Bank of England Super Thursday – interest rate decision and inflation report as it happened

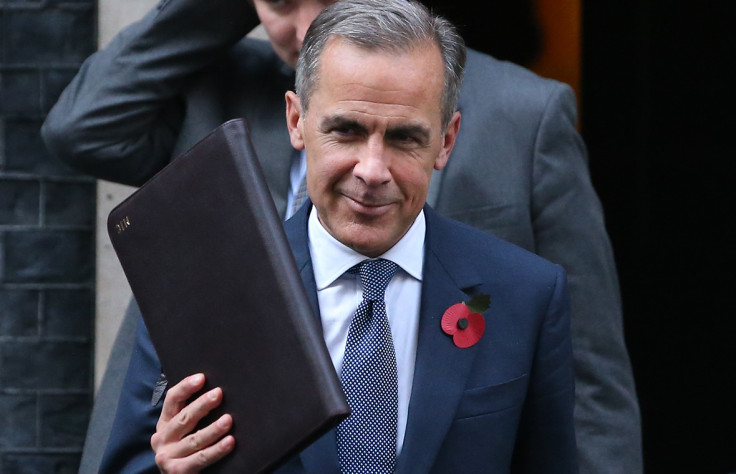

BoE keeps rates unchanged as Governor Mark Carney delivers quarterly inflation report.

Good morning and welcome to the IBTimes UK live coverage of Super Thursday. The Bank of England (BoE) has kept interest rates unchanged and revised its growth and inflation forecast for 2017.

- Bank of England keeps interest rates unchanged.

- Growth forecast for 2016 revised up from 2.0% in August to 2.2%.

- Growth forecast for 2017 revised up from 0.8% to 1.4%.

- Growth forecast for 2018 trimmed to 1.5% from 1.8%, with EU referendum expected to weigh on medium-term growth.

- Inflation expected to hit 2.7% next year, way above the Bank's intended 2% target.

- Pound surges close to $1.25 after rates announcement.

The press conference has now concluded. Thanks for following our live coverage of Super Thursday.

You can read more about the implications of the latest Bank of England's decisions here.

Carney stresses the BoE does not have bias on the direction or the timing of the next interest rates decision, explaining it could go either way. He adds the current stance on interest rates is appropriate.

Carney: "We don't feel under any political pressure." Theresa May has given full backing to monetary framework

— Kamal Ahmed (@bbckamal) November 3, 2016

Asked about the pound's sharp depreciation in the last three months, Carney says that while the BoE does not target the exchange rate, that does not it is indifferent to sterling's fluctuations.

Ian Stewart, chief economist at Deloitte, explained the latest revisions to growth forecast illustrates how difficult it is to measure the impact of Brexit.

"The big upgrades to the Bank's growth forecasts for this year, and next, underscore the difficulty of gauging the impact of Brexit, even in the short term," he said.

"Forecasts for how Brexit is likely to affect growth in the long term are even more speculative and uncertain. With growth and inflation over the next 18 months running well above the Bank's earlier expectations, monetary easing has moved to the back burner."

Carney on forecast changes: "It is entirely appropriate that we are challenged on what we got right and what we got wrong."

— Kamal Ahmed (@bbckamal) November 3, 2016

Earlier this week, the Governor announced he would step down from his role in 2019, meaning he would not remain at Threadneedle Street until 2021 as the former Chancellor George Osborne had hoped.

Asked whether he extend his stay if things are going well, Carney was categorical.

"I think we have all had enough of that saga so let's not reopen it," he said.

Carney is adamant the Bank did not get ahead of itself by trying to predict the kind of Brexit deal that Britain will end up with. Asked about this morning's High Court ruling over Article 50, Carney explains that is an example of the uncertainty surrounding the Brexit process.

"The negotiations haven't even begun. There will be volatility as those negotiations proceed. I see it as one of the example of that uncertainty."

The BoE Governor admits the Bank "will continue to learn" over forecasting as it makes major changes to growth and inflation forecasts. He adds that the pound's decline means balancing growth and CPI inflation has become more challenging, indicating there are limits to the Bank's willingness to tolerate overshooting inflation.

Governor Mark Carney: inflation now expected to be higher than projected, due to depreciation in sterling #InflationReport #SuperThursday pic.twitter.com/Vk9mZws4om

— Bank of England (@bankofengland) November 3, 2016

Carney says inflation expectations have "notably picked up", but the pound will have a more significant impact on inflation. He adds imported inflation will weigh on UK incomes.

Mark Carney: growth expected to be stronger for the rest of the year #InflationReport #SuperThursday pic.twitter.com/tpJx2z5vHp

— Bank of England (@bankofengland) November 3, 2016

Mark Carney's press conference has begun. You can watch it here.

This chart provides an excellent visual example of how the Bank is more optimistic about economic growth in 2017 and of its revised inflation forecast.

BoE sees scope for inflation to overshoot up to around 5% next year, while uncertainty around future GDP growth has increased markedly. pic.twitter.com/Fru9DRlUlW

— Rupert Seggins (@Rupert_Seggins) November 3, 2016

Economists believe we can expect the BoE to use monetary policy to address the problem of rising inflation - which is expected to exceed the Bank's 2% target next year - and one of the tool that they have at their disposal is the interest rate.

"Given that they have dropped the phrase of another rate cut is a possibility for this year, it means it is highly likely that the bank will increase the interest rate if inflation brings any threat for the UK economy," said Naeem Aslam, chief market analyst at Think Markets UK.

"However, at the same time, it is important to keep in mind, that most of the tail wind which inflation has is due to the lower currency and it is recovering its lost ground so they may not have to touch the interest rate any time soon."

Tom Stevenson, investment director for personal investing at Fidelity International, said the latest inflation makes it unlikely the BoE will cut rates again in the short term.

"Rising short term inflation means a rate cut is probably off the table for now," he said.

"At the same time, flagging growth in 2018 means we shouldn't expect a rate hike either for the foreseeable future."

He added that sterling's recent falls resulting in rising inflation, we will see diverging interest rates and inflation next year.

"In the short term that will dampen economic activity as real incomes are crimped and the Bank now forecasts growth next year of 1.4% and just 1.5% for 2018," explained.

"That, and the fall in sterling dropping out of the comparisons next summer, should see inflation moderate quite quickly again. Altogether that means the lower-for-longer environment continues for now."

The BoE's revised inflation forecast has delivered another shot in the arm to the pound, which has jumped above $1.2450.

Pound jumps yet again after Bank of England raises inflation forecast and holds rates https://t.co/BfG4oDrmG0 pic.twitter.com/YXjkcZeduA

— Bloomberg Brexit (@Brexit) November 3, 2016

As expected, the BoE has also raised its growth forecasts for 2017 to 1.4%, compared with previously released guidance suggesting the economy would expand by 0.8% next year.

However, it has cut its growth forecast for 2018 down to 1.5% from 1.8% and said the EU referendum would weigh on medium-term growth. Crucially, the BoE has warned that inflation is expected to hit 2.7% next year, way above its intended 2% target.

Bank of England project inflation hitting 2.75% by the end of 2017 - the highest forecast for inflation the Bank has ever made.

— Mark Broad (@markabroad) November 3, 2016

In its statement, the BoE said the Monetary Policy Committee has voted unanimously in favour of keeping interest rates unchanged, but added that policy can respond "in either direction" to a change of outlook.

MPC holds #BankRate at 0.25%, maintains government bond purchases at £435bn and corporate bond purchases at £10bn #SuperThursday pic.twitter.com/dzj4x197M2

— Bank of England (@bankofengland) November 3, 2016

With the government expected to appeal the ruling in December, the pound's rally could be short-lived, said City Index analyst Ken Odeluga.

"The appeal will drag out any process of resolution of the government's powers under law regarding Article 50, even as its resolve to carry out Brexit in spirit and in fact remains undiminished," he explained.

"That points to little let-up in sterling volatility, and in turn suggests Thursday's significant strengthening of the pound may not last."

However, for the time being, some positive news for the UK currency will be very much welcome.

"Another medium-term reading from the ruling can certainly be taken positive for sterling and other financial market," he added. "The UK after all, has shown evidence of inarguably resilient economic performance despite political uncertainty."

Analysts at Citigroup have suggested that while MPs are unlikely to reverse the referendum's decision, the ruling could soften the prospect of a 'Hard Brexit'.

"The government said in its submissions to the Court that a parliamentary ratification vote on the negotiation outcome was 'very likely'," they said in a note.

"However, MPs room for manoeuvre at that stage would be constrained by the alternative available, such as whether rejection means continued EU membership or 'hard Brexit' without any deal at all.

"A final ruling by the Supreme Court that parliament gets to vote on Article 50 would set a precedent and perhaps also lead to more parliamentary involvement and even votes during the negotiation process. The referendum gave MPs no direct guidance on which kind of Brexit voters want, so parliament would be free to reject the government's negotiation aims and results."

Mark Carney certainly has his work cut out ahead of his press conference, as the current political climate only fuels an already volatile economic environment. As for the pound, the currency has been boosted by news of the High Court ruling, but can it sustain its rally?

"If the British currency can maintain this momentum – and the Bank of England will have a great influence here – then investors may need to reassess their clear preference for dollar earners and exporters and begin to look at downtrodden domestic plays once more," said Tom Selby, senior analyst at AJ Bell.

Given the political atmosphere, Carney may as well use a tombola for his predictions at the QIR

— World First (@World_First) November 3, 2016

However, it is worth remembering that, before the referendum, the pound traded around $1.50, while now it has only climbed back above $1.24.

That rise in £ vs $ in context since the Referendum #Article50 #brexit pic.twitter.com/lJ6Bdq3IDV

— Mark Broad (@markabroad) November 3, 2016

Away from the latest Brexit-related developments, it is worth noting that data released earlier this morning showed Britain's services sector dismissed fears of a slowdown and continued to grow in October.

The services sector grew to 54.5, from 52.6, signalling the fastest expansion since January, according to the Markit / CIPS UK Services PMI index.

However, the report did note that the weak pound led to the highest month-on-month rise of inflationary cost pressures in the sector since the survey began 20 years ago. It added that input price inflation surged to the highest since March 2011.

#UK service sector input cost #inflation highest in 5 years, linked in many cases to the weak #GBP https://t.co/lZhrsdL3oK pic.twitter.com/yfzlZPGQSU

— Markit Economics (@MarkitEconomics) November 3, 2016

Meanwhile, here is a reminder of what happened three months ago, when the BoE cut interest rates to a historic low.

While the Bank is unlikely to cut interest rates again, the inflation report will be closely monitored in light of the pound's sharp decline. Three months ago, the BoE forecast annual inflation would rise to 2.4% in 2018 — above its stated 2% target — and hold steady until the first half of 2019, as sterling's depreciation after the Brexit vote would increase the price of imported goods.

However, since the last inflation report, the pound has lost a further 6% against its major rivals and National Institute of Economic and Social Research think-tank predicted earlier this week that consumer price inflation would hit 4% late this year.

"The [Bank's] forecast for CPI inflation in two years' time will be the highest since it began forecasting the CPI 12 years ago," said Samuel Tombs, chief economist at Pantheon Macroeconomics.

Should the Bank, as expected, rule out further rate cuts, the pound could receive a much-needed boost, according to Lee Hardman, currency analyst at MUFG.

"We expect Governor Carney to reiterate in the accompanying press conference that the BoE is not indifferent to weakness in the pound," he said.

"Delivering a rate cut in the near-term could prove counter-productive if it further destabilises the pound and triggers another lurch lower increasing upside risks to inflation."

The pound soared above $1.24 after the High Court ruled today that MPs must have a vote on triggering Article 50, the official mechanism to split from the EU. However, it has quickly retreated to $1.2352

BREAKING: Brexit Ruling: U.K. Government Loses Lawsuit Over Article 50 Vote https://t.co/00MmByGiSH pic.twitter.com/BVBOwciAXB

— Joe Weisenthal (@TheStalwart) November 3, 2016

You can read in depth about the High Court ruling here.

Three months on from Britain's vote in favour of leaving the European Union, the economic slowdown forecast by the BoE is yet to materialise, which means the Monetary Policy Committee might be forced to retract some of the warnings it issued before and immediately after the vote.

Analysts expect Britain's central bank to stand put on interest rates after slashing them to a historic low in August.

"Only 2 out of 58 economists polled by Bloomberg expect the BoE to cut interest rates at this meeting," said Kathleen Brooks, research director at City Index.

"The market is currently pricing in a mere 5% chance of a rate cut on Thursday, back in September there was a 25% chance of a cut. As UK inflation and growth have both beat forecasts in recent weeks, UK interest rate expectations have drifted higher."

© Copyright IBTimes 2025. All rights reserved.