Czech Central Banker Debunks Fear of Deflation and Currency Market Intervention

The Czech economy is not in danger of falling into deflation and does not need currency interventions to support it, according to a senior official at the Czech National Bank (CNB).

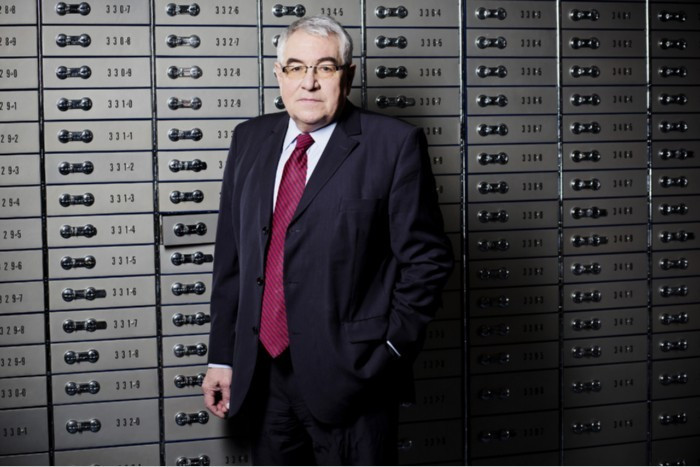

Kamil Janáček, a member of the bank's board, said he did not see any need to interfere in the foreign exchange market to prevent a collapse in prices and was worried about the consequences for the Czech economy if the CNB did this.

"The problem is not to launch currency interventions. The problem is that once you start this process you must have an idea how to get out of it, meaning an idea about an exit. For now, I do not have a quite clear idea [about that]."

Janáček said that he feared that any sale of Czech crowns would make the country's highly open economy vulnerable to volatile currency trades and fluctuations.

Members of the bank's board have been debating whether the CNB should take a more activist monetary policy to help the economy which just exited from a six-quarter long recession in the second quarter of 2013.

The national unemployment rate stands at 7.6% in the Czech Republic.

The GDP of the Czech Republic in market prices at the end of 2012 was 384371m Czech crowns (£12.8bn, $20.5bn, €14.9bn), according to Eurostat.

Some regions of the Czech Republic have been faring much worse than metropolitan centres such as the capital Prague.

The Ostrava region, which is heavily industrialised, has been suffering badly during the recession with the Paskov coal mine that employs thousands of workers under threat of closure.

The Salvation Army has talked about the increasing poverty of many people in the Czech Republic.

Despite the problems the Czech economy has faced, Janáček indicated that other members of the board were concerned about the consequences of currency intervention and how it could affect economic stability.

"I think I am not alone on the banking board with this concern," he said.

However, he also said that if deflation lasted for several months and that combined with a return to recession, he would support interventions.

"While deciding, I always weigh a whole mix of different factors and conditions, it definitely does not depend on one factor."

"The possibility that the economy could get near a deflation situation is... much closer than it would be if inflation was above 2 percent," he added.

The Czech Republic held a general election from October 25-26 that yielded no concrete results and considerable uncertainty over the country's political future.

Janáček said the election or its result could not change any of his views on monetary policy setting.

© Copyright IBTimes 2025. All rights reserved.