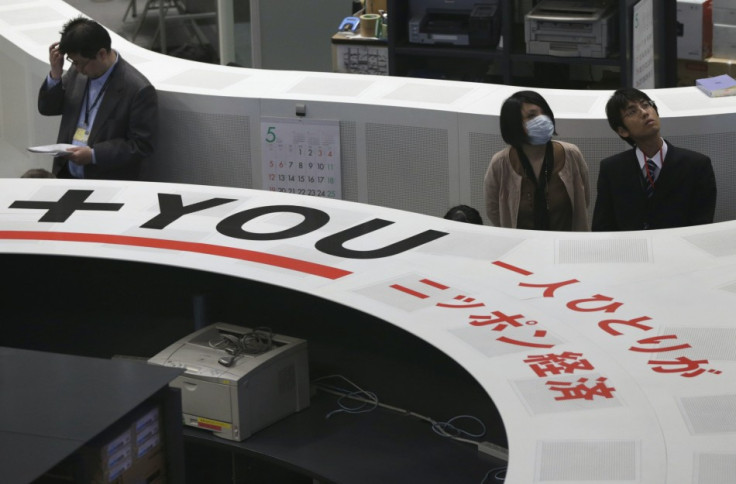

Asian Markets Rally after Fed Reassurance on Bond-Buying

Asian markets rose in early trade, supported by a strong rally in Wall Street after comments from senior US Federal Reserve officials hinted that the Fed may not slow down its asset buying program.

Japan's Nikkei average gained 1.1% or 174.35 points to 15555.37, buoyed by a rally in exporters' stocks which were supported by the yen staying above the $102 mark. Tokyo advanced after the Bank of Japan raised its economic outlook, on the back of rising exports and growing demand, while it kept its monetary-policy unchanged.

China's Shanghai composite index was up 0.1% or 2.63 points to 2307.74.

South Korea's Kospi was up 0.6% or 11.16 points to 1992.25. Australia's S&P/ASX was down 0.4% or 21.80 points to 5158.30 after rising in early trade.

The Hong Kong market was closed in the morning after the Hong Kong Observatory put out a rain storm warning. Trading is expected to resume at 1:00 p.m. local time.

Wall Street remained bullish after investors inferred two senior Federal Reserve officials' comments as indication that the American central bank may not reduce its bond-buying activity, which has been a critical stimulator of global stocks for a while now.

The inference helped push both the benchmark S&P 500 and the Dow to record highs on 21 May.

In Tokyo, Mitsubishi Motors rose 2.6%, after shooting up 34% in the previous trading session.

Consumer electronics makers gained. Sony jumped 9.7%, Panasonic moved up 3.9%, Daikin Industries gained 3.5% while Canon gained 2.2%.

In Seoul, Kia Motors moved up 3.3%, while Hyundai Heavy Industries gained 1.2%.

In Sydney, miner Rio Tinto rose 2.1%, while BHP Billiton gained 1.2%. Shares of Westpac Banking were down 0.7%.

© Copyright IBTimes 2025. All rights reserved.