Labour's Ed Miliband to Propose Restricting Size of UK's Big Banks

Labour leader Ed Miliband is to propose capping the size of major British banks and forcing them to sell off branches to smaller rivals.

In a major speech on Friday 17 January, it is understood that Miliband will say reforming the UK's banking sector will be a key target of a new Labour government.

There have been suggestions that Labour would impose a cap of 25% on the market share of any bank which grew too big.

However, the details of what a market cap would mean in practice and what types of banks, account holders, branches and sectors it would be applied to are yet to be known.

Miliband has already suggested that he would like to make banking more regionally focused and support smaller retail banks to wrest market share away from their larger investment bank rivals such as Barclays, HSBC and RBS. This may mean selling off high street branches.

The improving British economy has put Miliband under pressure to suggest how an economy would look different if Labour wins the election in 2015.

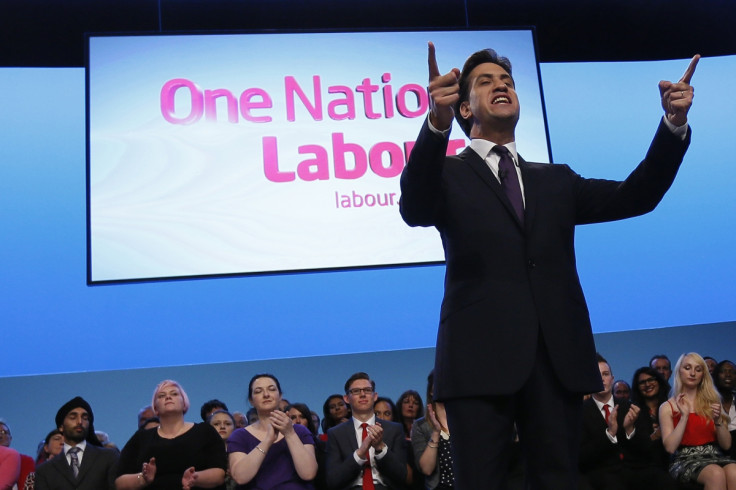

At the Labour conference in September 2013, he captured the political agenda with a "cost of living crisis" stating that economic recovery was not being felt by the majority of British workers.

The cost of energy, and the problem of stagnant wages have so far provided Miliband with ammunition to attack David Cameron.

© Copyright IBTimes 2025. All rights reserved.